Blog

A deep-dive into a variety of pension topics to help you understand and learn more about your pension and the Scheme.

Menu

A deep-dive into a variety of pension topics to help you understand and learn more about your pension and the Scheme.

Our blogs will give you information, tips, insights and guidance to help you get to know your pension and support you on your journey to retirement.

For example, you may have chosen which funds to invest in or have deliberately opted for a more ‘hands-off approach’ and had those funds selected for you.

Either way, as you approach retirement, you have a few key decisions you need to make. Perhaps the most important of those are:

For most IWDC members, the Normal Retirement Age (NRA) is between 60 and 65 years old. If you’re unsure of what your NRA is, you can check it in your Member Guide. This can be found in the library section of your myRPS account.

You can also take your benefits earlier or later if your prefer. This could be from age 55 (or as early as 50 if you have a Protected Pension Age) up until your 75th birthday.

You may also be able to start taking your pension earlier if you need to stop work early due to ill-health.

If you’re invested in a Lifestyle Strategy you should think about choosing a Target Retirement Age (TRA), if you haven’t done so already, and regularly review your TRA to ensure it remains appropriate for you.

A Lifestyle strategy automatically moves your contributions into investment funds which are thought best for your circumstances. The aim is to protect your PRA from sudden swings in the markets, by gradually switching your investments from higher growth to more stable funds. This process starts ten years before your TRA or your NRA if you haven’t chosen a TRA. You can find out more about the fund choices available here. You can also find and change your TRA by logging in to your myRPS account.

When to retire is quite a personal choice and may be affected by other circumstances, and not just when you reach a suitable age. For example it may be a question of whether you feel you can afford to retire. You can read more about getting your savings on track and the options available to you if the numbers don’t quite add up, such as making Additional Voluntary Contributions (AVCs) here

You can also read more about all of these options, and how they could affect your PRA, here

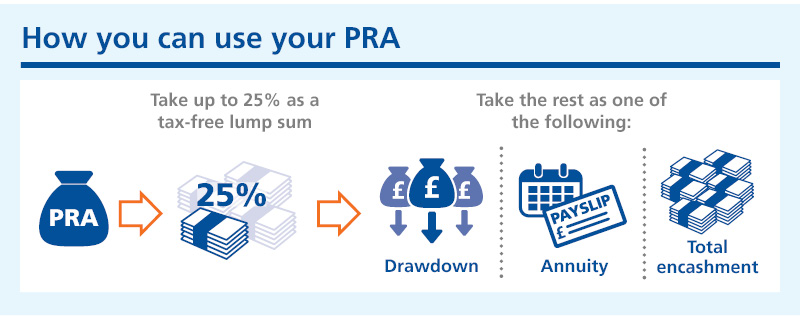

You have 3 main options for taking the money built up in your PRA.

You can find a summary of these options in our short video here

Each comes with its own different tax implications, benefits and risks, so it’s important you consider your options carefully before making a decision.

Whichever option you choose, you could decide to take up to 25% of your PRA as a tax-free lump sum.

There’s a lot to consider here, but help is at hand.

You can use the retirement modeller in your myRPS account to experiment with your options.

The modeller works out how much your total pension pot could be when you retire by taking into account the following:

It also lets you test out the different options for taking your money, such as annuity, drawdown and encashment, to see what impact they would have on your income.

In addition, the modeller can illustrate the impact on your pension pot and potential benefits at retirement if you make changes to your:

Once you have this information, you may find it helpful to speak to a financial advisor

Liverpool Victoria (LV) has been chosen as the official partner to give RPS members access to financial advice. LV can be contacted on 0800 023 4187.

You are still free to choose your own Independent Financial Adviser (IFA). You can find an IFA in your area at unbiased.co.uk

More free and general information is also available from MoneyHelper, created by the Government.

You can also find more tips for making the right decision for you here.

Once you’ve decided how you want to go ahead, you will need to apply for your PRA.

You can do this by contacting the scheme administrator, Railpen, using the details here

What happens after that depends on the ways you’ve chosen to take your PRA.

