Blog

A deep-dive into a variety of pension topics to help you understand and learn more about your pension and the Scheme.

Our blogs will give you information, tips, insights and guidance to help you get to know your pension and support you on your journey to retirement.

/understanding-the-value-of-your-pra.jpg?sfvrsn=6fcc6f7b_1)

For our Industry Wide Defined Contribution (IWDC) members, how much income you get in retirement depends on 3 things:

If you're a DB member your benefits are calculated in a different way - please visit the how we calculate DB pension benefits blog to find out more.

The easiest way to understand the value of your pension pot, is to request an estimate. You can do this for free anytime, either in your myRPS account, or by contacting us directly.

You can also use the DC modeller in your myRPS account. This will show you what your pension pot could be worth when you plan to take it, as well as the options you have for how to take it. You’ll also be able to see the impact of making additional contributions while you are paying into the Scheme.

Alternatively, you could check your Annual Benefit Statement (ABS). This is usually sent to you every year, around the month of your birthday, and can be accessed via your myRPS account.

Your ABS will show you how much you and your employer have paid in over the last 12 months and the current value of your pension pot on the day your ABS was produced.

If you need help accessing your myRPS account, requesting an estimate or using the modeller, you can find short video walkthroughs in our Video Library and on our YouTube Channel.

As outlined above, how much income you get in retirement, depends on:

You have an active role to play in each of these stages, and can take steps to affect the potential outcome as explained below.

/ifgfx_dc_how-saving-in-a-dc-scheme-works_v01_no-title.jpg?sfvrsn=d62ce951_3)

As an IWDC member, both you and your employer pay regular contributions into your pension pot, also known as your Personal Retirement Account (PRA).

The amount you both pay, depends on:

Your Pensionable Pay is the amount of your total salary your employer decides is pensionable on the 1 April each year. You can find more definitions for key terms on the glossary page.

You can also find more details about contribution rates in your Member Guide and Key Features leaflet, which can both be found in your myRPS account.

You can also choose to boost your pot by making Additional Voluntary Contributions (AVCs).

AVCs are additional contributions that you decide to make, on top of your normal pension contributions outlined above. Like your normal contributions, AVCs are taken from your pay before income tax is applied.

You choose:

Visit the saving more page for details on how to start paying AVCs and what difference it could make to you.

You may also be able to transfer benefits from other pension schemes into the IWDC Section. The value of the pension benefits would then be added to your pot.

You can find further details about transfers, and the forms you would need to complete, on the transferring my pension page.

We strongly recommend you seek independent financial advice before transferring pension benefits. You can find more details on how to do that on the guidance and advice page. You must legally seek independent financial advice if you transfer defined benefits (e.g. from a final salary or career average scheme) into a DC scheme if the transfer value is over £30,000.

When considering how much to pay into your pension pot, please remember to think about tax allowance limits, such as the Annual Allowance and Money Purchase Annual Allowance, which limits the amount you can save tax-free towards all your pension arrangements in any tax year.

See the pension tax limits page for more details.

The money you pay into your pension pot doesn’t just sit idle. It’s invested into a range of funds, provided by the Trustee, with the aim of helping it to grow over time.

The funds vary in the types of assets they invest in, from stocks and bonds to real assets such as property. They also offer a varying degree of risk and return as well.

The important thing to remember is that you can choose where to invest. Your decision could be based on a variety of factors, such as:

Alternatively, if you are unsure about which funds to invest in or just don’t have the time to manage things, you may want to think about Lifestyle strategies. With this approach your money is invested in funds thought to be suitable for a ‘typical’ member who wants a particular outcome. There are 3 options to choose from depending on whether you’re planning to take your pot as a lump sum, flexible drawdown or annuity, and you can read more about each of those ways of taking your savings below.

You can choose to invest in a mix of Lifestyle strategies and individual investment funds. And you can switch your funds at any time, by logging into your myRPS account.

Whether you opt for a Lifestyle strategy or self-select funds, you should review your choices regularly to make sure they are still right for you.

Please bear in mind that every investment has a level of risk, with the potential to grow and decrease. Market volatility will mean that the value of your pot fluctuates. This can be stressful, particularly when it comes to thinking about your retirement plans and savings. But the ups and downs of financial markets is a natural part of investing and different types of assets can experience different levels of volatility.

