Blog

A deep-dive into a variety of pension topics to help you understand and learn more about your pension and the Scheme.

Menu

A deep-dive into a variety of pension topics to help you understand and learn more about your pension and the Scheme.

Our blogs will give you information, tips, insights and guidance to help you get to know your pension and support you on your journey to retirement.

/levelling-out-retirement-income.jpg?sfvrsn=38491c1c_3)

When you retire, your Railways Pension Scheme (RPS) pension benefits probably won’t be your only source of income. Having different retirement income streams, like the State Pension, can give you financial security and peace of mind for when your working years are over.

When you’re planning for retirement, keep in mind that you won’t be able to claim your State Pension until you reach your State Pension Age.

Many members choose to take their RPS pension benefits before they claim their State Pension.

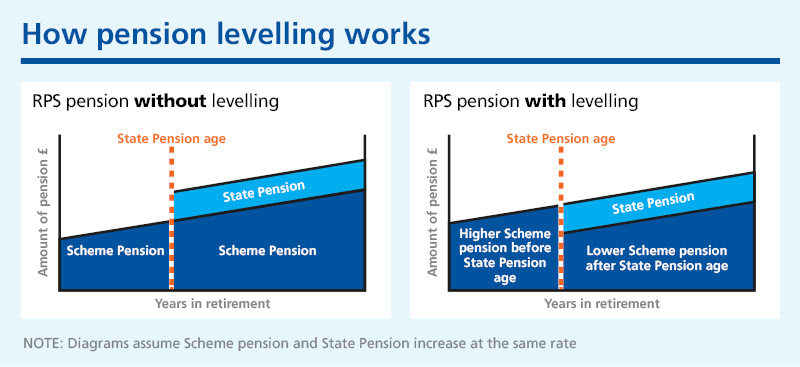

If you’re a defined benefit (DB) member, when you take your RPS pension benefits you may have the option to level-out your income, until you claim your State Pension.

This option is only available for DB members of the RPS. If you’re an IWDC member, you can learn about your options on the How I can take my IWDC pot page.

Your State Pension Age (SPA) is the age when you can claim your State Pension. You can check your SPA at Gov.uk. Your SPA is likely to be later than the age you can take your RPS pension.

When you take your RPS pension benefits, you may have the option to adjust the amount of pension you get from the RPS.

If you are eligible, you may be able to take a higher RPS pension before your SPA, and lower RPS pension after. You may also be able to take up to 25% (but no more than £268,275) of your total pension benefits as a tax-free cash lump sum with this option.

This aims to level-out your pension income over time, as shown below.

Your RPS pension payments will be worked out based on your SPA when you take your RPS pension benefits.

If the government changes the SPA later, or if you decide to delay claiming your State Pension until after your SPA, your RPS pension payments would still reduce at your original SPA.

Use your estimates to plan ahead

You can use your State Pension forecast and your RPS pension estimate to help you work out how much income you might get. You can request an estimate to see how much you would get if you choose to level-out your income in your myRPS account.

Your RPS pension and your State Pension are separate. So, the amount that your RPS pension reduces by may not be exactly the same amount as the State Pension you get.

If the amounts are different, it might mean your retirement income when you reach SPA could be less, or more than you had before SPA.

You may choose to level-out your income if you want to:

But it’s important to plan ahead and think carefully about whether it’s right for you.

Picture your retirement

You might want to level-out your income, to get a higher RPS pension before you’re able to claim your State Pension.

This can give you flexibility to manage your income when you might need it most, for example if your RPS pension is your only source of income until you claim your State Pension. In that case, you might want a higher pension to help cover bills, support your family or make a few home improvements.

To get an idea of the income you might need after tax, try the Retirement Budgeting Calculator in your myRPS account.

If you choose to level-out your income, when you reach your SPA, your RPS pension will reduce permanently. This means you’ll have less pension from the RPS when you start getting your State Pension.