For example, neither drawdown nor annuity are offered directly by the RPS, so if you opt for either of these routes you will need to:

You can read more about applying for your PRA and how to identify a new provider if required here

22/6/2021

Author: Editorial

<p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">As an IWDC member, you can choose not only how and when you want to retire, but how your money is invested in the meantime.</span> <span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"> </span> </p><p>All of this can have a real effect on how much you end up with, so it’s worth taking the time to get to know your pension and make sure you have all the information you need to make the right decisions for you. <br></p><p>Here’s a few things to look out for: </p><h2><strong style="background-color: rgba(0, 0, 0, 0); color: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto; font-size: inherit">1. Your investment funds</strong></h2><p>As an IWDC member, the money you pay into your pension (known as contributions) is invested in a variety of specially selected funds.<strong style="background-color: rgba(0, 0, 0, 0); color: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto; font-size: inherit"> </strong></p><p>You can choose these funds for yourself, or take a more hands-off approach and have them managed for you by the Scheme’s investment manager, RPMI.<span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"> </span></p><p>If you decide to manage the funds yourself, there are five ‘self-select’ funds to choose from, each with different levels of risk. <span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"> </span></p><p>If you would prefer to have the funds managed for you, then you will be invested into a Lifestyle Strategy. This means your investments will automatically change over time as you move towards your retirement.<span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"> </span></p><p>Either way, it’s important to keep an eye on your funds and consider regularly whether they still meet your needs. <span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"> </span></p><p>For example, if you have just joined the Railways Pension Scheme and don’t plan to retire soon, you may want to take more risks for higher returns. </p><p> If you are getting closer to retirement, you may have a more cautious approach to investments and opt for more ‘stable’ funds which have a lower risk of losing value. </p><p>More information about all of the fund options available can be found <a href="/iwdc-members/managing-investments/fund-choices">here<span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"> </span></a></p><p>And you can review your investment funds at any time by logging in to your <a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable=""></a><a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable="">myRPS account</a> <br></p><h2><strong>2. Your Target Retirement Age</strong><br><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span></h2><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">If you’re invested in one of the lifestyle strategies mentioned above you can choose a Target Retirement Age (TRA). </span><br></p><p>This sets the age at which you hope to stop work. And it’s important because it affects the way your investments are handled. </p><p>Ten years before your TRA, your contributions will be automatically moved into investment funds that are deemed more stable. While these funds may grow at a smaller rate, they should protect your Personal Retirement Account (PRA) from any sudden changes in the market and, in particular, from any losses you wouldn’t have time to recoup. </p><p>Your TRA can be anywhere between 55 and 75 years old, or from age 50 if you have a Protected Pension Age. </p><p>It can be checked and changed at any time, by logging in to your <a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable=""></a><a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable="">myRPS account</a>t </p><p>Once logged in you can also use the retirement modeller to see what impact changing your TRA could have on your pension overall. </p><h2><strong>3. Your savings </strong></h2><p>You can check how much is in your PRA at any time by logging in to your <a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable=""></a><a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable="">myRPS account</a> </p><p>Once logged in you can also use our retirement modeller to see what your PRA might be worth by the time you retire. </p><p>If you’re not sure whether it’s going to be enough, then you can use our <a href="/knowledge-hub/help-and-support/retirement-budgeting-calculator">retirement budgeting calculator</a> to work out how much it might cost to get the retirement lifestyle you want, and compare the two. </p><p>More information about getting your savings on track can be found <a href="/iwdc-members/im-planning-to-take-my-iwdc-pot/how-much-ill-need">here</a></p><p>And if you’re still paying in to your IWDC pension, you can find more details about how to boost your PRA through Additional Voluntary Contributions (AVCs) <a href="/iwdc-members/Im-still-working/saving-more">here</a> </p><h2><strong>4. Your helping hand</strong><br></h2><p>Before making any changes to your IWDC pension, you may wish to get independent financial advice. <br></p><p>Liverpool Victoria (LV) has been chosen as the official partner to give RPS members access to financial advice. LV can be contacted on 0800 023 4187. </p><p>You are still free to choose your own Independent Financial Adviser (IFA). You can find an IFA in your area at <a href="https://www.unbiased.co.uk/" target="_blank" style="font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto" data-sf-ec-immutable=""></a><a href="https://www.unbiased.co.uk/" target="_blank" data-sf-ec-immutable="">unbiased.co.uk.</a><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"> </span></p><p>You can find out more about your retirement options as an IWDC member in the RPS <a href="/iwdc-members/im-planning-to-take-my-iwdc-pot/how-i-can-take-my-iwdc-pot">here<span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"> </span></a></p><p>You can also get general pensions information and guidance through<a href="https://www.moneyhelper.org.uk/en/pensions-and-retirement/" target="_blank" data-sf-ec-immutable=""> </a><a href="https://www.moneyhelper.org.uk/en/pensions-and-retirement/" data-sf-ec-immutable=""></a><a href="https://www.moneyhelper.org.uk/en/pensions-and-retirement/" data-sf-ec-immutable="">MoneyHelper</a> </p>