Visit the basics I need to know page for more information about investments and the choices you can make.

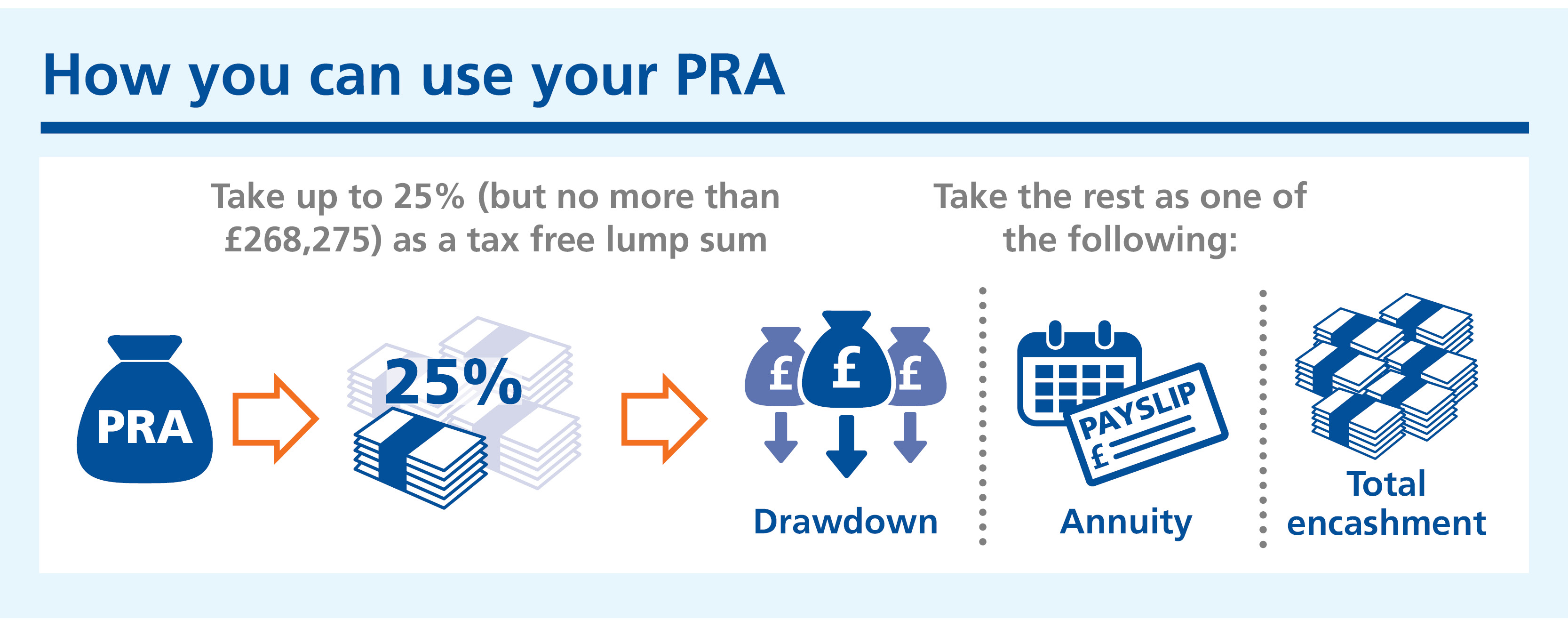

There are different ways you can choose to take your pension pot. Each option comes with its own tax implications, benefits and risks, and will have an impact on how much income you receive.

You can normally take up to 25% (but no more than £268,275) of your pension pot as a tax-free cash lump sum, although you do not have to take a lump sum if you don’t want to.

Your ABS includes an illustration of what your annual pension could be if you choose to take an annuity, although this is based on various assumptions and is not guaranteed.

The RPS doesn’t provide annuities directly, so to access these you would need to transfer your funds to another provider.

You can find more details about all of these options on the how can I take my IWDC pot page.

Read the latest updates from the world of pensions and see how they affect you as a member of the Scheme.

We provide regular newsletters to help you navigate your pension whether you're paying into the Scheme, not paying in anymore, or receiving your pension.

Register with Platform today to have your say in how we communicate with you and other members about your pension.