Blog

A deep-dive into a variety of pension topics to help you understand and learn more about your pension and the Scheme.

Menu

A deep-dive into a variety of pension topics to help you understand and learn more about your pension and the Scheme.

Our blogs will give you information, tips, insights and guidance to help you get to know your pension and support you on your journey to retirement.

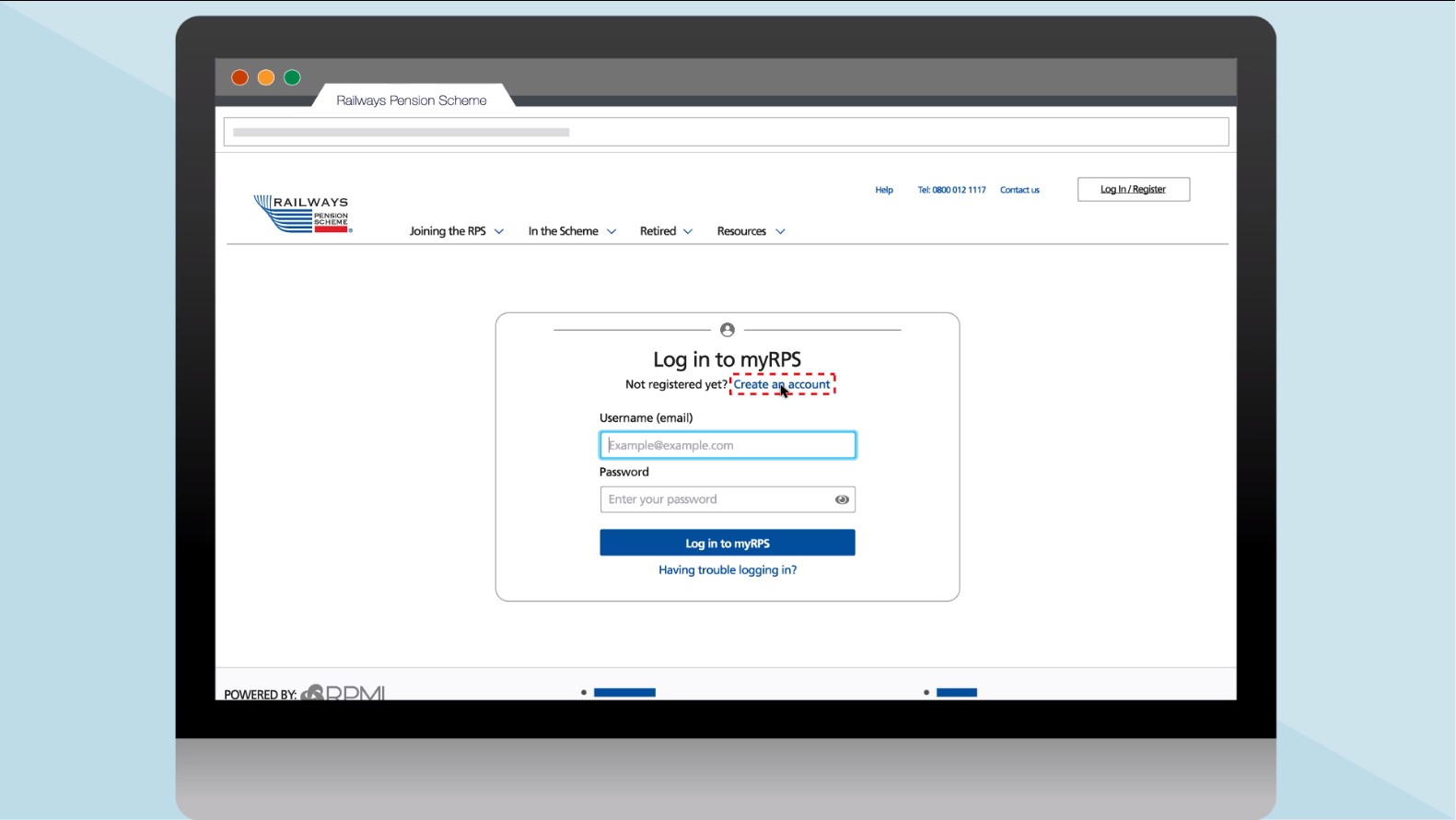

You may also need to re-register even if you were signed up to the old site. Here’s how to do it.

Before you start make sure you have the following to hand:

Then follow the steps below.

The site works well on most browsers but is not supported by Internet Explorer 11 or Android using IOS versions 10 and under.

