Blog

A deep-dive into a variety of pension topics to help you understand and learn more about your pension and the Scheme.

Menu

A deep-dive into a variety of pension topics to help you understand and learn more about your pension and the Scheme.

Our blogs will give you information, tips, insights and guidance to help you get to know your pension and support you on your journey to retirement.

How much you’ll get is based primarily on:

While knowing this in advance can help take away some of the worry, there are still 2 decisions you need to make. These are:

You can find a summary of your options for each point below.

Many members in a DB pension scheme will stop work once they reach Normal Retirement Age (NRA). This is usually between 60 and 65 years old, depending on the section of the Scheme you’re a member of.

You can check your NRA in your Member Guide. This can be found in the library section once you have logged in to your myRPS account.

If you’re 55 or over (or 50 with a Protected Pension Age) you may be able to take early retirement.

You may also be able to start taking your benefits early if you have to stop work due to ill health.

Alternatively, you may be able to delay taking your pension up to the age of 75.

Each of these options will have an impact on how much pension you receive each month and may have additional consequences, particularly if you decide to start claiming your benefits early and then return to work. You can find out more here

We understand that when to retire is very much a personal choice and may depend on what you can afford to do, as well as when the rules will allow it. You can find out more about getting your pension savings on track, and what to do if the numbers don’t add up, such as making Additional Voluntary Contributions (AVCs) here

There are 4 main ways to take your benefits from DB pension within the RPS. These are outlined below, although the rules of your specific section may vary so please check your Member Guide for more details.

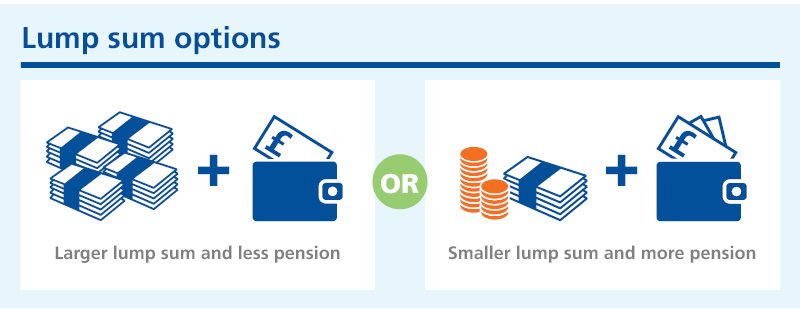

1. Part lump sum/part pension – so you get some of your pension as a one off lump sum and the rest as regular pension payments. Depending on the rules of your section, you can usually decide how this is split, for example:

And generally, as long as the lump sum is worth 25% of your entire benefits, or less, then it will be tax free.

2. All pension – so you take all of your benefits as regular pension payments, and none as a lump sum. This may be restricted if you have paid any Additional Voluntary Contributions (AVCs) and by the rules of the particular section of the Scheme you’re paying into

3. All cash –This is only possible in very limited circumstances, such as:

And where the rules of your specific section allows.

4. Transfer out – you may be able to transfer your entire DB pension to another type of pension within the RPS, or to a different provider all together. This will depend on whether or not you’re still paying in, the rules of your specific pension section and whether the new provider accepts transfers. You can also choose to transfer just your Additional Voluntary contributions (AVCs) if your section rules allow. Transferring your pension does, however, carry significant risks and you should read the details here carefully, before making any decisions. By law you will also need to get financial advice if you’re considering a transfer of DB benefits worth more than £30,000.

In addition to these 4 main choices, you can also opt to tweak how you claim your benefits in a number of different ways.

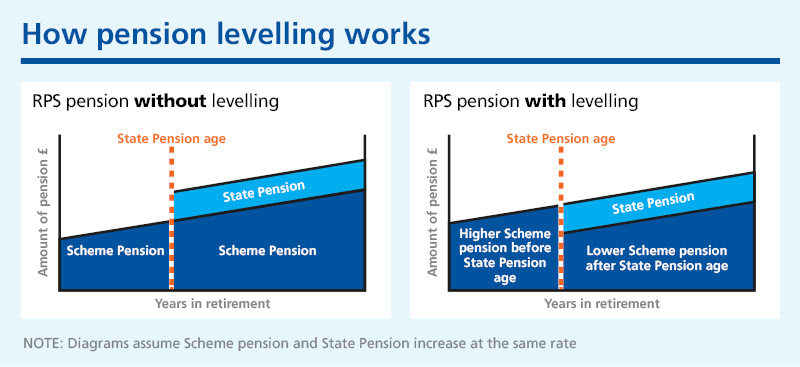

The first is to take a level pension option. This means taking more of your RPS pension before you reach State Pension age and then less RPS pension after you reach State Pension age. This is designed to make sure you have a consistent level of income throughout your retirement, as shown below:

The second option is to give up part of your pension to leave extra pension for your dependants. This would give a named dependent 15% more of your pension when you die, than they would have otherwise received as standard according to the rules of the Scheme. However, the money will be lost if your dependant dies before you do and you cannot change your named dependant once this option has been taken. Exactly how of your pension you give up will depend on your age and sex, as well as those of your dependant.

You can read more about all of these options, including how they can be affected if you have any Additional Voluntary Contributions (AVCs) in our written guide or short video

There’s a lot to consider here, but help is at hand.

If you’re still paying into your pension, then you can get an idea of how much it might be worth when you retire by using the pension planner in your myRPS account.

This will show you what your annual income could be when you stop work and how much you may be able to take as a tax-free lump sum.

The planner will also let you see how this might change depending on how and when you choose to take your pension, for example if you go for the level pension option mentioned above.

If you’re no longer paying into your pension (are a preserved member) you won’t have access to the pension planner, but you can still get an estimate of your pension benefits by logging in to your myRPS account.

While the pension planner and estimates offer no guarantee of your future benefits, they will give you a rough idea of what your pension might be worth and give you a starting point for considering your options.

From there, you may find it helpful to get independent financial advice.

Liverpool Victoria (LV) has been chosen as the official partner to give RPS members access to financial advice. LV can be contacted on 0800 023 4187.

You are still free to choose your own Independent Financial Adviser (IFA). You can find an IFA in your area at unbiased.co.uk

More free and general information is also available from MoneyHelper, sponsored by the Department for Work and Pensions.

You find more tips for making the right decision for you here.

Once you’ve decided how you want to go ahead, you will need to apply for your pension.

You should do this around three months before you want payments to start, just to make sure there is time for everything to be processed.

If you’re still paying into your pension, all you need to do is tell your employer that you’re ready to start claiming your benefits and they will tell the scheme administrator.

If you’re not currently paying in (and are a preserved member) you’ll need to contact the scheme administrator directly.

