How I can take my IWDC pot

Find out more about the different ways you can take your IWDC pot when you're ready.

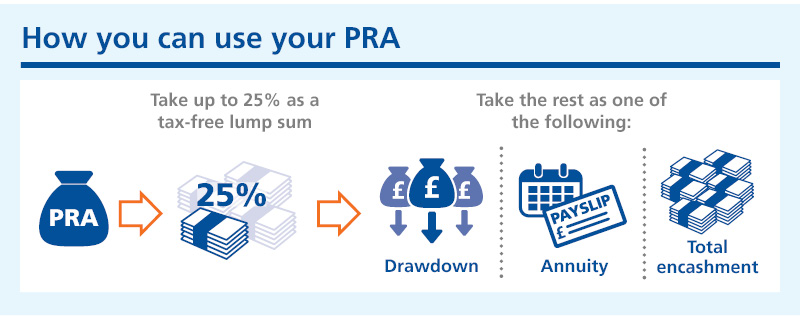

There are 3 main ways to take your pension pot.

You can:

You can normally take up to 25% (but no more than £268,275 unless you have a higher protected amount) of your pension pot as a tax-free lump sum and choose one, or a combination of these options for the remaining amount of your pension pot. You do not have to take a tax-free lump sum.

The 3 options all come with different tax implications, benefits and risks. You can read about them in more detail on the following pages:

Watch this short video for an overview of how you can use the money in your IWDC pension pot and some of the things you might want to consider.

The Railways Pension Scheme doesn’t currently offer an annuity or drawdown option directly, so to access these you would need to transfer your Personal Retirement Account to another provider.

If you were an active member of the Scheme on 5 April 2006, you may have a Protected Pension Age (PPA). This gives you the right to take your pension pot from age 50. If you decide to transfer to another provider, you will likely lose your Protected Pension Age.

Once you transfer to another provider, the options available, the fees you pay, and what you might get in retirement, will depend on which provider you choose and the rules of that arrangement.

You can use your pension pot to take a cash lump sum and to buy an annuity or to drawdown on it by taking it a bit at a time, if you wish. You can decide what the best option is, depending on your circumstances.

If you take all the money in your IWDC pot as a cash lump sum (total encashment), the value of your pot will be paid directly to you in a single payment and 25% of it (but no more than £268,275 unless you have a higher protected amount) will be tax-free. The rest of the payment will be taxed.

If you choose to transfer to an annuity provider, your new provider may have the ability to move some of your pot into a drawdown arrangement. The opposite could also be possible if you choose drawdown and also want to buy an annuity. However you would need to discuss this with your new provider after you had transferred out of the IWDC Section.

If you decide to take your pot as a cash lump sum (total encashment) or take part of it as a lump sum and use the rest to buy an annuity, your lump sum would be paid to you directly from the Scheme. Your annuity payments would be paid by your new provider.

If you choose drawdown, the lump sum payments would be paid by your new provider.

The DC Retirement Modeller is a handy tool that shows the estimated value of your IWDC pot when you plan to take it and helps you understand how you can take your money. Look in the 'Planning for the future' area of your myRPS account once you've logged in.

Once you’ve taken some of your IWDC pot, there may be a limit on how much you can keep saving into your pension before paying tax. This limit is known as the Money Purchase Allowance (MPAA).

It is usually triggered if you:

Where the MPAA is triggered, the most you can currently pay tax-free into your DC pot in the future is £10,000 per year.

You can delay taking your IWDC pot up to age 75.

It is important that you regularly review your investment choices to make sure they remain appropriate for you. The risks are similar to all investments. The value of your pension pot may go up but it can also go down. If you are closer to retirement, you may want to adopt a more cautious approach.

You can track and change your investment choices by logging in to your myRPS account.

If you die, while you're still a member of the IWDC Section, the value of your IWDC pot will be paid to your beneficiaries.

In addition, if you die while you're still paying into the IWDC Section, a lump sum cash payment could be paid to those you care about. See the Nominations for death benefits page for more information on this. You can say who you'd like a lump sum to be paid to by logging into your myRPS account and going to the 'My Nominations' page in the 'My Pension' area.

If you’re unsure of the best way to take your Personal Retirement Account, then you may want to speak to an Independent Financial Adviser (IFA).

Liverpool Victoria (LV) has been chosen as the official partner to give Scheme members access to financial advice. LV can be contacted on 0800 023 4187.

You are still free to choose your own Independent Financial Adviser (IFA).

Find an IFA in your area at unbiased.co.uk.

A range of planning tools are also available within your myRPS account to help you consider your options. For IWDC members this includes:

Find out how to check if your pension savings are on track to give you the lifestyle you want when you retire.

What to do when you're ready to take your IWDC pot and what will happen next.