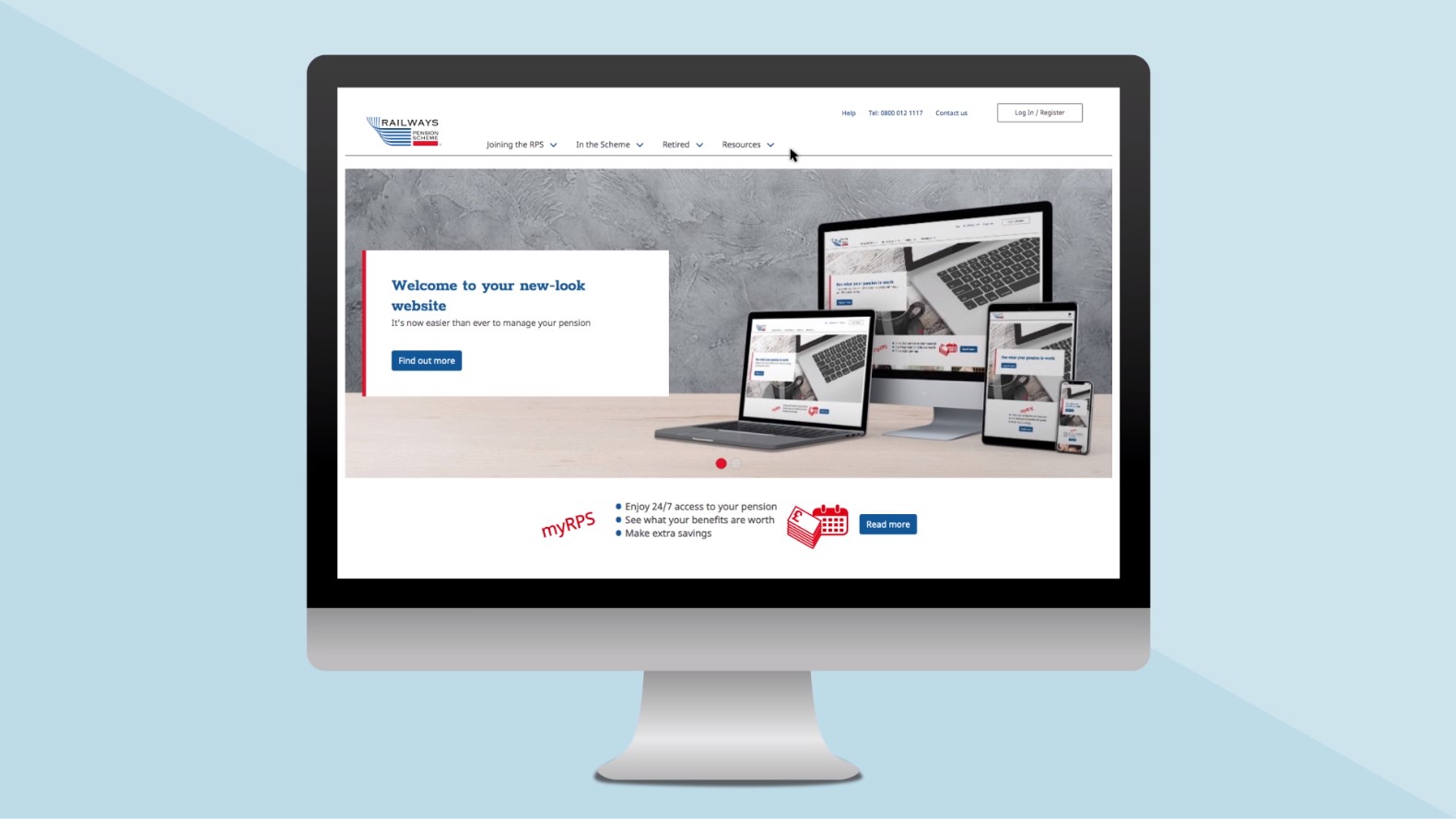

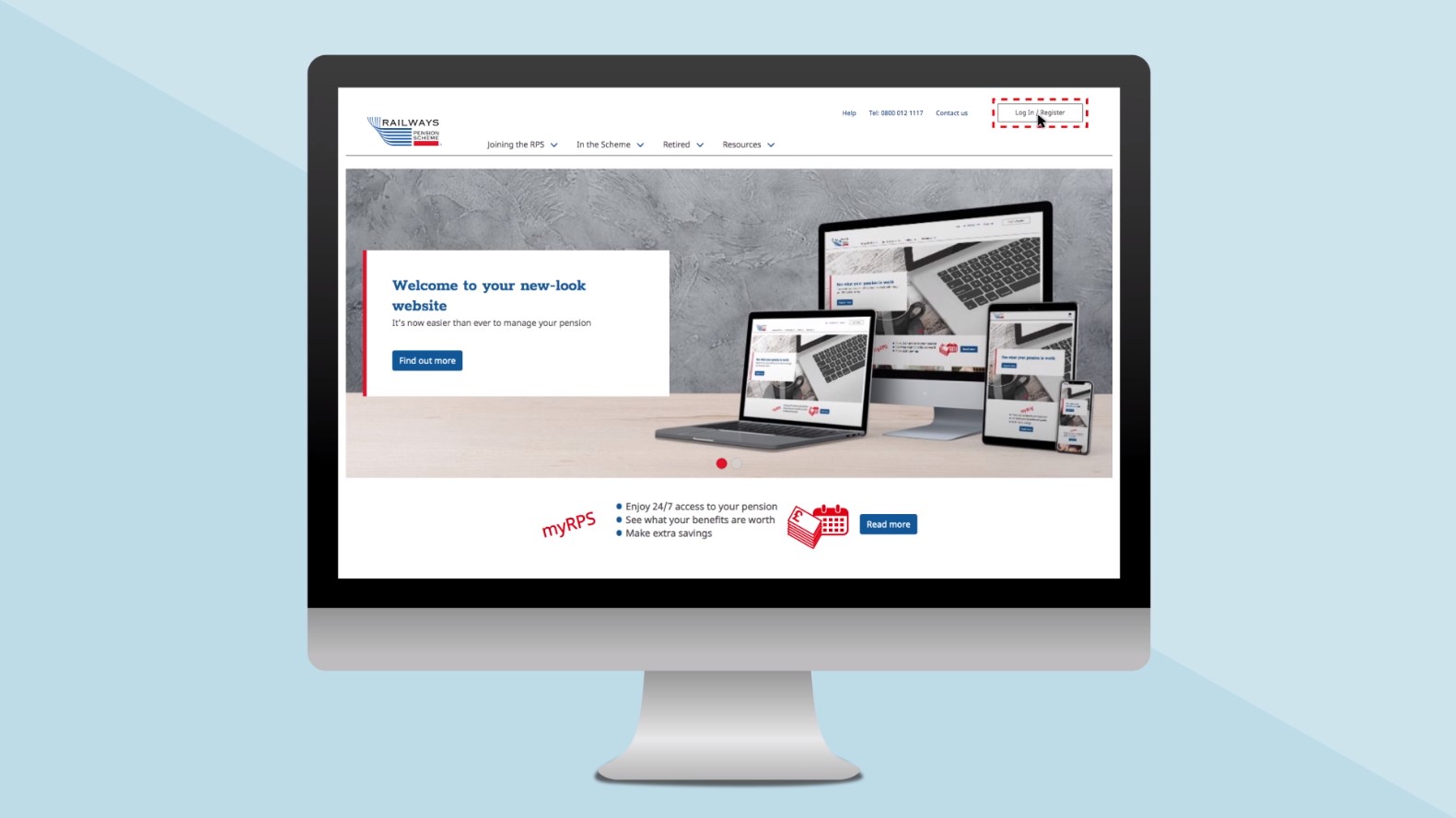

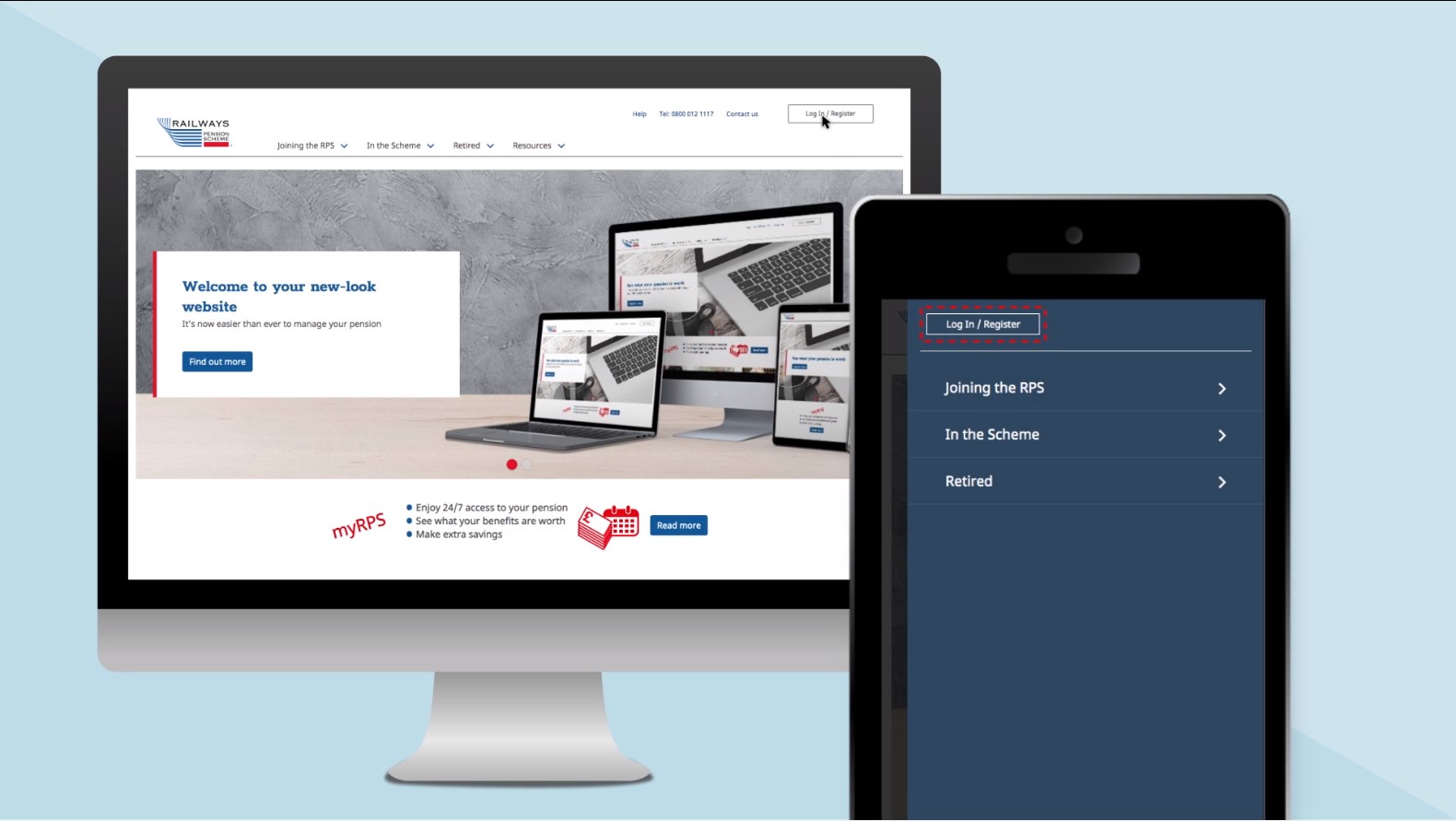

If you’re on a desktop or laptop, click ‘login/register’.

If you’re on a tablet or phone, select ‘menu.' Then login/register.

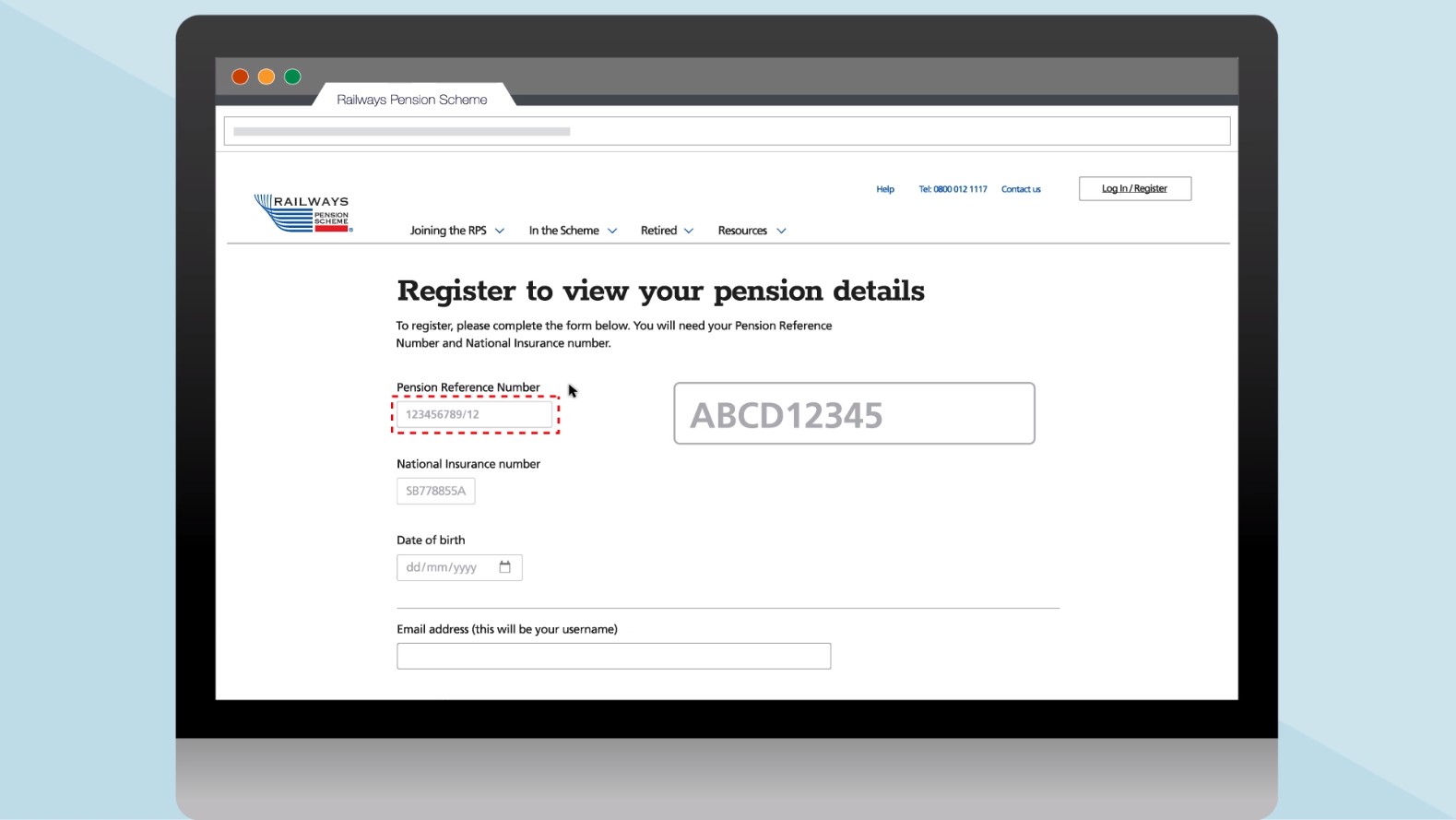

4. Fill in your pension reference number

You can find this on any recent letters we’ve sent you. It should be a series of nine numbers, followed by /00 or a series of letters, followed by a series of numbers.