You can find out more about applying for your pension here

12/7/2021

Author: Editorial

<p>Figuring out your future can be a daunting task but these simple steps might help...<strong style="background-color: rgba(0, 0, 0, 0); color: var(--color-h2); font-size: var(--font-size-h2); text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></strong></p><h2><strong style="background-color: rgba(0, 0, 0, 0); color: var(--color-h2); font-size: var(--font-size-h2); text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">1. Work out your costs</strong></h2><p>Use the <a href="https://member.railwayspensions.co.uk/knowledge-hub/help-and-support/retirement-budgeting-calculator" data-sf-ec-immutable="" data-sf-marked="">Retirement Budgeting Calculator</a> to work out how much you might need to cover your costs when you stop work. </p><p>The calculator allows you to estimate a wide range of expenses, and you can adjust each to a level that feels right for you. This includes:</p><ul><li>Transport</li><li>Holidays and leisure</li><li>Household costs</li><li>Food and drink</li><li>Helping others </li><li>Clothing and personal and</li><li>Anything else you expect to pay for, including care costs or charity donations <p>It also takes into account the '<a href="https://www.retirementlivingstandards.org.uk/" target="_blank" data-sf-ec-immutable="">Retirement Living Standards</a>' which set a benchmark for affording certain lifestyles as shown below.</p><img src="https://cdn3.railpen.com/mp-sitefinity-prod/images/default-source/infographics-(current)/rps-retirement-living-standards_v04_matrix-on-own.svg?sfvrsn=2b554472_4" alt="A grid showing how much 3 different levels of retirement lifestyle might cost"><p> </p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; word-spacing: normal; caret-color: auto; white-space: inherit">At the end, the calculator will give you a personal target to aim for with your income.</span></p></li></ul><h2><strong style="background-color: rgba(0, 0, 0, 0); color: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto; font-size: inherit">2. Work out your income</strong><br></h2><p>Look at what money you’ll have coming in when you stop work. </p><p>You can find out how much your RPS pension could be worth by logging in to your <a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable="">myRPS account</a>.</p><p>There you’ll find an estimate of your benefits, as well as tools specifically designed to show how much you might have saved by the time you stop work. </p><ul><li>For IWDC members it’s the retirement modeller </li><li>For DB members currently paying into the Scheme it’s the pension planner </li></ul><p>Once you find out what your RPS pension could be worth, add this to any other expected sources of income. This could include:</p><ul><li>Your State Pension – the amount you receive is set by the Government. You can request an estimate online at <a href="https://www.gov.uk/check-state-pension" target="_blank" data-sf-ec-immutable="">gov.uk/check-state-pension</a> </li><li>Other pensions – you may have a private pension or pensions linked to previous employment. You’ll need to speak to each of the providers individually for estimates on those accounts. If you’ve lost their contact details, the Pensions Tracing Service may be able to help. It’s a free, Government-backed, service available online (<a href="https://www.gov.uk/find-pension-contact-details" target="_blank" data-sf-ec-immutable="">gov.uk/find-pension-contact-details</a>) and over the phone (0800 731 0193). Other companies offer a similar service but many charge a fee </li><li>Savings and investments – if you have savings outside your pension, get those statements from your bank or other provider </li><li>Combined, these figures should give you an idea of how much money you might get when you stop work. You can then compare this to your target income from step 1.</li></ul><h2><strong>3. Compare your costs with your income and take action if needed</strong></h2><p>If you’re worried that your income in retirement, won’t cover your costs, there are a number of things you can do. </p><ul><li>Consider topping up your pension pot if you’re still paying into the Scheme – think about paying more into your pension if you can. This is known as making Additional Voluntary Contributions (AVCs). It’s tax-free up to certain limits. You can find out more <a href="/pension-essentials/saving-more">here.</a> </li></ul><ul type="disc"><li>Get advice – speak to an Independent Financial Adviser for guidance. <strong>Liverpool Victoria (LV)</strong> has been chosen as the official partner to give RPS members access to financial advice. LV can be contacted on 0800 023 4187. This service is authorised and regulated by the Financial Conduct Authority. </li></ul><ul><li>Think about changing your retirement age – you can delay taking your pension, giving you more time to increase it. This is not a decision to be taken lightly and we suggest you speak with a Financial Adviser first.</li></ul><ul><li>Clear your debts – if possible, try to pay off any debts you owe before you retire. </li></ul><ul></ul>

What does retirement look like to you? And how will you get there?