Think about whether levelling-out your income will give you enough money together with your regular State Pension payments.

Your annual pension increase

Even though your RPS pension payments will reduce after your SPA, the amount you get will still increase each year, in line with the Scheme rules. You can learn more on the Annual pension increase page.

As part of your retirement planning, it’s always a good idea check how much State Pension you’re likely to get, and that it meets your expectations. You can check your State Pension forecast at Gov.uk and learn more on the dedicated State Pension page.

If you choose to level-out your income, it’s even more important to check your State Pension forecast.

Keep in mind that your tax payments may change over time,

depending on the amount of income you receive.

When you take your RPS pension, it becomes part of your

taxable income.

Levelling-out your RPS pension could help stabilise your tax

payments when you get your State Pension, and help to give you peace of mind

about your financial future.

There are many ways to take your RPS pension benefits, and

levelling-out your income is just one option. The choice is yours, so think

about this carefully.

Speaking to a trusted financial expert could help you plan

ahead and choose the best option for you. You can find a list

of specialist sites and professional advisers on the Guidance and advice page.

To explore your options, try the free pension planning tools in your myRPS account. If you’re still paying into your RPS pension, you can use the Pension Planner to see what your pension might be worth, and how you can choose to use it.

To learn more about your retirement options, read the information on the Ways to take my pension page. For more detailed information, check your Read as You Need guide to retirement options.