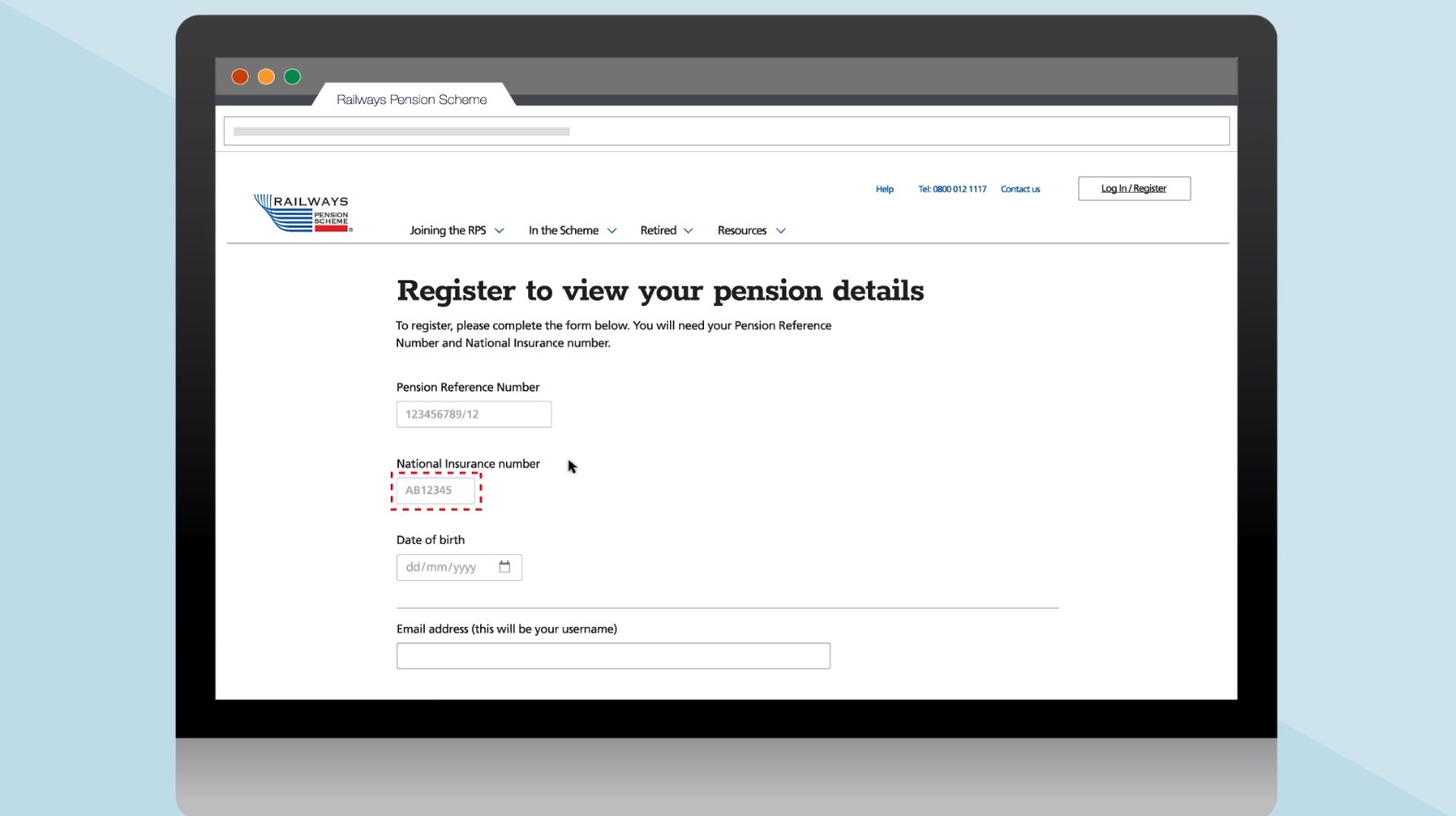

5. Add your National Insurance number

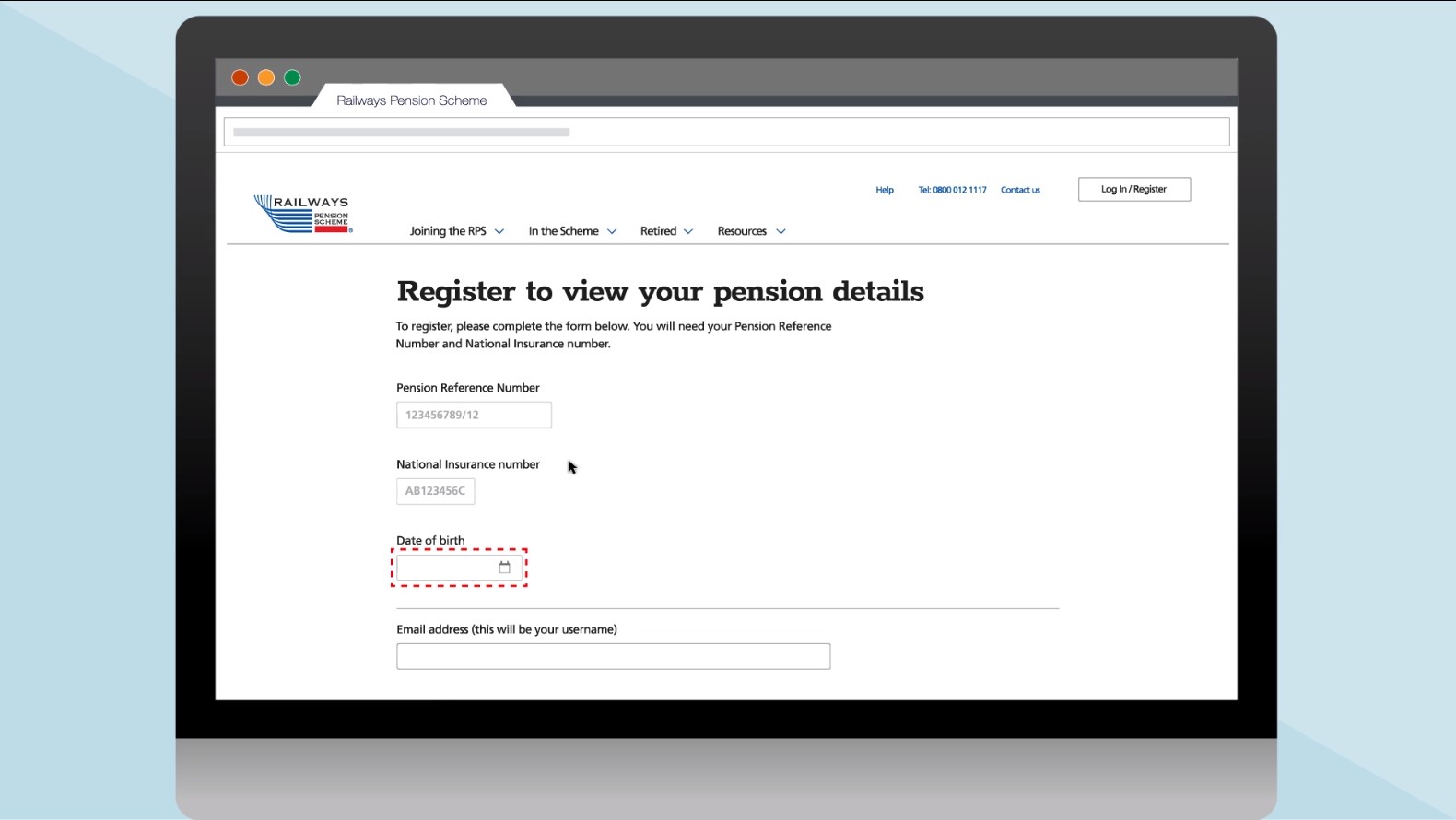

6. Enter your date of birth

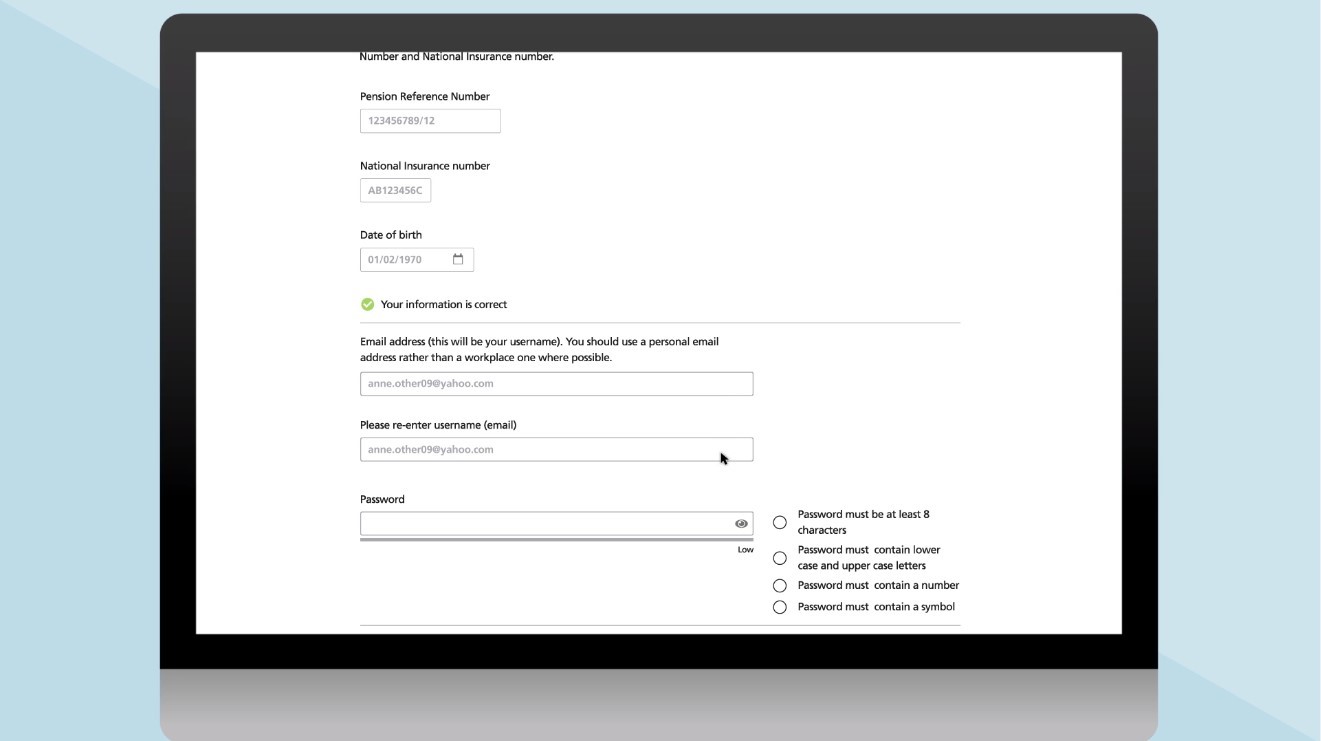

7. Enter your personal email address

You will need to re-enter it in the box underneath just to make sure we’ve got it right