19/7/2021

Author: Editorial

<p><strong></strong>Your pension is effectively a safeguard for the future. A way to make sure you have money to spend when you stop work.<span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span></p><p>With that in mind, it’s important you understand what your pension can do for you and how to make the most of it. That’s where a financial adviser might be able to help.<span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span></p><h2><strong>Do I HAVE to get financial advice? </strong></h2><p><strong></strong>There are a limited number of circumstances where getting financial advice is a legal requirement. For example, if the value of your DB benefits is more than £30,000 and you are looking to transfer to a Defined Contribution/Personal Pension Arrangement, then by law you have to get financial advice before the transfer can be made. </p><p>And the Government are currently considering more circumstances where financial or pension advice may be legally required.</p><p>In most cases though, whether or not to get financial advice is entirely your choice. </p><p>Before that, you may find some of the answers you’re looking for in your Member Guide, or in the wide range of informative content available across the member website. </p><p>This includes a number of tools designed help you understand your pension and consider your options, such as:</p><ul><li>The <a href="/knowledge-hub/help-and-support/retirement-budgeting-calculator">Retirement Budgeting Calculator</a>, to help you work out how much income you might need, to enjoy the lifestyle you hope when you stop work</li><li>A retirement modeller for IWDC members and a pension planner for DB members, showing how much your pension might be worth by the time you retire. These can be found by logging in to your <a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable="">myRPS account</a> </li><li>A range of videos in the <a href="https://member.railwayspensions.co.uk/resources/video-library" data-sf-ec-immutable="">video library</a>, covering topics such as planning and saving, tax and your retirement options <strong></strong></li></ul><h2><strong>When to think about getting financial advice for your pension </strong></h2><p>Reasons for consulting a financial adviser can include getting help with:</p><ul><li>General financial planning</li><li>Tax </li><li>Deciding how to take your pension when approaching retirement </li><li>Avoiding pension scams by getting an expert opinion and/or a steer toward reputable services/products</li></ul><p>Getting advice for your pension could also be particularly useful if things in your life have changed, or if you’re considering a change of another kind. </p><p>For example: </p><ul><li>If you are starting a pension </li><li>If you are considering whether to transfer your pension</li><li>If you’ve recently received money, such as inheritance, or a lump sum pension pay-out and are unsure what to do with it </li><li>If your personal situation has changed, for example through divorce </li></ul><h2><strong>The benefits of getting financial advice for your pension</strong></h2><p>Getting financial advice usually means having an expert in your corner. For example, someone who can: </p><ul><li>guide you through any difficult decisions relating to your pension and recommend a way forward to suit your needs</li><li>point you towards products and options that will best match your personal circumstances and goals. And in some cases access products you wouldn’t necessarily have found on your own. </li><li>put together a plan and make sure it stays on track over the longer term, even making adjustments with your permission if necessary </li><li>help make sure you’re within the relevant tax allowances and advise on alternatives if you’re reaching them </li><li>look at ways to boost your pension</li></ul><h2><strong style="background-color: rgba(0, 0, 0, 0); color: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">Finding the right financial adviser for your pension</strong></h2><p>It’s important to first understand the different between guidance and advice. They may sound similar, but from a financial perspective there is an important difference. </p><p>Individuals and organisations offering financial guidance can simply provide you with information about your options. Whereas financial advisers can actually recommend which product they think would suit you best. </p><p>Unlike guidance services, financial advisers are regulated by the Financial Conduct Authority (FCA). This means they have to agree to a certain level of standards and you can get additional support through the Financial Ombudsman Service or Financial Services Compensation Scheme if things go wrong.</p><p>Liverpool Victoria (LV) has been chosen as the official partner to give RPS members access to financial advice. </p><p>LV covers all areas of pension advice, including:</p><ul type="disc"></ul><ul><li>retirement</li><li>financial planning</li><li>transfers</li></ul><p>And has a dedicated team, with specific knowledge on the Scheme.</p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">LV can be contacted on 0800 023 4187.</span></p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">You are still free to choose your own Independent Financial Advisor (IFA). You can find an IFA in your area at </span> <a href="https://www.unbiased.co.uk/" target="_blank" data-sf-ec-immutable="" style="font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal">unbiased.co.uk</a> </p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">More information about getting help and advice is also available <a href="/pension-essentials/guidance-advice">here</a><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">. </span></span> </p><h2><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><strong style="background-color: rgba(0, 0, 0, 0); color: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">Considering the cost of financial advice</strong></h2><p><strong style="background-color: rgba(0, 0, 0, 0); color: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></strong><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">Getting financial advice can be expensive. </span></p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">Any member who contacts LV will be evaluated for free first, to make sure that only those who truly need advice will progress to the chargeable stage. And even then, LV will offer its services at a discounted rate for RPS members.</span></p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">If you chose to find your own independent adviser, then keep in mind that not everyone offers a free introductory session and that their charges and areas of expertise may differ. So it’s best to shop around to find the best fit.</span></p><h2><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><strong style="background-color: rgba(0, 0, 0, 0); color: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">Looking out for scams offering financial advice</strong></h2><p><strong style="background-color: rgba(0, 0, 0, 0); color: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></strong><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">Scammers sometimes pose as financial advisers, or claim to be offering financial guidance and advice, as a way of getting their hands on your pension.</span></p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">You should be particularly cautious if anyone contacts you out of the blue, or offers you a free pension review or no-obligation consultation. Especially if they actively encourage you to transfer your pension or ‘unlock your benefits early.’</span></p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">Before entering a conversation with anyone, you should check their details against the </span> <a href="https://register.fca.org.uk/s/" data-sf-ec-immutable="" style="font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal" data-sf-marked="" target="_blank">Financial Conduct Authority (FCA) register</a> <span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"> to make sure they are fully regulated and have the FCA’s permission to provide the services they’re claiming to offer.</span> </p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">You can also check the FCA’s </span> <a href="https://www.fca.org.uk/consumers/unauthorised-firms-individuals" data-sf-ec-immutable="" style="font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal" data-sf-marked="" target="_blank">warning list</a> <span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"> to see the names of companies who are known to be operating without proper authorisation.</span> </p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">You can read more about staying safe from scams </span> <a href="https://member.railwayspensions.co.uk/resources/safety-and-scams" data-sf-ec-immutable="" style="font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal">here</a> </p>