14/4/2025

Author: Editorial

<p><em>This blog is the first of a series of 3 articles on saving more with BRASS, so stay tuned for more information coming soon.</em><em></em></p><p>BRASS is the main arrangement for members of the Railways Pension Scheme (RPS) who want to pay more on top of the normal contributions they make towards their pension. </p><p>It’s available to all Defined Benefit (DB) active members and is a great way to boost your retirement income. </p><p>BRASS is popular with our members, and we sometimes receive specific questions about different aspects of saving more with it. We’ve explained some of the specifics of BRASS below to help you get to grips with it.<del cite="mailto:Rob%20Hughes" datetime="2025-04-08T07:12"> </del><br></p><p>Please visit the <a href="https://member.railwayspensions.co.uk/defined-benefit-members/saving-more-BRASS-AVC-Extra/saving-more-with-BRASS" data-sf-ec-immutable="">Saving more with BRASS area of the website</a> for more information. </p><p> </p><h4>The fundamentals of BRASS</h4><h3>Who’s BRASS available to</h3><p>BRASS is available to anyone who is a DB active member of the RPS and wants to save more towards their pension. <br></p><p>It may be particularly useful to you if you have additional earnings which don’t quality for your main Scheme pension, such as overtime or bonus payments, for example. </p><p> </p><h3>How to join BRASS</h3><p>To join BRASS, speak to your employer. They’ll provide you with a form you’d need to complete and return to them. You can also complete the form when you <a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable="">log into your myRPS account</a>. Once logged in, go to the ‘Planning for your future’ area. Once you’ve completed the form, you can download a copy and email it to your employer. <br></p><p>Any BRASS contributions you decide to make are taken from your pay by your payroll department, before tax. That way, you get tax relief on anything you put in to your pot (up to the Annual Allowance limit).</p><p> </p><h3>How does it work</h3><p>When you join BRASS, you’ll automatically start a Personal Retirement Account (PRA). Think of your PRA account as a separate pot of money your BRASS contributions go into. <br></p><p>Your PRA is separate to your defined benefit pension with the Scheme. The savings you have in it are classed as defined contribution savings and are invested in a range of funds. <br></p><p>The aim of the investments is to help the value of your PRA pot to grow over time. But like any investment, the value of your funds could go up and down. <br></p><p>You can <a href="/defined-benefit-members/saving-more-BRASS-AVC-Extra/brass-fund-choices">select the funds you’d like your pot to be invested in</a> or you can leave that to the Scheme’s investment experts – the choice is yours. </p><p> </p><h3>How much you can save into BRASS</h3><p>You can pay as little as £2 per week or £10 per month (if you are paid monthly) on top of the normal contributions you make to your pension. <br></p><p>There’s a maximum you can pay in each year – usually 15% of your gross earnings. If you want to pay more than the BRASS maximum, <a href="https://member.railwayspensions.co.uk/defined-benefit-members/saving-more-BRASS-AVC-Extra/save-more-AVC-Extra" data-sf-ec-immutable="">you can join another arrangement called AVC Extra (not available to Network Rail members).