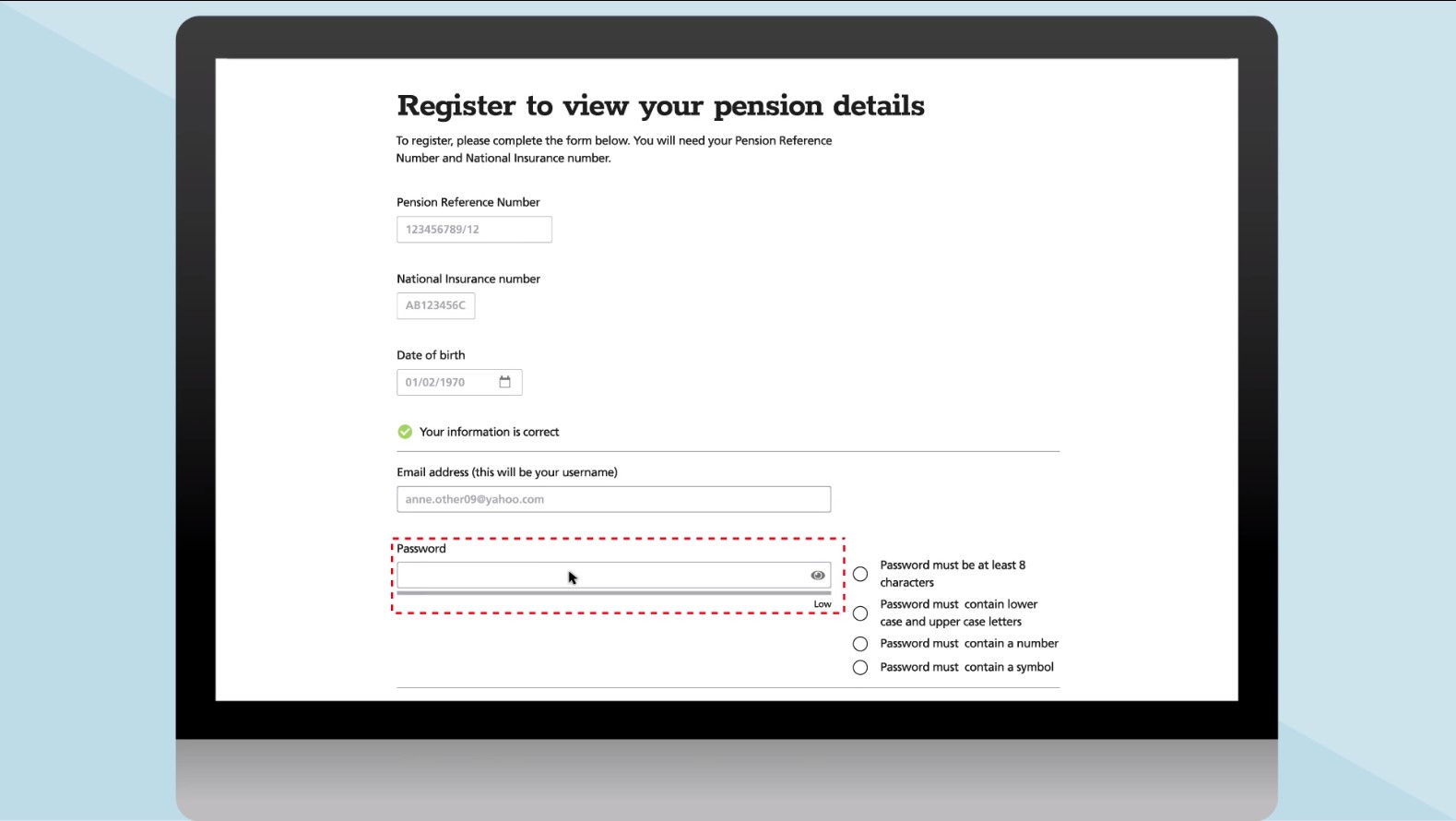

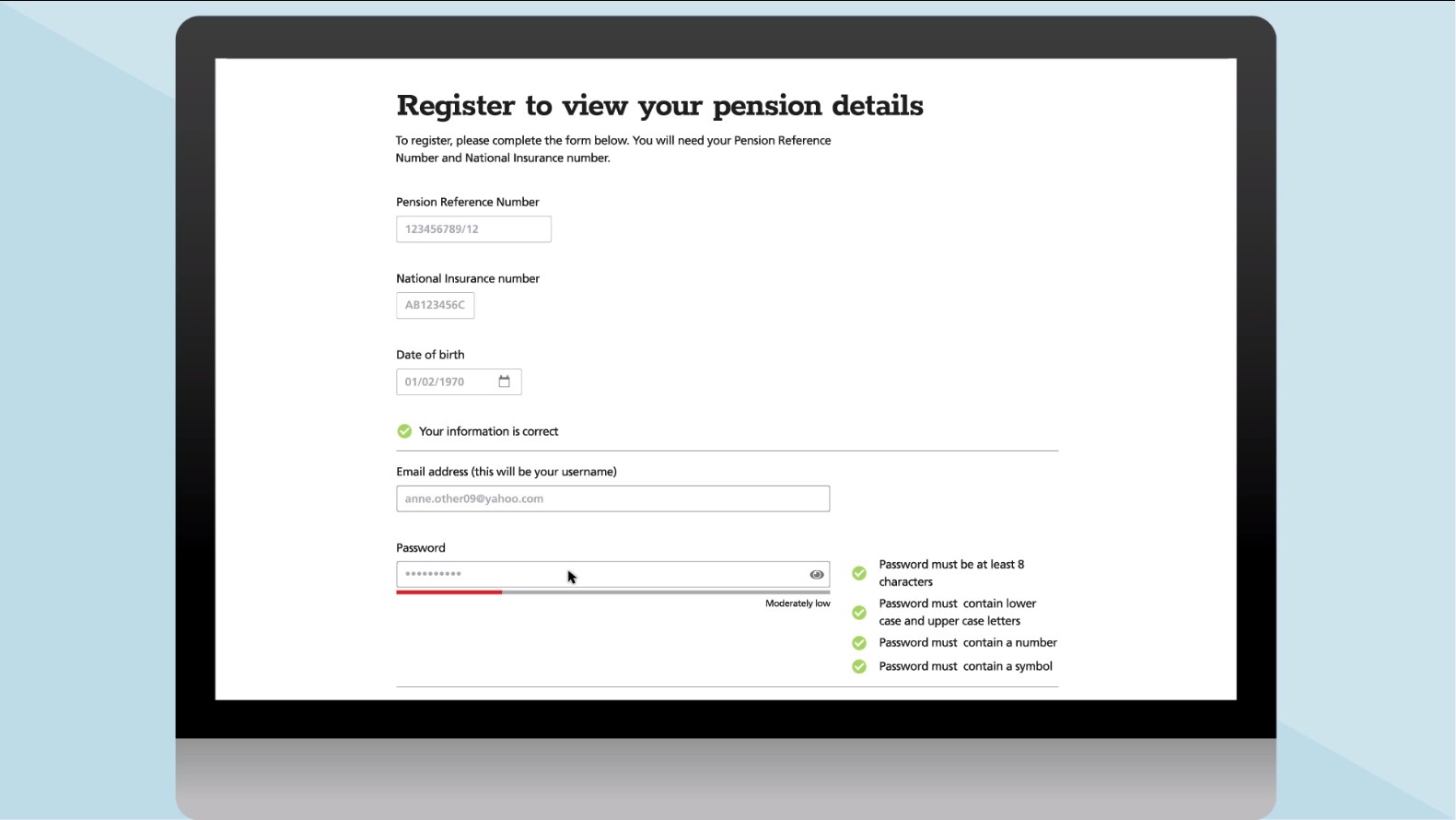

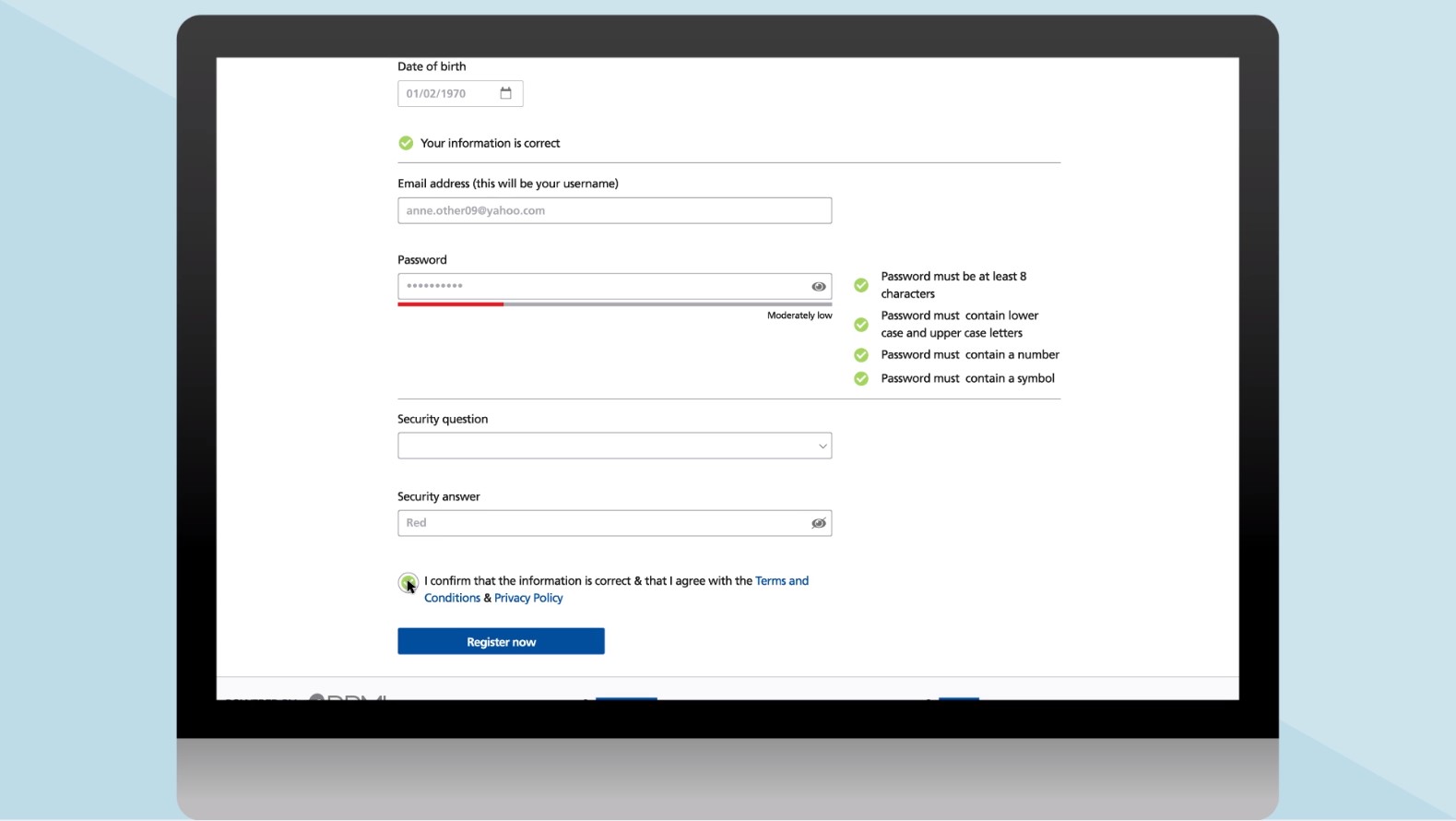

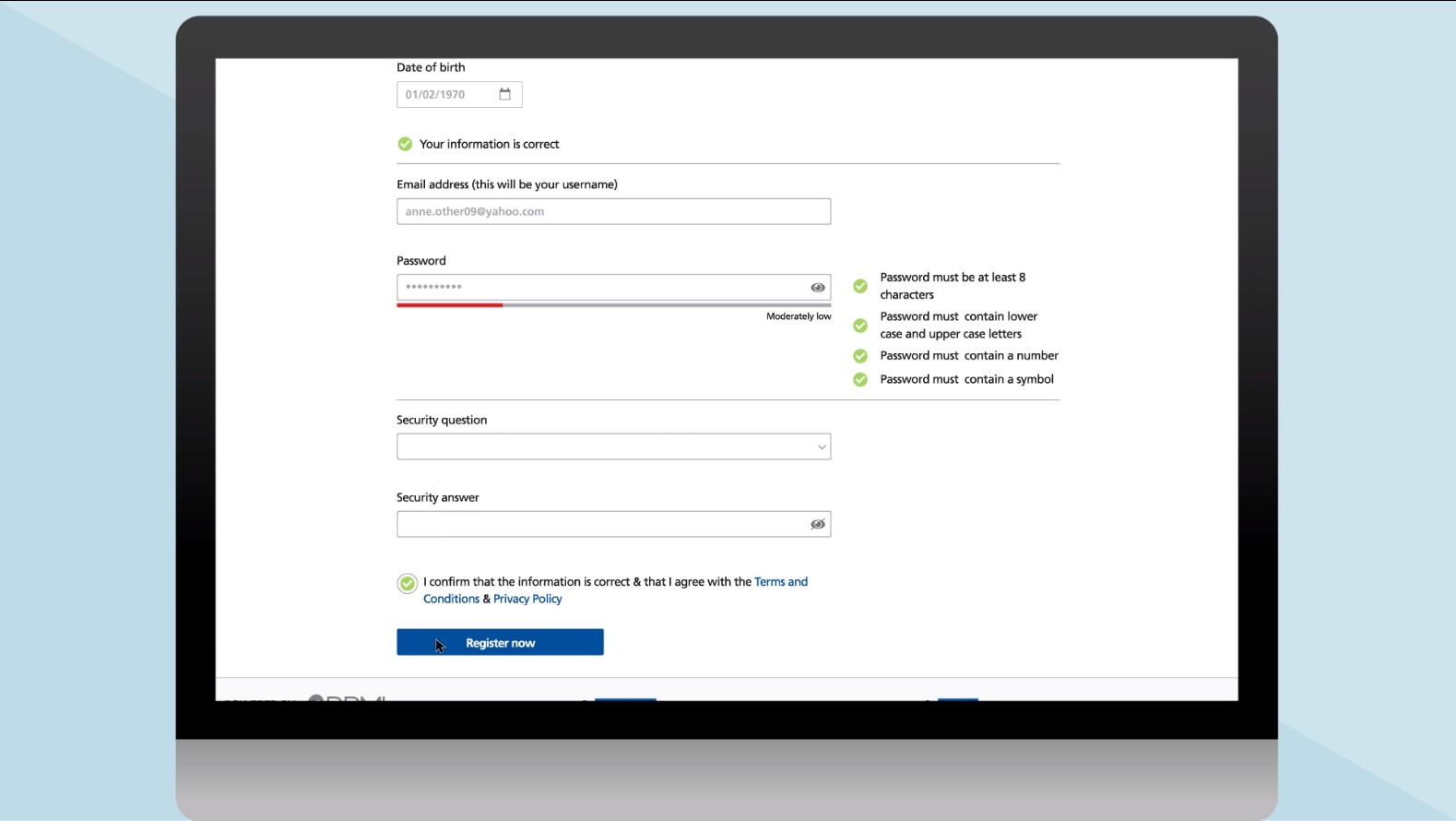

8. Create a password

This must be between 8 and 20 characters long. And contain at least:

You will see green ticks displayed when you have met all of these requirements

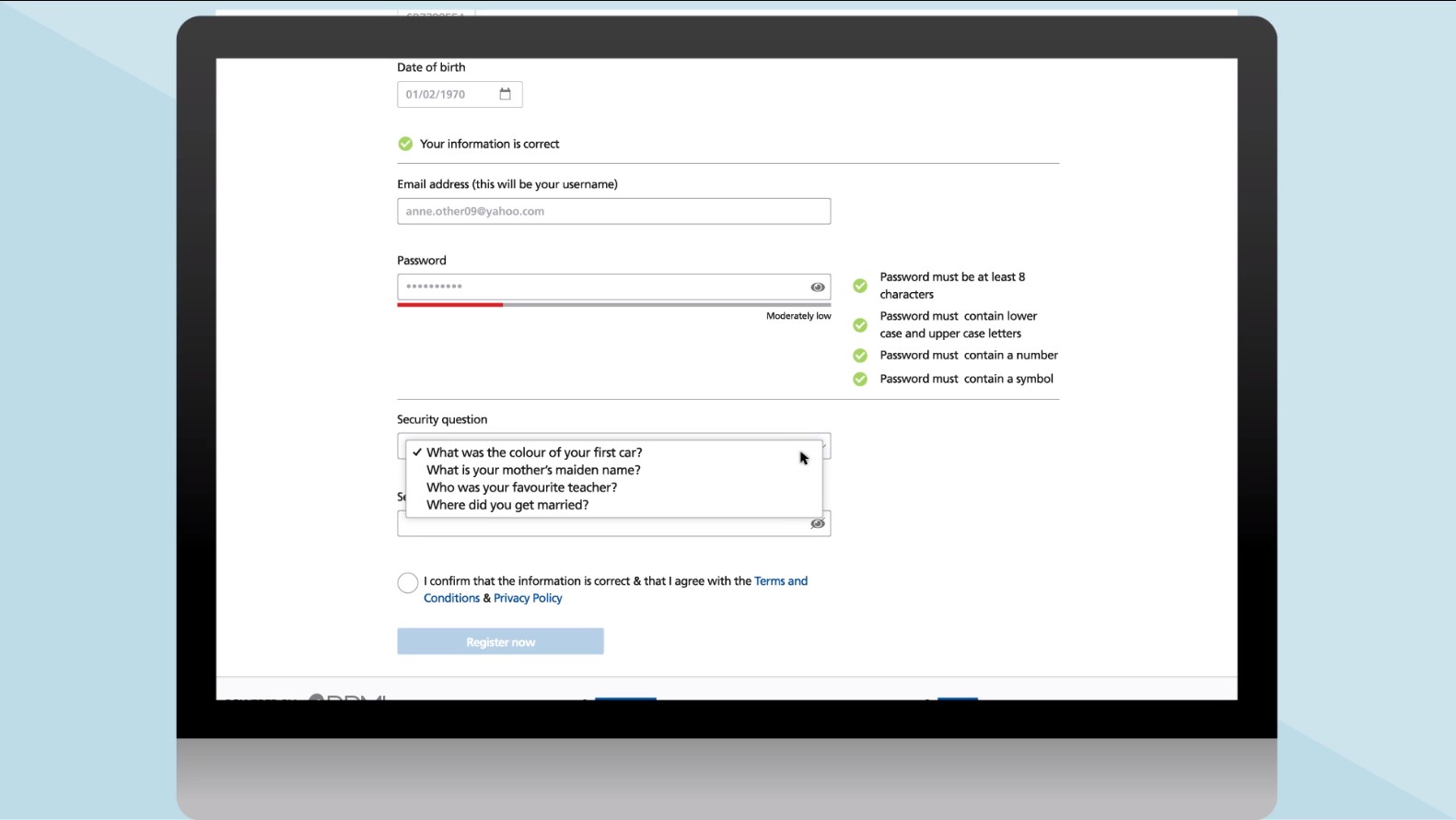

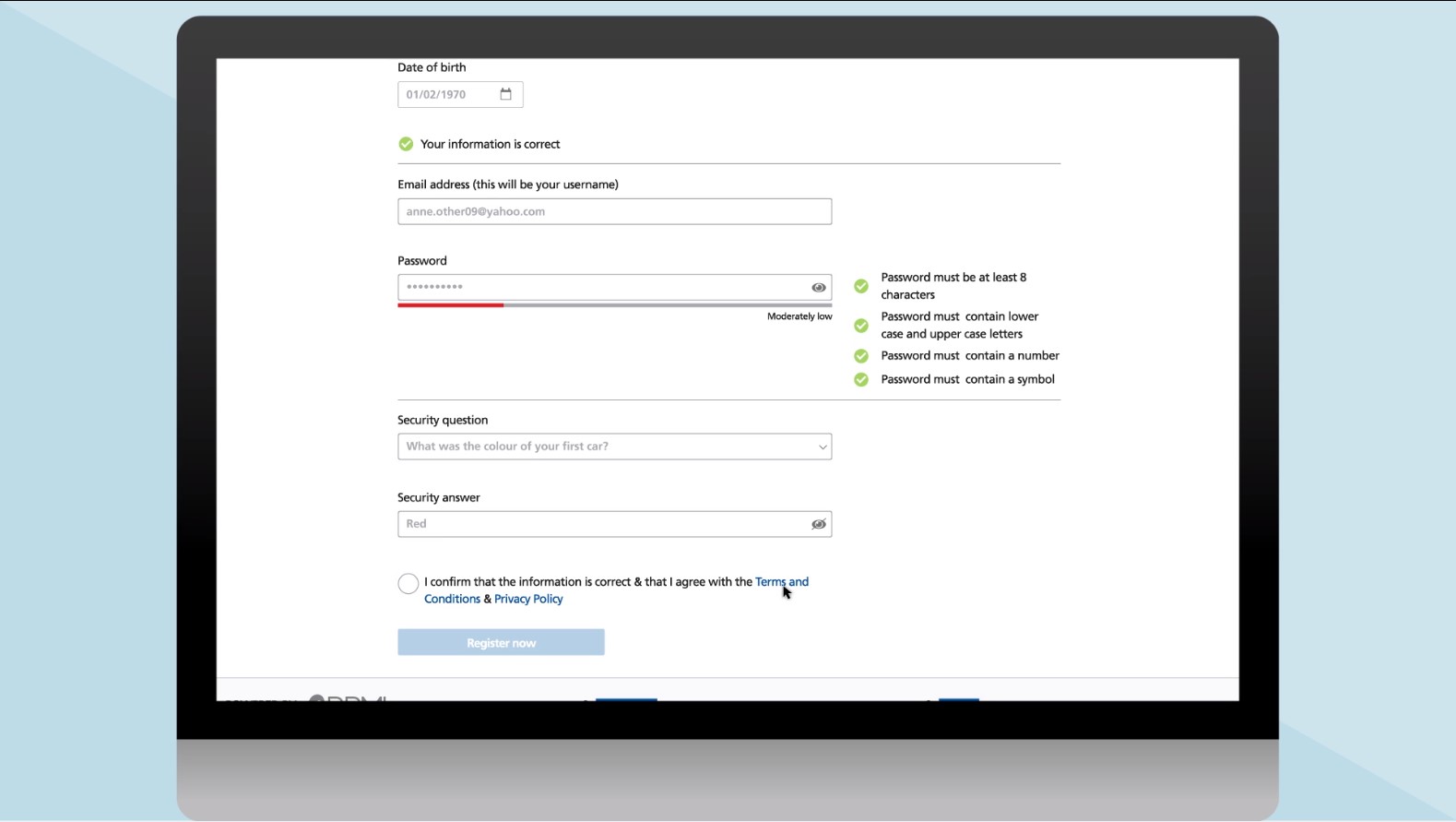

9. Choose a security question from the drop down menu

10. Type your answer to the security question in the box where requested

11. Read the terms and conditions. Then tick the box to confirm you have done so

12. Select ‘register now’

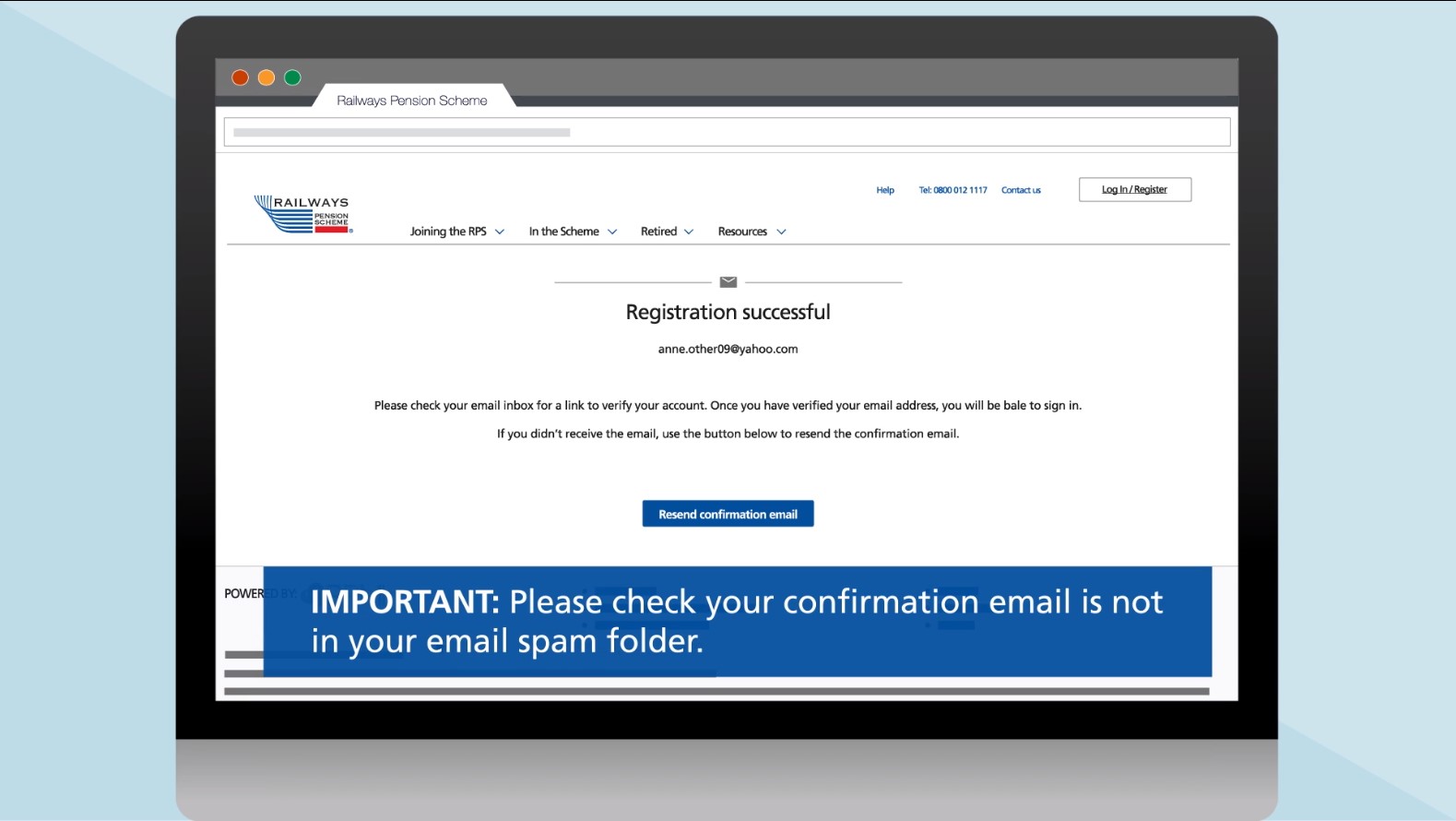

13. Check your email.