There are so many things in life that are out of our control – but your pension doesn’t have to be one of them.

12/7/2021

Author: Editorial

<p>Figuring out your future can be a daunting task but these simple steps might help...<strong style="background-color: rgba(0, 0, 0, 0); color: var(--color-h2); font-size: var(--font-size-h2); text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></strong></p><h2><strong style="background-color: rgba(0, 0, 0, 0); color: var(--color-h2); font-size: var(--font-size-h2); text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">1. Work out your costs</strong></h2><p>Use the <a href="https://member.railwayspensions.co.uk/knowledge-hub/help-and-support/retirement-budgeting-calculator" data-sf-ec-immutable="" data-sf-marked="">Retirement Budgeting Calculator</a> to work out how much you might need to cover your costs when you stop work. </p><p>The calculator allows you to estimate a wide range of expenses, and you can adjust each to a level that feels right for you. This includes:</p><ul><li>Transport</li><li>Holidays and leisure</li><li>Household costs</li><li>Food and drink</li><li>Helping others </li><li>Clothing and personal and</li><li>Anything else you expect to pay for, including care costs or charity donations <p>It also takes into account the '<a href="https://www.retirementlivingstandards.org.uk/" target="_blank" data-sf-ec-immutable="">Retirement Living Standards</a>' which set a benchmark for affording certain lifestyles as shown below.</p><img src="https://cdn3.railpen.com/mp-sitefinity-prod/images/default-source/infographics-(current)/rps-retirement-living-standards_v04_matrix-on-own.svg?sfvrsn=2b554472_4" alt="A grid showing how much 3 different levels of retirement lifestyle might cost"><p> </p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; word-spacing: normal; caret-color: auto; white-space: inherit">At the end, the calculator will give you a personal target to aim for with your income.</span></p></li></ul><h2><strong style="background-color: rgba(0, 0, 0, 0); color: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto; font-size: inherit">2. Work out your income</strong><br></h2><p>Look at what money you’ll have coming in when you stop work. </p><p>You can find out how much your RPS pension could be worth by logging in to your <a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable="">myRPS account</a>.</p><p>There you’ll find an estimate of your benefits, as well as tools specifically designed to show how much you might have saved by the time you stop work. </p><ul><li>For IWDC members it’s the retirement modeller </li><li>For DB members currently paying into the Scheme it’s the pension planner </li></ul><p>Once you find out what your RPS pension could be worth, add this to any other expected sources of income. This could include:</p><ul><li>Your State Pension – the amount you receive is set by the Government. You can request an estimate online at <a href="https://www.gov.uk/check-state-pension" target="_blank" data-sf-ec-immutable="">gov.uk/check-state-pension</a> </li><li>Other pensions – you may have a private pension or pensions linked to previous employment. You’ll need to speak to each of the providers individually for estimates on those accounts. If you’ve lost their contact details, the Pensions Tracing Service may be able to help. It’s a free, Government-backed, service available online (<a href="https://www.gov.uk/find-pension-contact-details" target="_blank" data-sf-ec-immutable="">gov.uk/find-pension-contact-details</a>) and over the phone (0800 731 0193). Other companies offer a similar service but many charge a fee </li><li>Savings and investments – if you have savings outside your pension, get those statements from your bank or other provider </li><li>Combined, these figures should give you an idea of how much money you might get when you stop work. You can then compare this to your target income from step 1.</li></ul><h2><strong>3. Compare your costs with your income and take action if needed</strong></h2><p>If you’re worried that your income in retirement, won’t cover your costs, there are a number of things you can do. </p><ul><li>Consider topping up your pension pot if you’re still paying into the Scheme – think about paying more into your pension if you can. This is known as making Additional Voluntary Contributions (AVCs). It’s tax-free up to certain limits. You can find out more <a href="/pension-essentials/saving-more">here.</a> </li></ul><ul type="disc"><li>Get advice – speak to an Independent Financial Adviser for guidance. <strong>Liverpool Victoria (LV)</strong> has been chosen as the official partner to give RPS members access to financial advice. LV can be contacted on 0800 023 4187. This service is authorised and regulated by the Financial Conduct Authority. </li></ul><ul><li>Think about changing your retirement age – you can delay taking your pension, giving you more time to increase it. This is not a decision to be taken lightly and we suggest you speak with a Financial Adviser first.</li></ul><ul><li>Clear your debts – if possible, try to pay off any debts you owe before you retire. </li></ul><ul></ul>