</a> We’ll cover AVC Extra in a future blog post. <br></p><p>You can change how much you contribute at any time – this is especially useful if you know you have a big bill or expense coming up. <br></p><p>And, you can make one-off payments too. You can make a one-off contribution directly when you <a href="/my-rps">log into your myRPS account</a> if you wish and via payroll. <a id="_anchor_1" href="https://railpen-my.sharepoint.com/personal/jenny_prodanova_railpen_com/Documents/0.Personal/2025/Blogs/BRASS%20QA_March%202025_v4.docx#_msocom_1" name="_msoanchor_1" data-sf-ec-immutable=""></a><a href="https://member.railwayspensions.co.uk/defined-benefit-members/saving-more-BRASS-AVC-Extra/saving-more-with-BRASS" data-sf-ec-immutable="">Find out how to do this on the Saving more with BRASS page.</a> </p><p> </p><h3>Changing your BRASS contributions</h3><p>If you are not in a salary sacrifice arrangement, you can increase, pause or stop your contributions at any time. To do this, log into your <a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable="">myRPS account</a> and look for a BRASS e-form in the Planning for the future area of your account. You can also contact your employer directly. <br></p><p>If you are in a salary sacrifice arrangement, there may be an annual window in which you can increase, reduce or stop your BRASS contribution.</p><p> </p><h3>What happens to your BRASS contributions if you get a new job</h3><p>If you leave work, you cannot continue to pay into BRASS.<br></p><p>Your BRASS pot will remain invested in your chosen fund(s) until you claim your benefits or transfer to another pension provider.<br></p><p>If you change railway employer, you will stop paying BRASS contributions to your previous employer’s section of the Scheme. If your new employer has a section in the Railways Pension Scheme and you join, you can restart your BRASS contributions by contacting your employer. <br></p><p>Both PRA pots will be kept separate unless you decide to transfer your previous membership along with your BRASS pot into your current membership.</p><p> </p><h3>Transferring your BRASS pot</h3><p>You may be able to transfer the money in your BRASS pot to another arrangement, separately to your defined benefit pension, if you wish. However, you can only do that if you have already stopped paying into BRASS.<br></p><p>To start the process, you can either tell your employer or request a transfer out quote (CETV) when you log into your myRPS account. More information on transferring your BRASS pot is available on the <a href="https://member.railwayspensions.co.uk/defined-benefit-members/saving-more-BRASS-AVC-Extra/taking-my-BRASS" data-sf-ec-immutable="">Taking my BRASS page</a>.<br></p><p>You should think carefully before making a decision to transfer your BRASS pot out of the Scheme. You may want to consider getting financial advice. You can find out more about how do that on our <a href="https://member.railwayspensions.co.uk/pension-essentials/guidance-advice" data-sf-ec-immutable="">guidance and advice</a> page. </p><p> </p><h3>What happens to your BRASS pot if you die in service</h3><p>If you die before taking your BRASS pot, the pot would be included within any tax-free cash lump sum paid to your beneficiaries. The tax-free cash lump sum is paid at the discretion of the Trustee.</p><div><div><div id="_com_1"></div></div></div>

Some specifics of BRASS, explained.

