Ways to take my pension

Discover the different ways you can take your DB pension. and choose what's right for you.

Select from the headings below to learn more about the different ways you can take your pension and a few things you might want to consider to help make the right choice for you.

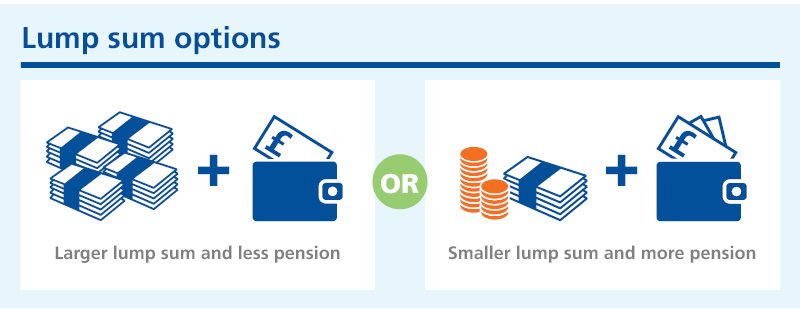

You can take some of your benefits as a cash lump sum and the rest as regular pension payments.

Generally, you may be able to take up to 25% (but no more than £268,275) as a tax-free cash lump sum unless you have any Lifetime Allowance protection.

There may be other rules about the exact amount you can take as a lump sum depending on the rules of the specific section of the Scheme you’re a member of. You can find out more in your Member Guide.

Get your Member Guide by logging in to your myRPS account. You'll find it under 'My Library.'

Otherwise, it’s up to you decide how much of each you take.

You may be able to take all of your benefits as regular pension payments, and none as a lump sum.

This is done by converting any lump sum entitlement into additional pension.

It may be restricted if you have paid any Additional Voluntary Contributions (AVCs) to BRASS and by the rules of the particular section of the Scheme you’re paying into. You can find out more in your Member Guide.

Get your Member Guide by logging in to your myRPS account. You'll find it under 'My Library'.

You may be able to take it all as a cash lump sum if:

It will also depend on the rules of your specific Section. You can find out more in your Member Guide.

Get your Member Guide by logging in to your myRPS account. You'll find it under 'My Library'.

It may be possible to transfer your (DB) pension to another provider.

Visit the transferring my pension page for more information.

If you are considering transferring your pension then you may benefit from financial advice.

You might have to get advice by law, if the value of your DB benefits is more than £30,000 and you are looking to transfer to a Defined Contribution/Personal Pension Arrangement.

Please keep in mind that both Financial Conduct Authority (FCA) and The Pensions Regulator (TPR) believe that it will be in most people’s best interests to keep their defined benefit pension.

Finding a financial advisor

Visit the guidance and advice page for more information on how to find a financial advisor.

You could decide to give up part of your own pension entitlement in order to give extra pension to these dependants.

In doing so:

However, if your named dependant dies before you do then the money you've given up will be lost. It will not go back into your pension. And you cannot change your named dependant once this option has been taken.

Visit the my pension when I die page to read more about death benefits.

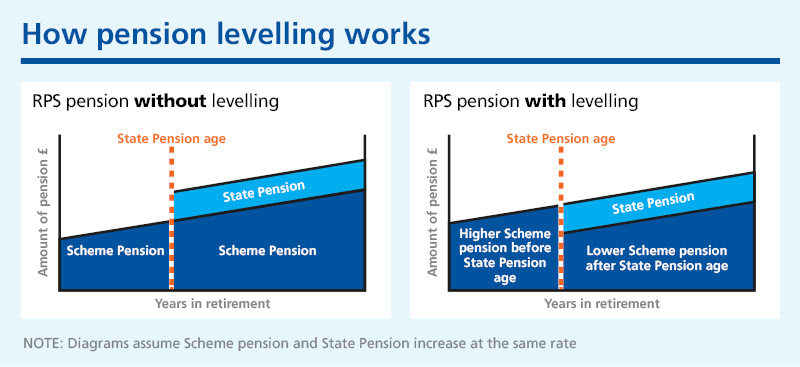

You may want to take your RPS pension before you can claim your State Pension.

With the level pension option you get more pension from the RPS before your State Pension age and then less pension from the RPS after your State Pension age. Check your State Pension age on the government website.

This aims to smooth or level out your income throughout your retirement as shown in the diagram.

If you’ve paid into either of these then it may affect you when you take your pension.

For example, most sections of the Scheme require you to take a value equal to your BRASS pot as a cash lump sum when you take your pension.

Find out more about BRASS and AVC Extra in the saving more area of this website, particularly on the pages for taking my BRASS account and taking my AVC Extra account.

A range of planning tools are available within your myRPS account to help you consider your options.

For DB members this includes a Pension Planner, showing what your pension might be worth when you retire and the different ways you can choose to use that money.

Check the Read as You Need guide on retirement options for more detailed information.

If you’re unsure which option will be best for you, you may want to get expert help.

Visit the guidance and advice page to find out how to get help.

You can see a summary of your options in this short video.