Blog

A deep-dive into a variety of pension topics to help you understand and learn more about your pension and the Scheme.

Our blogs will give you information, tips, insights and guidance to help you get to know your pension and support you on your journey to retirement.

So you’ve made the decision to retire. And now, after years, or even decades of saving, you’re ready to claim your Industry-Wide Defined Contribution (IWDC) pension.

Thanks to pension freedoms introduced by the Government in 2015, there are more ways than ever for members of a defined contribution (DC) scheme, like the IWDC section, to take their pension savings.

But with great choice, comes great responsibility.

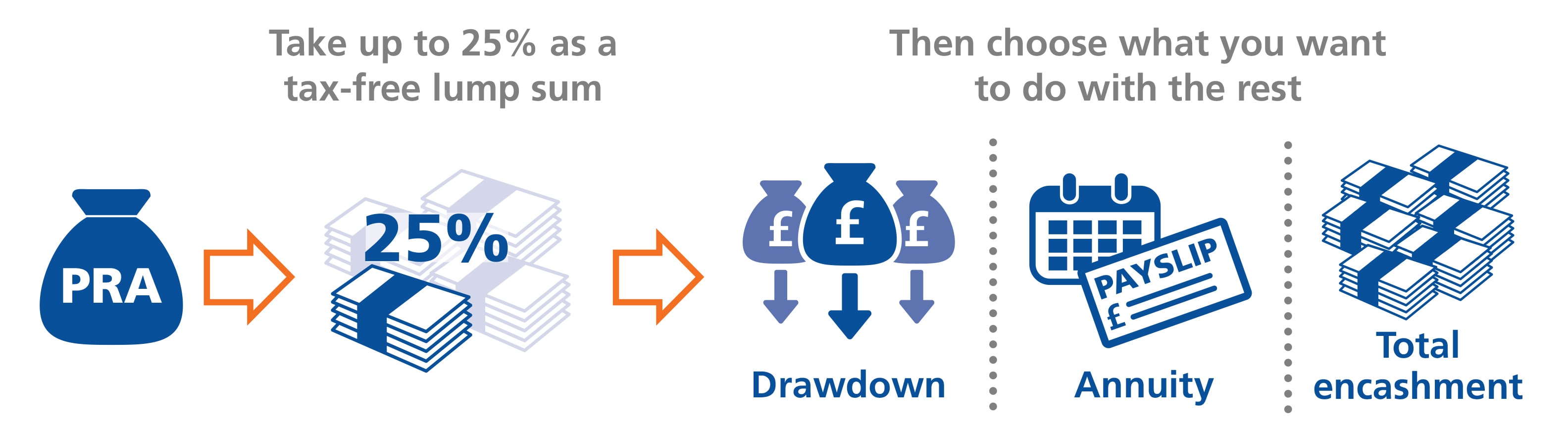

The money you’ve built up in the IWDC section is known as your Personal Retirement Account (PRA). And how you choose to take that money can have a huge impact not only on how much you get, but on how much you have to pay in terms of fees and tax.

So let’s look at your options…

You have 3 main ways to take your PRA as a member of the IWDC section:

You can see a summary of your primary options, and how they differ in the table below.

You can also read about each option in more detail using the relevant link here

The RPS doesn’t currently offer an annuity or drawdown option directly, so to access these you would need to transfer your PRA to another provider.

Options other than the 3 listed above may also be available in line with pension freedoms, however these are not currently offered in partnership with the RPS.

| Drawdown | Annuity | Encashment | |

| What is it? | A drawdown is basically a flexible income. Your PRA remains invested in funds specifically designed for that purpose. And you take out cash whenever you want to, up until your PRA runs out. | An annuity is a policy that you buy using money from your PRA. It then guarantees you an income for the rest of your life. Or for a set period of time if it’s fixed term. | Encashment basically means taking all of your PRA as a cash lump sum. |

| What are the benefits? |

| Depending on what type you choose, an annuity could give you:

| Instant access to all of the savings in your PRA |

| What are the risks? |

|

|

|

Whichever option you choose, you could decide to take up to 25% of your PRA as a tax-free lump sum.

It may also be possible to mix and match your options, with a combination of cash, annuity and drawdown if you wish. To do so you would need first select a primary option (drawdown, annuity or encashment) and then take the necessary steps, for example:

For both drawdown and annuity you would need to discuss this with your new provider and it would only happen after your entire PRA had transferred out of the Scheme.

Before you jump straight in and start claiming your pension, there are a couple of things you may want to bear in mind.

1. The tax implications

Depending on how you access your PRA there may be a limit on how much you can keep saving in your pension before paying tax. This is known as the Money Purchase Allowance (MPAA).

It is usually triggered if:

Where the MPAA is triggered, it means that the most you can pay into your DC pot in the future is currently £4,000 pa.

This could be particularly problematic if you plan to continue paying in or leave part of your pot invested such as with drawdown.

For more information about the MPAA check out our Read As You Need Guide.

2. You can hold off taking your pension if you prefer

If you’re not quite ready to start taking your pension, then you don’t have to.

You can delay taking your benefits right up to the age 75.

On the plus side, this may give time for your benefits to increase, however there are still risks involved. For example the value of your PRA can go down, as well as up.

You can find out more about all your options, including what happens if you’re not ready to take your benefits, in the how I can take my IWDC pot section of this website.

You can see a summary of your retirement options as a member of the IWDC section in a short video. You can also read about them in more detail in the planning to take my IWDC pot section of the website.

A range of planning tools are then available within your myRPS account to help you consider these options and what might work best for you. This includes a retirement modeller, showing what your pension might be worth when you retire and the different ways you can choose to use that money.

You may also want to speak to an Independent Financial Adviser (IFA).

Liverpool Victoria (LV) has been chosen as the official partner to give RPS members access to financial advice. LV can be contacted on 0800 023 4187.

You are still free to choose your own Independent Financial Adviser (IFA). You can find an IFA in your area at unbiased.co.uk

Once you’ve made your decision and are ready to take your PRA, you need to contact the Scheme administrator, Railpen.

The information you need to provide, and the process involved in the next stages, will differ depending on whether you’ve chosen drawdown, annuity or encashment.

Find out more in applying to take my IWDC pot.

Read the latest updates from the world of pensions and see how they affect you as a member of the Scheme.

We provide regular newsletters to help you navigate your pension whether you're paying into the Scheme, not paying in anymore, or receiving your pension.

Register with Platform today to have your say in how we communicate with you and other members about your pension.