/how-we-calculate-a-pension.jpg?sfvrsn=92983ac2_1)

16/5/2025

Author: Editorial

<p>The answer is that this will depend on how long you’ve been a member, your Pay and the rules of the Section of the Scheme you are in. </p><p><strong>It’s a complex calculation and you may have several options, and the easiest, and most <span style="text-decoration: underline">accurate </span>way for you to get an understanding of what your DB pension benefits might be worth is to request an estimate in your </strong><a href="/login"><strong>myRPS account</strong></a><strong> or by contacting us directly. </strong></p><p>If you still want to learn more about what your pension benefits are based on, then you’ll find an overview in your Member Guide and summarised below. </p><p>Please bear in mind that this is an illustrative, and generic example, to be used for information purposes only. Rules may vary by Section and outcomes will be highly dependent on your individual circumstances. </p><p>If you’re a member of the Industry Wide Defined Contribution (IWDC), the value of your Personal Retirement Account (PRA) is paid in a different way. You can read more about that in a separate blog post: <a href="https://member.railwayspensions.co.uk/knowledge-hub/news-and-views/blog/rps-blog/2025/05/16/understanding-the-value-of-your-pra-for-iwdc" data-sf-ec-immutable="">The value of your PRA for IWDC</a>. </p><h3>The basis for a defined benefit calculation in the RPS </h3><p>In general, a defined benefit (DB) scheme like the Railways Pension Scheme (RPS), pays you a regular income for life when you retire. </p><p>In most sections, this income is broadly based on your final or final average pay and how long you’ve been a member of the Scheme. </p><p>You can also choose to take a tax-free cash lump sum. </p><p>In this blog, we’ll use an example of how your pension and the separate tax-free cash lump sum would be calculated, if you had a final average pay of £50,000 and Scheme membership of 25 years and 30 days. </p><p>This example does not include any Additional Voluntary Contributions (AVCs), including BRASS or AVC Extra, which can impact how your pension benefits are paid. Please visit the <a href="/defined-benefit-members/saving-more-BRASS-AVC-Extra">saving more area </a>to find out more about how you can take your BRASS or AVC Extra pots. </p><p>If you are a member of a Career Average Revalued Earnings (CARE) DB arrangement in the RPS your calculation would be slightly different and you can find out more in your Member Guide. </p><h3>Example of how DB pension payments are calculated in the RPS<strong></strong></h3><p><img src="https://cdn3.railpen.com/mp-sitefinity-prod/images/default-source/infographics-(current)/how-an-rps-pension-is-calculated-v2.png?sfvrsn=17f72fae_3" width="800" alt="A graphic showing how a DB pension in the RPS is calculated"></p><p><strong>1. </strong><strong>As outlined above, in many Sections, we use final average pay as a starting point for the pension calculations.</strong> </p><p>This may be different in your Section of the Scheme and you can find more information in your Member Guide. </p><p>For this example, we will use a final average pay of £50,000. </p><p>Final average pay is set by your employer and is defined as, your Pay or Pensionable Pay (whichever is higher) averaged over the 12 months before you: </p><ul><li>take your pension</li><li>leave the Scheme or </li><li>die</li></ul><p><em>Your Pensionable Pay is the amount of your total salary your employer decides is pensionable on the 1 April each year.</em> You can find more definitions for key terms on the <a href="/knowledge-hub/help-and-support/glossary">glossary page</a>. </p><p><strong>2. In most sections, in line with the Scheme rules, a value of 1.5 times the Basic State Pension is then deducted (or ‘offset’) from the calculation when your pension is worked out. </strong><a id="_anchor_2" href="https://railpen.sharepoint.com/sites/CustomerExperienceFunction/ProjectsActive/RAIL/RPS/Web/RPS%20website%20-%202024%20onwards/Content/4%20-%20Knowledge%20hub/2%20-%20News%20and%20views/Blogs/Approved%20-%20how%20we%20calculate%20pension%20benefits%20blog%20v3.docx#_msocom_2" name="_msoanchor_2" data-sf-ec-immutable=""></a></p><p>This was originally included in the rules to ensure members would receive a good income after 40 years membership, relative to their final average pay, and when their Scheme pension was considered in combination with the State Pension. <br></p><p>The amount of the Basic State Pension is set by the government. It can change over time and usually goes up every year. You can read more on the <a href="/pension-essentials/state-pension">State Pension webpage</a> or at <a href="https://www.gov.uk/browse/working/state-pension" target="_blank" data-sf-ec-immutable="" data-sf-marked="">gov.uk</a><br></p><p>For this example we have used £8,667 as the final average Basic State Pension amount. </p><p><strong>3. We then divide the remaining total by 60</strong><a data-sf-ec-immutable=""></a></p><p>This is based on the pension accrual rate set in the Scheme rules. </p><p><strong>4. The final step is to multiply by the number of years and days of Scheme membership</strong> </p><p>For example, if someone has been a member in the Section for 25 years and 30 days we would multiply by 25.082191.