What does retirement look like to you? And how will you get there?

19/7/2021

Author: Editorial

<p><strong></strong>Your pension is effectively a safeguard for the future. A way to make sure you have money to spend when you stop work.<span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span></p><p>With that in mind, it’s important you understand what your pension can do for you and how to make the most of it. That’s where a financial adviser might be able to help.<span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span></p><h2><strong>Do I HAVE to get financial advice? </strong></h2><p><strong></strong>There are a limited number of circumstances where getting financial advice is a legal requirement. For example, if the value of your DB benefits is more than £30,000 and you are looking to transfer to a Defined Contribution/Personal Pension Arrangement, then by law you have to get financial advice before the transfer can be made. </p><p>And the Government are currently considering more circumstances where financial or pension advice may be legally required.</p><p>In most cases though, whether or not to get financial advice is entirely your choice. </p><p>Before that, you may find some of the answers you’re looking for in your Member Guide, or in the wide range of informative content available across the member website. </p><p>This includes a number of tools designed help you understand your pension and consider your options, such as:</p><ul><li>The <a href="/knowledge-hub/help-and-support/retirement-budgeting-calculator">Retirement Budgeting Calculator</a>, to help you work out how much income you might need, to enjoy the lifestyle you hope when you stop work</li><li>A retirement modeller for IWDC members and a pension planner for DB members, showing how much your pension might be worth by the time you retire. These can be found by logging in to your <a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable="">myRPS account</a> </li><li>A range of videos in the <a href="https://member.railwayspensions.co.uk/resources/video-library" data-sf-ec-immutable="">video library</a>, covering topics such as planning and saving, tax and your retirement options <strong></strong></li></ul><h2><strong>When to think about getting financial advice for your pension </strong></h2><p>Reasons for consulting a financial adviser can include getting help with:</p><ul><li>General financial planning</li><li>Tax </li><li>Deciding how to take your pension when approaching retirement </li><li>Avoiding pension scams by getting an expert opinion and/or a steer toward reputable services/products</li></ul><p>Getting advice for your pension could also be particularly useful if things in your life have changed, or if you’re considering a change of another kind. </p><p>For example: </p><ul><li>If you are starting a pension </li><li>If you are considering whether to transfer your pension</li><li>If you’ve recently received money, such as inheritance, or a lump sum pension pay-out and are unsure what to do with it </li><li>If your personal situation has changed, for example through divorce </li></ul><h2><strong>The benefits of getting financial advice for your pension</strong></h2><p>Getting financial advice usually means having an expert in your corner. For example, someone who can: </p><ul><li>guide you through any difficult decisions relating to your pension and recommend a way forward to suit your needs</li><li>point you towards products and options that will best match your personal circumstances and goals. And in some cases access products you wouldn’t necessarily have found on your own. </li><li>put together a plan and make sure it stays on track over the longer term, even making adjustments with your permission if necessary </li><li>help make sure you’re within the relevant tax allowances and advise on alternatives if you’re reaching them </li><li>look at ways to boost your pension</li></ul><h2><strong style="background-color: rgba(0, 0, 0, 0); color: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">Finding the right financial adviser for your pension</strong></h2><p>It’s important to first understand the different between guidance and advice. They may sound similar, but from a financial perspective there is an important difference. </p><p>Individuals and organisations offering financial guidance can simply provide you with information about your options. Whereas financial advisers can actually recommend which product they think would suit you best. </p><p>Unlike guidance services, financial advisers are regulated by the Financial Conduct Authority (FCA). This means they have to agree to a certain level of standards and you can get additional support through the Financial Ombudsman Service or Financial Services Compensation Scheme if things go wrong.