You should have received an email to the email address you entered when registering. This confirms that your registration has been successful. It may be in your spam/junk folder rather than your inbox.

14. Click the link in the email asking you to verify your account.

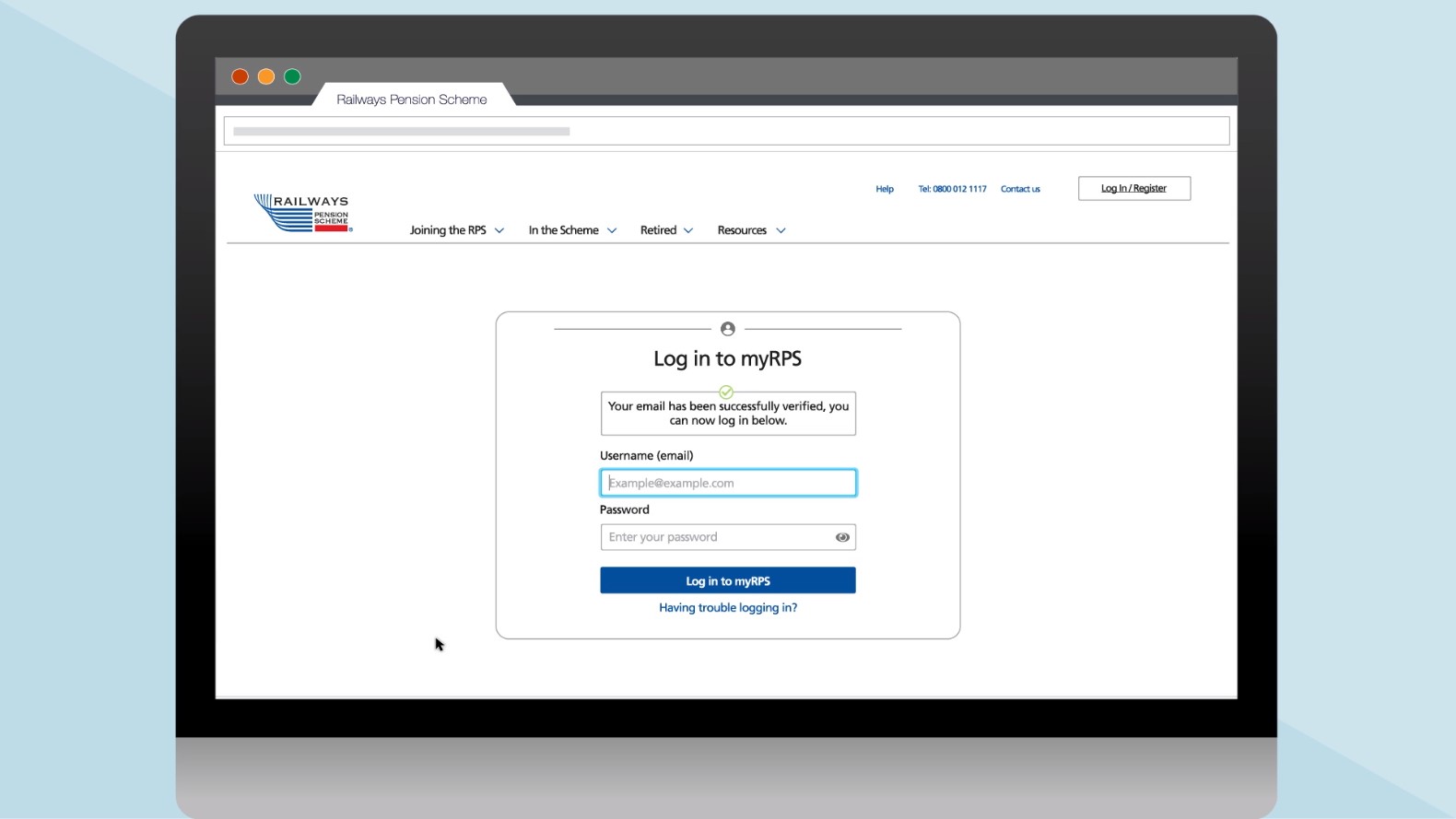

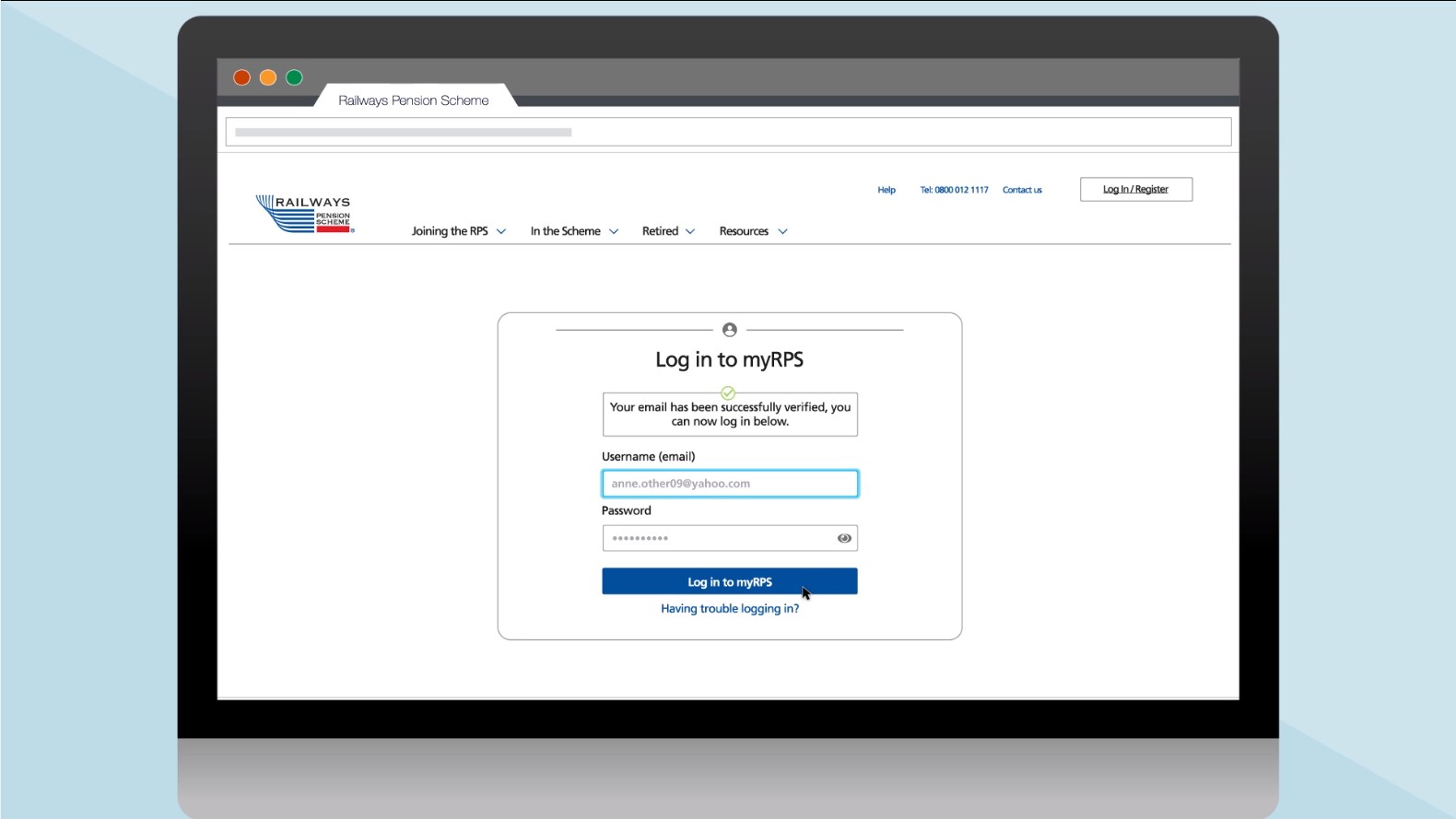

15. The link will take you back to the RPS website. You will then need to re-enter the email address and password you used to register.