<br></p><p>30 days are divided by 365 days to give 0.082191 and with 25 years added, this gives a total membership period of 25.082191. <br></p><p>That gives us the total yearly pension the member is entitled to, per year, before tax </p><p>In this example, it would be £15,467 per year before tax is taken. In line with the scheme rules, we pay pensions on a four-weekly basis. </p><p>Please remember that this is a generic example, and the figures may vary depending on your individual circumstances and options, for example if you choose to take a higher lump sum (see below), or have paid into BRASS. <br></p><h3>Example of how a lump sum is calculated in the RPS</h3><img src="https://cdn3.railpen.com/mp-sitefinity-prod/images/default-source/infographics-(current)/how-your-lump-sum-is-calculated.png?sfvrsn=d9842561_2" width="800" alt="An equation showing how a lump sum is calculated "><p>Generally, as a defined benefit member, you may be able to take up to 25% of your pension benefits (but no more than £268,275) as tax-free cash, with the rest being used for regular pension payments as outlined above. </p><p>The rules of the RPS provide a lump sum, in addition to your Scheme pension. This is calculated separately and means you have to give up less of your Scheme pension if you want to take more tax-free cash.</p><p>In this example the basic lump sum would usually be calculated as follows:</p><p><strong></strong><strong>1. Starting with final average pay</strong> </p><p>We’ve used £50,000 again in this example but you can read more about how final average pay is defined in point 1 of the pension calculation above. </p><p><strong>2. Dividing it by 40</strong><br></p><p>This is based on the lump sum accrual rate set in the Scheme rules (and is different to the pension accrual rate outlined above).</p><p><strong>3. Multiplying that by the number of years and days of Scheme membership</strong> </p><p>Again, we’ve used 25 years and 30 days for this example (25.082191) as per the pension calculations above. </p><p><strong>4. This gives us the member’s basic lump sum amount</strong> </p><p>In this case it would be £31,352 <br></p><h3>A few other factors to bear in mind… </h3><p>The calculations above, are intended as a generic illustration, based on the basic pension and lump sum amounts being paid at Normal Retirement Age or Normal Pension Age. </p><p>However, there are other options to consider when taking your pension benefits. For example, you may be able to:</p><ul style="margin-left: 30px"><li>Take a higher cash lump sum (subject to limits) and less pension </li><li>Take a smaller cash lump sum and more pension </li><li>Take all your pension benefits as regular pension payments - this is only possible if the rules of your particular pension section allow it.</li><li>Take all your pension benefits as cash - this is only possible in limited circumstances. </li><li>Give up part of your own pension entitlement in order to give extra pension to your dependants. This is not the same as a spouse or dependants’ pension, which is paid from the Scheme to those who are eligible under the rules. </li><li>Take the level pension option – this means you can level out your pension benefits alongside what you will receive as your State Pension. With this option, you get more pension from the RPS before your State Pension age and then less pension from the RPS after your State Pension age</li><li>Take your benefits earlier, or later</li></ul><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; word-spacing: normal; caret-color: auto; white-space: inherit">All of these options would affect the basic calculations outlined above.</span></p><p>You can read more about your options for taking your pension benefits on the <a href="/defined-benefit-members/Im-planning-to-take-my-pension/ways-to-take-my-pension">ways to take my pension page</a>. </p><p>You can also use the pension planner in your <a href="/login">myRPS account </a>to see what your pension and tax-free cash payments might be worth when you retire. <a id="_anchor_9" href="https://railpen.sharepoint.com/sites/CustomerExperienceFunction/ProjectsActive/RAIL/RPS/Web/RPS%20website%20-%202024%20onwards/Content/4%20-%20Knowledge%20hub/2%20-%20News%20and%20views/Blogs/Approved%20-%20how%20we%20calculate%20pension%20benefits%20blog%20v3.docx#_msocom_9" name="_msoanchor_9" data-sf-ec-immutable=""></a></p><p>If you'd like more details about your estimated pension benefits and options, please request an estimate in your myRPS account or by contacting us directly. </p><p>If you need help requesting an estimate online you can watch this short video guide:</p><div data-sf-ec-immutable="" class="-sf-relative" contenteditable="false" style="width: 560px; height: 315px"><div data-sf-disable-link-event=""><iframe width="560" height="315" src="https://www.youtube.com/embed/VALJs1qoyTw?si=Orofg4_PBcvxC6oo" title="YouTube video player" sandbox="allow-scripts allow-same-origin allow-presentation allow-popups"></iframe></div></div><p> </p><p>We strongly suggest that you consider seeking independent financial advice before making any final decisions. You can find details about how to do that on the <a href="/pension-essentials/guidance-advice">guidance and advice page</a>.</p>

