30th Anniversary

Then, today and tomorrow: marking three decades of the Railways Pension Scheme (RPS).

Since its formation following the privatisation of the railways in 1994, the Railways Pension Scheme (RPS) has supported thousands of members on their retirement journey.

Here, we take a moment to reflect on where we’ve travelled so far, and look ahead to where we might go next…

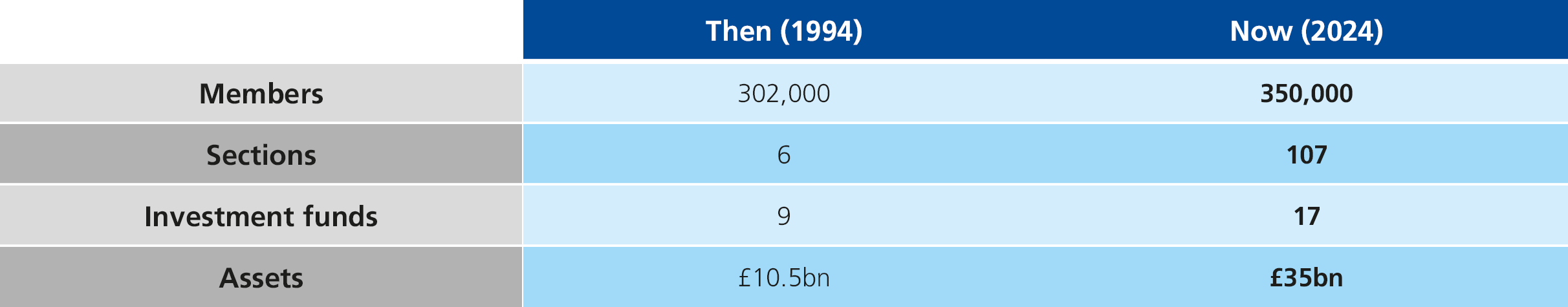

The numbers below offer a snapshot of where the RPS began and how it stands today. You can read more about the history of the Scheme and how it’s managed on the ‘ About the Scheme’ page.

The Scheme, like its members, has seen a lot of change over the past 30 years. This has meant responding not only to changes in the pension landscape, but in the wider economy and the world as a whole. Some of the most significant events affecting pensions in the past 3 decades are plotted in the timeline below. You can also download a copy as a PDF.

The RPS currently has more than 350,000 members. This ranges from those just joining the railway industry to many who’ve now retired after a long career. We asked a few of them to share their experiences with the Scheme, along with any advice they have for fellow members....

Andrew Turnbull, active member

"I'm relatively new to the rail industry, and so to the Railways Pension Scheme. Being in my late 20’s I want to make sure that I can plan as best I can for life after work for myself and my family.

I think that we’re very fortunate to have such a good pension scheme available to us on the railway and it is a huge perk of the job. I’ve found it worthwhile to take the time to understand more and plan my pension using the info on MyRPS.

My advice to anyone of a similar age and stage in their career is to give your pension some attention – we are lucky to have the RPS, and the future you will look back and thank you!"

Roger Coxhead, retired member

"When l was 28 Brass started. Being married with a baby money was tight, but l contributed 50 pence a week to start. As time went on with pay increases and promotions l upped my payment.

I regularly looked at the projection for my pension as l wanted to be prepared and know roughly what l would receive. There was a number of ‘what ifs’. Was l ready for retiring early due to redundancy? Again regular reviews helped me know. It was not wishing your life away but wishing for a comfortable later life with no surprises.

Then at the age of 55 there was a redundancy scheme announced. Because of my preparation l knew what l would receive from the RPS.

Since then l have been involved as a chair of governors at my local school, continued my career as a football referee and managed to keep active both mentally and physically.

My advice to anyone of whatever age is plan the future. Don’t let the future become the past. I tell my children, workmen and women, friends and their children always ‘plan for the future ‘and it’s not wasting your life away, it is just being forward thinking."

Peter Hales, retired member

"I joined Freightliner in 1977. I climbed the greasy pole and ended up as Port Manager in Felixstowe. I was made redundant after privatisation in 2003, but Network Rail took me on as a Site Manager. I retired aged 59 in 2007.

My one goal was to buy a camper van on retirement, which I did, and we went on a tour to Croatia for seven weeks.

Our rail pension is a wonderful blessing and I’m so glad I paid in extra towards it via the BRASS arrangement, which is a fantastic opportunity for everyone saving with the Railways Pension Scheme. It gives me the financial freedom and flexibility to enjoy my life after work and to make the most of it.”Phil Williams, retired member

As we look toward the future, we’re proud to continue helping our members plan for life after work and achieve a good financial outcome in retirement as we’ve done for the past 30 years. The RPS is in a strong funding position and well placed for the opportunities and challenges that lie ahead.

For more information visit the ‘About the Scheme’ section of the site. You can also find more details about your specific pension and what you get from being a member of the Scheme by logging into your myRPS account.

Read the latest updates from the world of pensions and see how they affect you as a member of the Scheme.

Sign up for our member group, Platform, to share your views on how we communicate about your pension.