</p><p>Liverpool Victoria (LV) has been chosen as the official partner to give RPS members access to financial advice. </p><p>LV covers all areas of pension advice, including:</p><ul type="disc"></ul><ul><li>retirement</li><li>financial planning</li><li>transfers</li></ul><p>And has a dedicated team, with specific knowledge on the Scheme.</p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">LV can be contacted on 0800 023 4187.</span></p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">You are still free to choose your own Independent Financial Advisor (IFA). You can find an IFA in your area at </span> <a href="https://www.unbiased.co.uk/" target="_blank" data-sf-ec-immutable="" style="font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal">unbiased.co.uk</a> </p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">More information about getting help and advice is also available <a href="/pension-essentials/guidance-advice">here</a><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">. </span></span> </p><h2><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><strong style="background-color: rgba(0, 0, 0, 0); color: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">Considering the cost of financial advice</strong></h2><p><strong style="background-color: rgba(0, 0, 0, 0); color: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></strong><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">Getting financial advice can be expensive. </span></p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">Any member who contacts LV will be evaluated for free first, to make sure that only those who truly need advice will progress to the chargeable stage. And even then, LV will offer its services at a discounted rate for RPS members.</span></p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">If you chose to find your own independent adviser, then keep in mind that not everyone offers a free introductory session and that their charges and areas of expertise may differ. So it’s best to shop around to find the best fit.</span></p><h2><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><strong style="background-color: rgba(0, 0, 0, 0); color: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">Looking out for scams offering financial advice</strong></h2><p><strong style="background-color: rgba(0, 0, 0, 0); color: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></strong><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">Scammers sometimes pose as financial advisers, or claim to be offering financial guidance and advice, as a way of getting their hands on your pension.</span></p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">You should be particularly cautious if anyone contacts you out of the blue, or offers you a free pension review or no-obligation consultation. Especially if they actively encourage you to transfer your pension or ‘unlock your benefits early.’</span></p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">Before entering a conversation with anyone, you should check their details against the </span> <a href="https://register.fca.org.uk/s/" data-sf-ec-immutable="" style="font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal" data-sf-marked="" target="_blank">Financial Conduct Authority (FCA) register</a> <span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"> to make sure they are fully regulated and have the FCA’s permission to provide the services they’re claiming to offer.</span> </p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">You can also check the FCA’s </span> <a href="https://www.fca.org.uk/consumers/unauthorised-firms-individuals" data-sf-ec-immutable="" style="font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal" data-sf-marked="" target="_blank">warning list</a> <span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"> to see the names of companies who are known to be operating without proper authorisation.</span> </p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">You can read more about staying safe from scams </span> <a href="https://member.railwayspensions.co.uk/resources/safety-and-scams" data-sf-ec-immutable="" style="font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal">here</a> </p>

Even someone who feels financially savvy can benefit from advice surrounding their pension. Here’s why…