One of the questions we most often get asked, is how we work out what pension benefits a defined benefit (DB) member should get.

/how-contributions-are-calculated-for-db.jpg?sfvrsn=f9c39f62_1)

18/6/2025

Author: Editorial

<p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; word-spacing: normal; caret-color: auto; white-space: inherit">In general, as a defined benefit (DB) member, the amount you pay in (contribute) depends on:</span></p><ul><li>The category of member you are </li><li>Your Pensionable Pay – this is your Pay at 1 April every year. This may be capped in some sections.</li><li>Your Section Pay – this is your Pensionable Pay minus 1.5 times the Basic State Pension. This may also be capped in some sections. </li><li>The contribution percentage rates for your Section, as set out in the Scheme rules. For some sections, Section Pay must be at least 50% or 55% of Pensionable Pay. </li></ul><p><strong>Please remember that rules vary between Sections and you should check your Member Guide for further details of what determines your contribution rate. </strong></p><p><strong>Contribution rates can also change for a number of reasons, for example as a result of the Actuarial Valuation, which is carried out every 3 years. You can find more details on why contributions change below. </strong><br></p><p>What sets a workplace pension apart from a personal pension and other savings options is that your employer normally contributes as well. How much your employer pays into the RPS depends on the same factors as your contribution amount outlined above.<span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; word-spacing: normal; caret-color: auto; white-space: inherit"> </span></p><p>For example: </p><p><img src="https://cdn3.railpen.com/mp-sitefinity-prod/images/default-source/infographics-(current)/db-contributions-table.png?sfvrsn=da463ccc_1" alt="An example of DB contribution rates and what they are based on"></p><p><strong style="background-color: rgba(0, 0, 0, 0); color: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; word-spacing: normal; caret-color: auto; white-space: inherit"></strong><strong style="background-color: rgba(0, 0, 0, 0); color: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; word-spacing: normal; caret-color: auto; white-space: inherit">You can find out what percentage you pay into the Scheme in your Member Guide. This is available in the 'My Library' area when you log into <a href="/login">your myRPS account</a>.</strong><br></p><p>You may also be able see your pension contributions on your payslip. <br></p><h4>How your contributions are paid:<strong> </strong><br></h4><p>Your pension contributions are taken from your gross pay, so they are not subject to Income Tax. This means you are getting tax relief on your contributions (up to certain limits) so that some of the money that would normally have gone to the government in tax, effectively goes towards your pension instead<br></p><p>Many employers also operate a salary sacrifice scheme for pension contributions, also known as SMART. It means that: <br></p><ul type="disc"><li>your employer pays your pension contributions on your behalf</li><li>your contractual pay is adjusted to reflect this change </li><li>you and your employer pay National Insurance on a lower salary<br></li></ul><p>If you’re unsure whether you pay your pension contributions via salary sacrifice please check with your employer. <br></p><p>You can also find more information in your Member Guide. <br></p><h4>When your contributions change<br></h4><p>The % rate of contributions can go up or down, to meet the cost of paying current and future benefits from the Section. <br></p><p>Generally, the rate is reviewed every 3 years and agreed between the Trustee, the employer and an external adviser known as the Scheme Actuary. <br></p><p>The contributions you pay are then fixed from July each year, using your Pensionable Pay at 1 April<br></p><p>They may change at other times, for example as a result of:<br></p><ul type="disc"><li>a change in personal circumstances, such as taking statutory maternity, paternity or adoption leave</li><li>a change in working hours e.g. moving to part-time hours<br></li></ul><p>You can read more about this on the <a href="/defined-benefit-members/im-still-working/changes-to-circumstances">change in circumstances page</a> and in your Member Guide. <br></p><h4>Ways of saving more<br></h4><p>You can choose to pay in more to ‘top-up’ your main pension savings if you wish. This is known as making Additional Voluntary Contributions (AVCs). <br></p><p>These are held separately from your main Scheme benefits and are invested in a fund, or range of funds, with the aim of growing your AVC pot over time. <br></p><p>Like your main Scheme contributions outlined above, AVCs are usually taken from your pay before tax, so you benefit from tax relief there too. <br></p><p>The main AVC arrangement in the RPS is called BRASS, which you can incorporate with your main Scheme benefits when you take them. If you reach the limit you can pay into BRASS, you may be able to apply for another arrangement, called AVC Extra. <br></p><p>You can find out more about both options in the <a href="/defined-benefit-members/saving-more-BRASS-AVC-Extra">saving more area</a> of the website. <br></p><p>You can put as much money as you want into your pension but there are certain limits which can affect the amount of tax relief you're allowed. If you exceed these limits, you may have to pay a tax charge. Visit the<a href="/pension-essentials/pension-tax-limits"> </a><a href="https://member.railwayspensions.co.uk/pension-essentials/pension-tax-limits" data-sf-ec-immutable="">pension tax limits page</a> to find out more. </p>

Do you know how much you contribute to your pension, or how it’s paid into the RPS?

Read the latest updates from the world of pensions and see how they affect you as a member of the Scheme.

We provide regular newsletters to help you navigate your pension whether you're paying into the Scheme, not paying in anymore, or receiving your pension.

Register with Platform today to have your say in how we communicate with you and other members about your pension.

Railways Pensions is powered by Railpen Limited

© Railpen Limited 2010-2025. Registered Office: 100 Liverpool Street, London EC2M 2AT

Each of Railpen Limited (registered in England and Wales No. 2315380) and Railway Pension Investments Limited (RPIL) (Registered in England and Wales No. 1491097) is a wholly owned subsidiary of Railways Pension Trustee Company Limited (Registered in England and Wales No. 2934539). Registered office for each company: 100 Liverpool Street, London EC2M 2AT. RPIL is authorised and regulated by the Financial Conduct Authority for some of its activities. The administration of occupational pension schemes is not a regulated activity. Full details about the extent of RPIL's authorisation and regulation by the Financial Conduct Authority are available from us on request.

Please manage your cookie choices by switching the consent toggles on or off under the purposes listed below. You can also choose to click:

Accept All Reject All