How the IWDC Section works

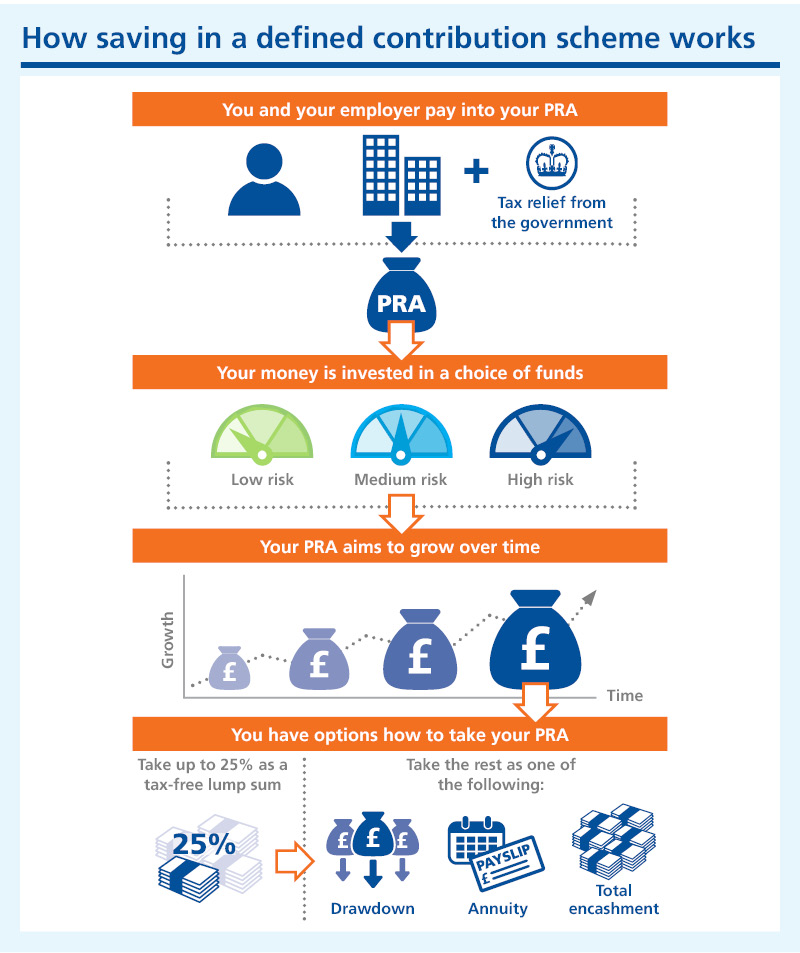

You and your employer pay in money into a 'pot' known as your Personal Retirement Account (PRA), which is mostly based on the performance of your chosen funds.

Your Key Features leaflet will tell you what you and your employer each pay in, but you can choose to save more if you wish. You can find a copy of your Key Features leaflet when you log in to your myRPS account, in the 'My Library' area. You should read this alongside your Member Guide which is available in the same area.

The money in your PRA is then invested into the funds or strategies you select with the aim of helping it grow. There is a range of funds to choose from, each with different risks and aims. You can learn more on the investing: the basics I need to know and my fund choices pages.

The value of your PRA will largely be based on the performance of the funds you've chosen. So, it’s important you keep an eye on how your investment funds are doing throughout your membership, even if you stop paying into the IWDC Section.

If you stop paying into the IWDC Section and your pot remains invested you will be a 'preserved' member.

As a preserved member, you will still get an annual benefit statement, so you can see the current value of your pot and how it’s invested. You can also make changes to your investment funds or you can transfer your pot to another scheme, as long as the new scheme allows.

It's up to you when you decide to take your pot. When you log in to your myRPS account, you can find a DC retirement modeller tool in the Planning for the Future area of your account. This will give you an idea of what your Personal Retirement Account (PRA) may be worth and your options for taking it.

The image below shows how the IWDC Section works and what happens to the money you pay in.

Find out more about the different ways you can take your IWDC pot.

Discover how investments work and why they matter to you...

Learn more about different investment options available to you as a member of the IWDC Section.