25/8/2021

Author: Editorial

<p><span style="background-color: rgba(0, 0, 0, 0); font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; font-family: inherit; color: inherit">There’s a lot to consider when it comes to stopping work. And many of our members find themselves facing some tricky questions…</span></p><ul><li>Have I saved enough?</li><li>Should I put off retirement? </li><li>How will I get my money? </li><li>Will I have to pay tax on my pension? </li><li>What will happen to my AVCs?</li></ul><p>You’ll find a whole host of resources designed to help you understand all of this and more in the I'm Planning to Take My pension areas of the website. </p><h3><strong>Your retirement options </strong></h3><p>This section of the site includes information covering all of your retirement options, including:</p><ul><li>When you can retire</li><li>How you can take your pension </li><li>Working out what’s best for you </li><li>How to apply for your pension </li></ul><p>All you have to do is choose the area that’s tailored for you.</p><ul style="list-style-type: disc"><li>For <strong>DB</strong> members it’s <a href="https://member.railwayspensions.co.uk/defined-benefit-members/Im-planning-to-take-my-pension" data-sf-ec-immutable="" data-sf-marked=""><strong>here</strong></a></li><li>For <strong>IWDC</strong> members it’s <a href="https://member.railwayspensions.co.uk/iwdc-members/im-planning-to-take-my-iwdc-pot" data-sf-ec-immutable="" data-sf-marked=""><strong>here</strong></a> </li></ul><h3><strong>Getting your savings on track</strong></h3><p>Within the ‘Planning to take my Pension’ sections of the site, you’ll also find ideas for making sure your pension savings are on track before you stop work. </p><p>This includes using our <a href="https://member.railwayspensions.co.uk/knowledge-hub/help-and-support/retirement-budgeting-calculator" data-sf-ec-immutable="" data-sf-marked="">retirement budgeting calendar</a>, to help you estimate how much you’ll need in retirement and give you a personal target to aim for with your income. </p><p>And tools that will help you to see if your pension might give you enough to meet this target. </p><ul><li>For DB members it’s the <strong>pension planner</strong> – designed to show what your annual income could be when you stop work. And how this might be affected by different options, such as taking a lump sum or opting for a level pension. <p><span style="background-color: rgba(0, 0, 0, 0); text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; font-size: inherit; font-family: inherit; color: inherit"> </span></p></li><li><p><span style="background-color: rgba(0, 0, 0, 0); text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; font-size: inherit; font-family: inherit; color: inherit">And for IWDC members it’s the </span><strong style="background-color: rgba(0, 0, 0, 0); color: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; font-size: inherit">retirement modeller</strong><span style="background-color: rgba(0, 0, 0, 0); text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; font-size: inherit; font-family: inherit; color: inherit"> - designed to show you what your pension pot might be worth when you retire. And the different ways you can choose to use that money, such as an annuity or drawdown.</span></p></li></ul><p>All the tools are quick and easy to use. And you can access the one that’s relevant for you by logging in to your <a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable="">myRPS</a> account. </p><h3><strong>Getting help and advice </strong></h3><p>If all of this sounds a little daunting, you can find out how to get help and advice to guide you through the retirement process <a href="/defined-benefit-members/Im-planning-to-take-my-pension/guidance-and-advice"> here</a></p><p>You’ll also find short videos talking you through your retirement options in the <a href="https://member.railwayspensions.co.uk/knowledge-hub/help-and-support/video-library" data-sf-ec-immutable="" data-sf-marked="">video library </a> </p><h3><strong>Watching out for scams </strong></h3><p>When you’re approaching retirement and looking at what to do with your pension, you may be at risk from scammers trying to get their hands on your savings. </p><p>You can find some top tips for spotting a scam and protecting yourself, <a href="https://member.railwayspensions.co.uk/pension-essentials/pension-scams" data-sf-ec-immutable="" data-sf-marked="">here</a> </p>

Are you approaching retirement? Or looking ahead to the day that you do? If so it’s important you understand all of your options.

Read the latest updates from the world of pensions and see how they affect you as a member of the Scheme.

We provide regular newsletters to help you navigate your pension whether you're paying into the Scheme, not paying in anymore, or receiving your pension.

Register with Platform today to have your say in how we communicate with you and other members about your pension.

Railways Pensions is powered by Railpen Limited

© Railpen Limited 2010-2025. Registered Office: 100 Liverpool Street, London EC2M 2AT

Each of Railpen Limited (registered in England and Wales No. 2315380) and Railway Pension Investments Limited (RPIL) (Registered in England and Wales No. 1491097) is a wholly owned subsidiary of Railways Pension Trustee Company Limited (Registered in England and Wales No. 2934539). Registered office for each company: 100 Liverpool Street, London EC2M 2AT. RPIL is authorised and regulated by the Financial Conduct Authority for some of its activities. The administration of occupational pension schemes is not a regulated activity. Full details about the extent of RPIL's authorisation and regulation by the Financial Conduct Authority are available from us on request.

Please manage your cookie choices by switching the consent toggles on or off under the purposes listed below. You can also choose to click:

Accept All Reject All