16. Select log in to myRPS

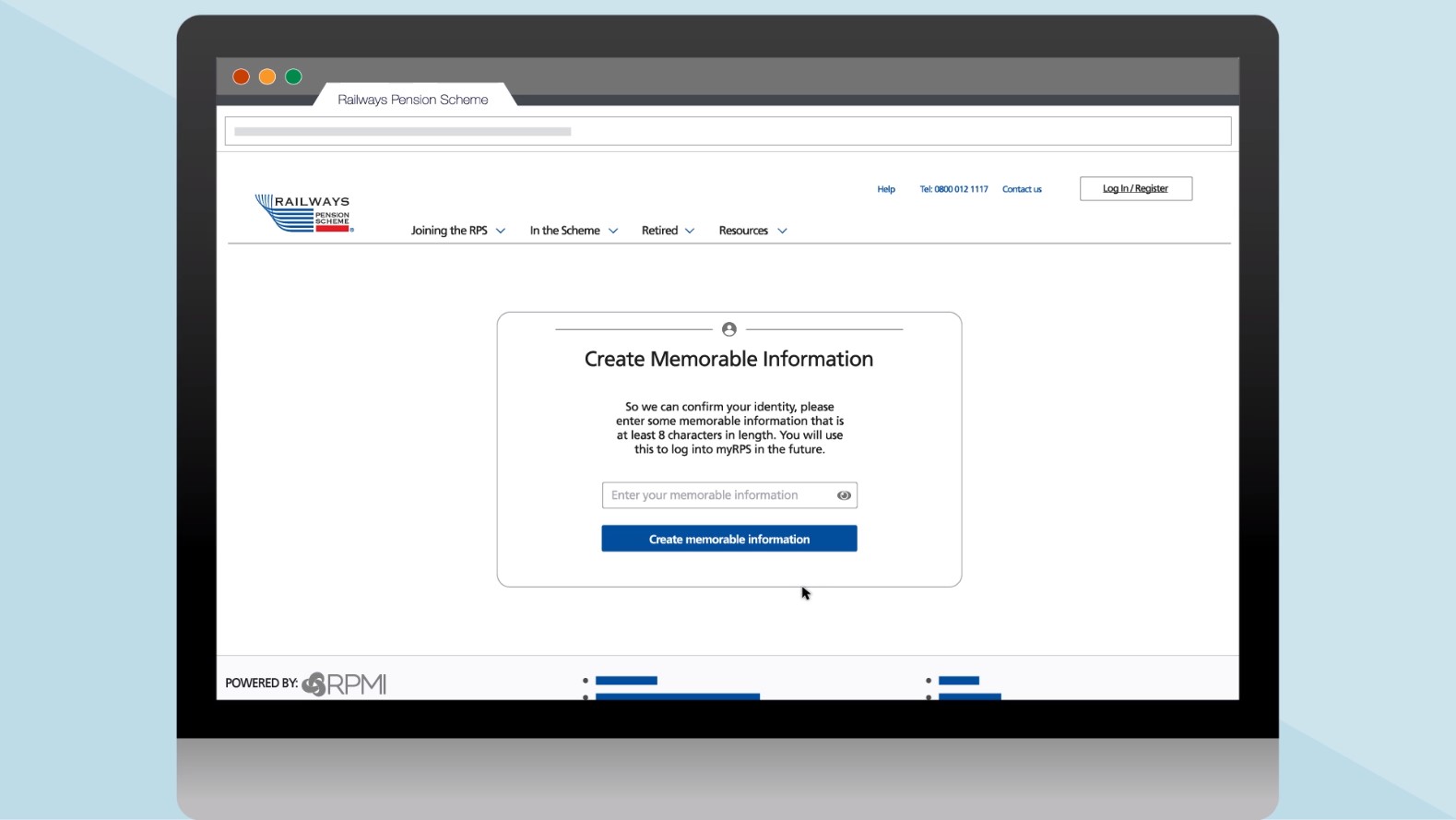

17. Add a final piece of memorable information

For added security, you’ll use this together with your password each time you log in. It should be at least 8 characters in length and be easy for you to remember.

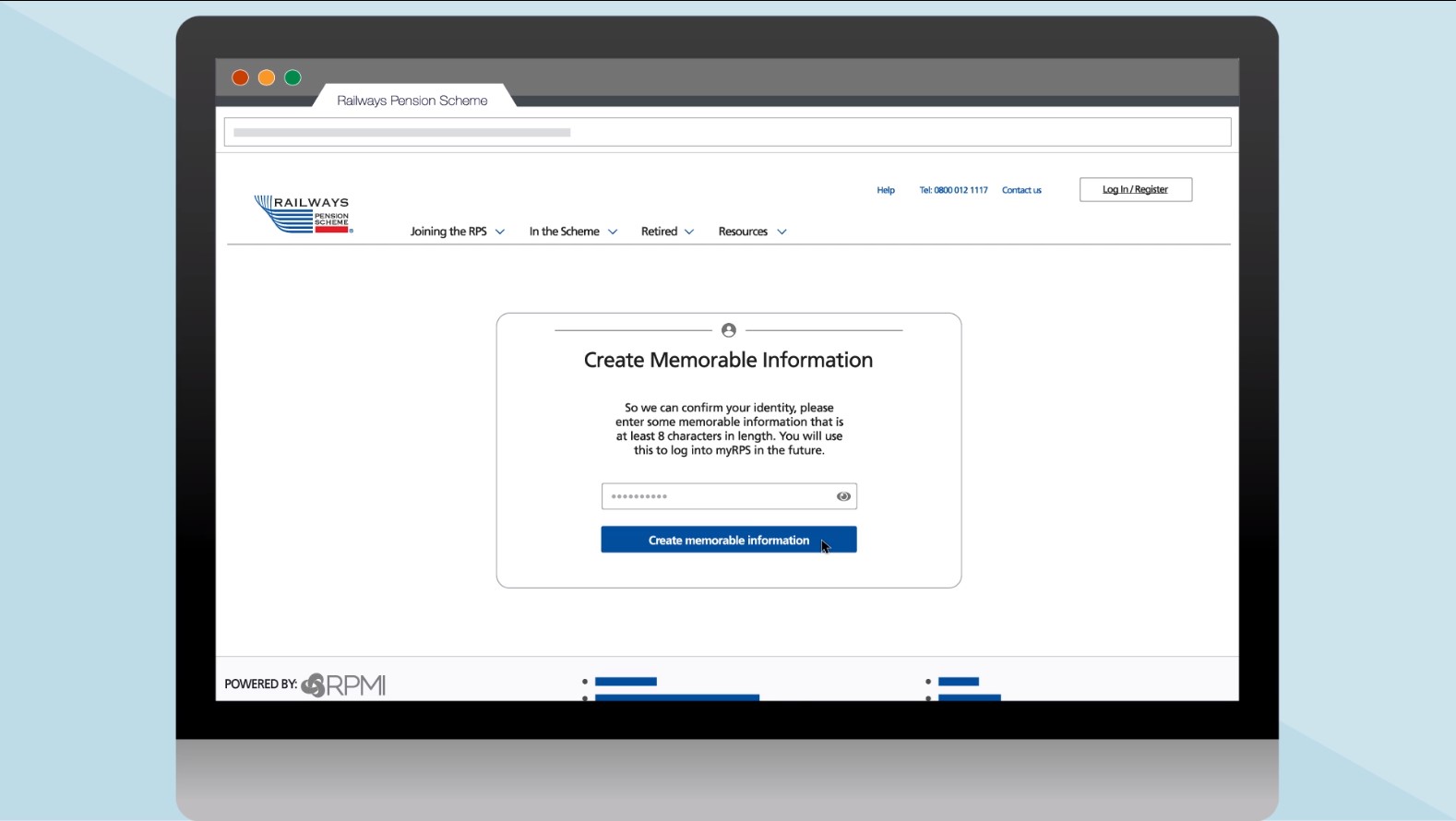

18. Select create memorable information.

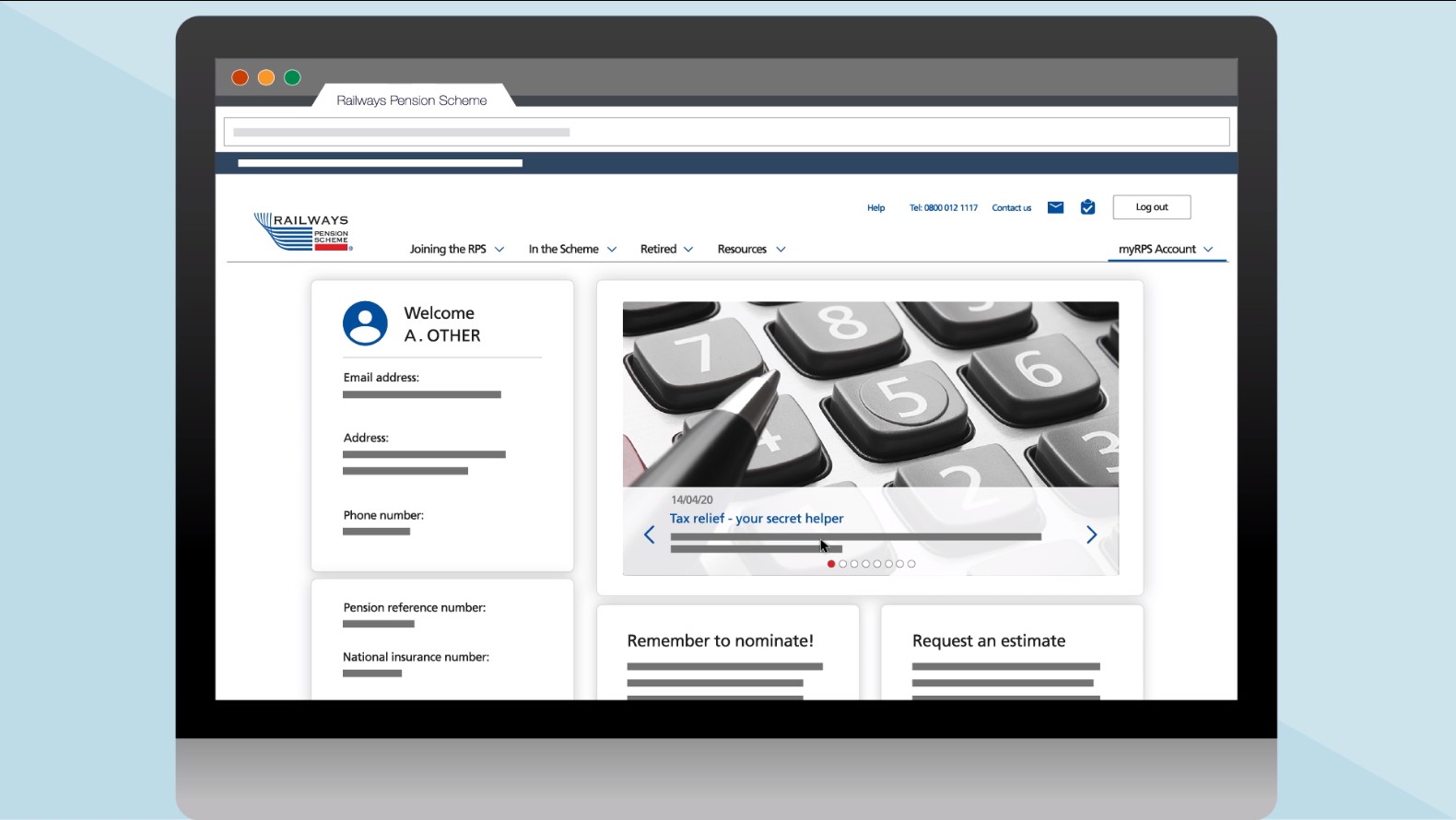

19. You should then be taken to your myRPS dashboard. And you’re all done.

To log back in at any time, simply

You can see a short video of these steps here

You can also find video other video guides for using the website here

This includes:

10/5/2021

Author: Editorial

<p>The planner is designed to show you what your annual income could be when you stop work and how much you may be able to take as a tax-free lump sum. <br><br>It also lets you see <span style="background-color: initial; font-size: inherit; font-family: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">what it might look like if you decide to start taking your benefits before claiming your State Pension and then level your income out afterwards. This is known as the ‘level pension’ option. <br></span></p><div><p>The planner is a quick and easy way to take control and make your pension work better for you. And we’ll be making even more improvements to it in the future.<br></p></div><div><strong>This planner is for anyone with a Defined Benefit pension. If you are a member of the Industry-Wide Defined Contribution (IWDC) Section, you should use the DC retirement planner instead. If you’re unsure which type of pension you have, please check your member guide. You can find a copy in the My Library section of your <a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable="">myRPS account. <br></a><br></strong></div><h2>How can I try the pension planner?</h2><p><a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable="">Log into your myRPS account</a> and go to the ‘Your pension planner’ section on the dashboard. Click ‘Try the planner’. Alternatively log into your online account and hover over the ‘myRPS account’ menu. Go to the ‘Planning for the future’ section and click on ‘Pension Planner’. <br><br><br><img alt="Your pension planner" src="https://cdn3.railpen.com/mp-sitefinity-prod/images/default-source/default-album/pension-planner/your-pension-planner.png?sfvrsn=17119713_5"><br><br><br>There is also a list of FAQs at the bottom of the page.<br><br><br><img alt="Pension planner FAQs" src="https://cdn3.railpen.com/mp-sitefinity-prod/images/default-source/default-album/pension-planner/pension-planner-faqs.png?sfvrsn=76e5590a_5"><br><br><br>You will already see the improvements we've made in comparison to the previous planner. This includes the use of real-time data to calculate your benefits.<br><br>While this will give you a more accurate result, it might also take a little longer to perform the calculation. Please be patient and if it looks to be taking a little longer than expected, this is probably because your real-time calculation is a little more complex. <br><br></p><h2>What does the pension planner do?</h2><p>Like the old one, the planner:<br></p><ul><li>works out what your annual pension is likely to be </li><li>shows your BRASS (if you have it) fund's current value and the projected future value</li><li>shows how much of a lump sum you may be able to take when you retire and how it would then affect your annual pension. If you have BRASS, it shows you how your BRASS fund works as part, or all of, your lump sum depending on the amount of BRASS you have and the size of lump sum you want</li></ul><p>The improved planner also:</p><ul><li>lets you see what it may look like if you go for a 'level pension' option</li><li>uses the latest salary data your employer has sent us, rather than the data from your last Annual Pension Estimate, to give you the most accurate results</li></ul><p>The planner's estimates are based on:</p><ul><li>your salary</li><li>retirement age</li><li>BRASS contributions made to date</li><li>weekly BRASS contributions going forward</li></ul><h2>How can I experiment with the pension planner?</h2><p>By simply using the plus and minus buttons in the planner, you can experiment with increasing or decreasing your: </p><ul><li>retirement age</li><li>weekly BRASS contributions</li><li>lump sum<br></li></ul><p><img alt="Using the pension planner" src="https://cdn3.railpen.com/mp-sitefinity-prod/images/default-source/default-album/pension-planner/using-the-pension-planner.png?sfvrsn=d6a2577_7"></p><p><br>This lets you see what may happen to your annual pension and lump sum if you're considering making any changes. It also lets you model different scenarios to see what your annual pension could be as a result. <br><br>Don't worry, the planner won't make any changes to your record. But it will show you what could happen if you did make the changes. <br><br>It's all about giving you the information you need to make the right decision for you. It's also a great way to see your pension benefits come to life and get a better view of what the future may hold. <br></p><h2>Will the pension planner tell me if I'm saving enough?</h2><p>The planner will show you how much your annual income is likely to be when you retire. <br><br>You can then compare this to the Retirement Living Standards (RLS) and decide for yourself whether it's likely to be enough for you.<br><br>As a guideline, the RLS shows that an individual will need between £10,200 and £33,000 per year when they finish work. You can find out more by visiting the <a href="https://www.retirementlivingstandards.org.uk/" target="_blank" data-sf-ec-immutable="">Retirement Living Standards website. </a> <br><br>We're busy building another new calculator using this RLS data to make it easier for you to judge how you may need and compare that to the results in the pension planner. <br><br></p><h2>What can I do with my pension planner results? </h2><p>Once you have your pension planner results, you can decide whether to take any further action. <br><br>For example, you may choose to:<br><br></p><ul><li>change your Target Retirement Age (TRA)</li><li>change your weekly BRASS contributions</li><li>make a one-off BRASS contribution</li></ul><p>Before making any changes, you may want to get advice from an Independent Financial Adviser. You can find one in your area by using the <a href="https://www.unbiased.co.uk/" target="_blank" data-sf-ec-immutable="">Unbiased website.</a> Remember to show them your pension planner results. <br><br>Please remember this planner has been designed to show you what your retirement benefits could be based on the information we currently hold for you and the options you have selected. <br><br><strong>The results shown by the planner are for illustration and comparison purposes only and do not guarantee any future outcome or entitlement. The results should not be replied upon for retirement planning. Your actual benefits in retirement could differ from the estimated figures shown. </strong><br><br></p><h2>Why wasn't the planner live before now?</h2><p>We know that many members really valued the planner on the old website and we wanted to reinstate it as soon as possible after the new site launched in September/October last year. <br><br>The main delay came from making sure we improved the planner and give members what they wanted most. <br><br>Based on survey results, thousands of members told us there were clear priorities for us to deliver on the new site:<br></p><ul><li>Online estimates</li><li>See more periods of membership under one log-in</li><li>Use more up-to-date salary data in the planner</li><li>Improve the planner to be able to model a level pension</li></ul><p>We put the new site live as soon as we had the online estimates ready and we're really pleased that more than 30,000 of you have already used the estimate tool.<br><br>You can now also see other periods of membership without having to log in with a separate ID. <br><br>Improving the planner did take a little longer than points 1 and 2 listed above, but we're pleased to say:<br></p><ul><li>it's now based on the latest salary data your employer has sent us, rather than on your last Annual Pensions Estimate as previously</li><li>it also lets you model what a level pension may look like. You can learn more about level pensions [here]<br></li></ul><p>For more information on what you can do with your online account, why not visit our <a href="https://member.railwayspensions.co.uk/resources/video-library" data-sf-ec-immutable="">Video Library?</a> We also have videos on there about planning and saving, your retirement options, and tax and other pension topics.<br></p>

If you're a DB member, there's a new way to see what your pension may be worth when you retire.

14/5/2021

Author: Editorial

<p>It's now even easier for you as a pensioner to keep a close eye on your benefits and manage them quickly and conveniently online. <br><br>Log into your myRPS account that is personalised for each individual member and holds your private pension information. <br><br>Once you've logged in, you can:<br></p><ul><li>Check and download your payslips</li><li>Check your P60</li><li>Check and update your contact details (such as your email address, phone number and postal address)</li><li>View and update your death benefit nominations (if you retired within the last five years)</li><li>Access messages about your pension account</li></ul><p> </p><p><img src="https://cdn3.railpen.com/mp-sitefinity-prod/images/default-source/default-album/payslips/payslips.png?sfvrsn=1a347dfc_3" alt="Payslips in your online account"></p><p> </p><h2>Download your payslip</h2>You can now download your payslip when you log into your myRPS account as a retired member. Simply go to the 'Check your payslips' section of the dashboard and click 'View payslips'. <br><br>Under your current payslip, you can select 'Download payslip' which is next to the 'Print payslip' option. When you click to download your payslip, a new tab will open with your payslip displayed in a new web page. <br><br>The payslip will also download and open as a PDF if you have a PDF viewer or editor installed. If you don't have a PDF viewer or editor, you'll be able to go into your downloads and select how to open it from there - you may choose to open it in Chrome, for example. <br><br>You can also scroll down to see your previous payslips, and when you click the little arrow next to each one, you'll get the option to download or print. <br><br>If you have any issues with downloading your payslip, please contact our Helpline on 0800 012 1117 or by emailing <a href="mailto:csu@railpen.com">csu@railpen.com</a>.<br><br><h2>Your P60</h2>As a retired member, you can log into your online account and view your P60s. <br><br>Your P60 will be moving to the Payslips section within your account. Your P60 shows the tax you've paid on your pension in your tax year. <br><br>As usual you receive a message straight to your inbox saying that your P60 is available to view, however you can also find your P60 in the Payslips section of your account. <br><br>Simply log into your online myRPS account and go to the 'My Pension' section. Then, go to the 'Payslips' tab. Here you can see your payslip, a history of the details we hold for your payslips, and an option to view and download your P60. You can pick the tax year you want before you view and/or download. <br><br>You can only view your P60 if you're a UK tax payer - anyone in an Irish or Guernsey payroll will not be able to see their P60. <br><br><strong>If you're a RPS member with multiple schemes, use the Scheme Switch function in the top left corner of your account to switch between schemes to find which one your P60 sits in. </strong><br><br><h2>Downloading your P60 </h2>When you select the tax year you want from the dropdown list, the download button will appear if your P60 is available.<br><br>If your P60 is not available, you will see a message that says 'P60 is unavailable' in place of the download button. <br><br>If you have any questions about your P60, please get in touch with the Helpline by emailing <a href="mailto:csu@railpen.com">csu@railpen.com</a> or calling 0800 012 1117. <p> </p>

Download your payslips and view your P60s online today by logging into your online account.

Read the latest updates from the world of pensions and see how they affect you as a member of the Scheme.

We provide regular newsletters to help you navigate your pension whether you're paying into the Scheme, not paying in anymore, or receiving your pension.

Register with Platform today to have your say in how we communicate with you and other members about your pension.

Railways Pensions is powered by Railpen Limited

© Railpen Limited 2010-2025. Registered Office: 100 Liverpool Street, London EC2M 2AT

Each of Railpen Limited (registered in England and Wales No. 2315380) and Railway Pension Investments Limited (RPIL) (Registered in England and Wales No. 1491097) is a wholly owned subsidiary of Railways Pension Trustee Company Limited (Registered in England and Wales No. 2934539). Registered office for each company: 100 Liverpool Street, London EC2M 2AT. RPIL is authorised and regulated by the Financial Conduct Authority for some of its activities. The administration of occupational pension schemes is not a regulated activity. Full details about the extent of RPIL's authorisation and regulation by the Financial Conduct Authority are available from us on request.

Please manage your cookie choices by switching the consent toggles on or off under the purposes listed below. You can also choose to click:

Accept All Reject All