Blog

A deep-dive into a variety of pension topics to help you understand and learn more about your pension and the Scheme.

Our blogs will give you information, tips, insights and guidance to help you get to know your pension and support you on your journey to retirement.

If you are in a defined contribution (DC) arrangement, such as BRASS, AVC Extra or the IWDC Section, you can decide how the money you pay into these arrangements is invested. If you don’t want to choose investment funds, you will be invested in a default arrangement.

There are a range of investments for you to choose from. How these different investments perform, determines how much money is in your pension pot and whether its value goes up, or down.

The first choice you need to make is how hands-on you want to be.

Do you want to:

If you can’t decide, you will automatically be invested in a Lifestyle strategy by default.

If you’re a defined benefit (DB) member, this information only applies to money you pay in to BRASS or AVC Extra. Your DB pension as a whole works differently and the benefits you receive do not depend on investment performance but on your length of service and salary.

If you don’t feel comfortable looking after your investments directly, you can opt for a more ‘hands-off’ approach and choose a ‘Lifestyle strategy’.

We call this ‘hands-off’ because there are fewer decisions for you to make at the outset. However, it’s still really important that you take an active interest in your investment choices and review them regularly. No investment is 100% safe and the appropriateness of the strategy you choose may change depending on your circumstances or world events.

Lifestyle strategies build your pension savings while you’re still working. All investments have risk, and the lifestyle strategies have been designed with risk and return expectations that reference many members’ retirement plans – for example, some members want to take all of their pension pot as cash at once; while others might want to keep some or all of their pot invested and only take smaller lumps of cash when it’s right for them.

There are 3 Lifestyle strategies offered by the RPS:

You choose which of these 3 strategies you prefer.

Based on your chosen strategy, the money you pay into your pension will then be invested on your behalf by the Trustee.

In order to protect your pension pot, these investments move automatically as you get closer to your ‘target retirement age.’ Exactly how that happens depends on the Lifestyle strategy you have chosen. You can read more below, or in our fund factsheets.

While much of the work within a Lifestyle strategy happens automatically, there is still a lot for you to think about, not least:

The 3 Lifestyle strategies offered by the RPS are designed to meet these preferences as much as possible. But remember, the Trustee invests your pension contributions in accordance with the strategy you’ve chosen so it’s vital you keep track of your pension pot to make sure your investment choices remain appropriate.

Individual investments which are grouped together are called a fund.

Each of the 3 Lifestyle strategies offered by the RPS is made up of 3 separate funds:

Each of these funds has a different level of risk.

How your pension pot is split between the funds depends on the Lifestyle strategy you have chosen (by selection or by taking the default investment strategy) and when you are planning to take your benefits. This is known as your Target Retirement Age (TRA).

Your investment allocation is reviewed and aligned to your chosen Lifestyle strategy (depending on your age), around 4 times a year. You don’t have to do anything, because all of this happens automatically. If you are taking your benefits, we will not exclude you from this exercise unless you have returned all required documentation to initiate your benefit request.

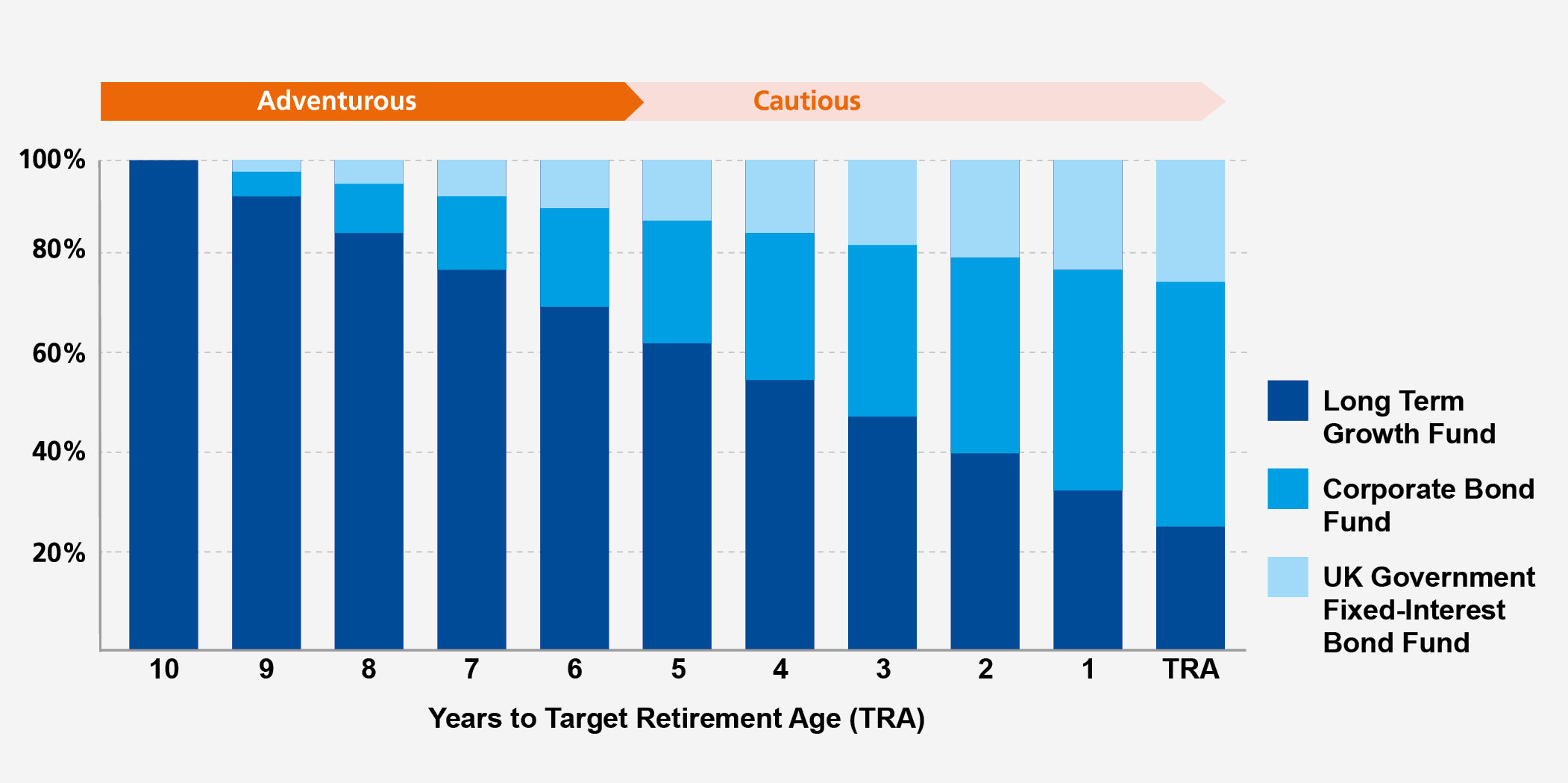

Around 10 years before your TRA, your money will start to move from high-risk funds – with potentially higher growth and higher losses – to less risky ones. Of course the risk of any strategy also needs to be considered in the context of your retirement plans. This is shown in the illustration below.

Exactly how much remains invested in the higher-risk funds, depends on which Lifestyle strategy you have chosen.

While the risk classification of each investment fund has been carefully considered, it is external economic factors that will ultimately determine the extent to which your investment goes up or down.

You can find more information about Lifestyle strategies in our fund factsheets

If you feel comfortable looking after your investments and want to be more hands-on, you can manage your investments by yourself.

You decide:

There are 7 funds to choose from:

Each fund has a different objective and risk rating, so you can choose the one that’s right for you. For example, the lowest risk rated fund is the Deposit Fund but there are a range of medium and high risk funds too. Please check your lifestyle or self-selected investment options to ensure the risk rating meets your appetite.

Alongside these 7 funds, you can also invest in any of the 3 Lifestyle strategies mentioned above.

You can find out about the investment funds, including their risk ratings, in the fund factsheets.

If you choose this hands-on investment funds approach, your money will not automatically move from high to lower risk funds as you get closer to retirement. That means it’s up to you to decide if, and when that’s necessary, and to make the investment fund switch yourself.

You can change your investment choices at any time

To change the strategies or funds you’re invested in now, or where you want to invest in the future, log into your myRPS account. Then, go to the 'My pension' section and 'Funds' page.

If you're in a Lifestyle strategy you can also check, and change, your Target Retirement Age (TRA) in your myRPS account.

Any changes you do make to your TRA may affect your investments including the allocation of your pot between investment funds and the risk profile of your investment.

Make sure you have read all of the information available on the website and try out the Pension Planner (DB members) or Retirement Modeller (DC members) to help you understand the consequences before you act.

You can get help deciding what’s right for you

You can find more information about your investment options on the my investment choices page.

If you need more support, you can also get financial advice.

Our advice partner Liverpool Victoria (LV) offers members financial advice at a discounted rate. You can contact LV on 0800 023 4187. You can also find Independent Financial Advisers in your local area at Unbiased.co.uk.

Read the latest updates from the world of pensions and see how they affect you as a member of the Scheme.

We provide regular newsletters to help you navigate your pension whether you're paying into the Scheme, not paying in anymore, or receiving your pension.

Register with Platform today to have your say in how we communicate with you and other members about your pension.