Even someone who feels financially savvy can benefit from advice surrounding their pension. Here’s why…

6/8/2021

Author: Editorial

<p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"> </span></p><p><span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">Nobody likes to imagine getting older, so many of us choose to ignore our pensions. It’s nothing new, but it’s unwise. A recent study* has found two-thirds of adults retiring in 2021 in the UK won’t have enough in their pension to fund their post-work life. Many people are now facing a difficult retirement.</span> <span style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto"></span><br></p><h2>Women especially should consider their position<br></h2><p>Society and family structures have changed hugely since the UK pension system was first created in the early 1900s. The traditional nuclear family was the norm, with men typically earning the money and women raising the children at home. But now, this family model has changed. There are more women than ever in the workplace, there are many single-parent families and different family structures.</p><p>According to a report published by Barnett Waddingham in March 2021**, women who take time off work have fewer pension savings than women who don’t.</p><p>For a woman taking two 12 month career breaks in her early 30s, with no pension savings or salary increase during this time, it can lead to a level of pension savings at retirement of around 10% lower compared to a woman with no career breaks.</p><h2>Lack of pension parity for women<br></h2><p>It’s not just career breaks that impact women’s pension savings. The report found that the pension gap between men and women is most stark in the high affluence group – typically because men’s pay in this group is significantly higher than women’s.</p><p>There are many more contributing factors, including:</p><ul><li>Taking on caring responsibilities for children, ageing parents or other family members typically gives less flexibility for many women to progress in their careers, earn more and contribute more to workplace pensions;</li><li>The imbalance of women working in lower paid or lower skilled occupations;</li><li>Women are more likely to be on zero-hour contracts or working multiple part-time roles so do not reach workplace pension auto-enrolment thresholds;</li><li>The increasing rates of divorce, particularly in later life;</li><li>The low level of default contribution rates in general.</li></ul><h2>Will you have enough for the retirement you want?<br></h2><p>Women in particular should carefully consider their options well before retirement, and whether they have enough saved to maintain their current lifestyle. </p><p>Our planning tools can help. </p><p>When you log in, or register for an account, you will see two modellers in the ‘Planning for the future’ section of your ‘myRPS account’.</p><ul><li>Defined benefit members can use the <strong>pension planner</strong></li><li>IWDC members can use the <strong>retirement modeller</strong>.</li></ul><p>All members can then use the <strong>retirement budgeting calculator</strong> to find out if your current level of pension benefits and/or savings will be enough, or whether you might want to make adjustments.</p><p>You can use the calculator together with your latest benefit statement, or <strong>request an estimate. </strong>It’s free to do, you can request as many as you like, and the estimate is usually ready within an hour. </p><p>These planners will show you what your annual income is likely to be when you retire. As a rough guideline, current research shows you will need between £10,200 (basic) to £33,000 (comfortable) per year when you finish work.</p><p>The Retirement Living Standards are benchmarks for the income you might need in order to afford different lifestyles - minimum, moderate and comfortable. Full details can be found at <a href="http://www.retirementlivingstandards.org.uk/" data-sf-ec-immutable="">retirementlivingstandards.org.uk</a>. But as a general rule, they suggest the following:</p><img src="00ddcd22-bb33-4a45-9ba4-28b0d6aff300" style="background-color: rgba(0, 0, 0, 0); color: inherit; font-family: inherit; font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto" alt="retirement Living Standards are benchmarks for how much you might need in retirement based on a minimum, moderate or comfortable lifestyle"><p><br>It’s never too early – or too late- to start making extra contributions to your pension savings.</p><h2>How to save more with Additional Voluntary Contributions</h2><p>Additional Voluntary Contributions (AVCs) are flexible extra pension savings you can make from your pay (before tax is taken) on top of the normal contributions you make to your pension.</p><ul type="disc"><li>One of the perks of AVCs is that you don’t need to save a set amount every month. If you’ve got an expensive time coming up, you can reduce your contributions, or equally you can add more in if you have some to spare. </li><li>AVCs are a great way to save extra money for retirement if you get large payments that don’t qualify for your pension, such as overtime and bonus payments.</li><li>You’ll also get government tax relief on anything you put in up to your annual allowance - currently £40,000 for most people. If you’re a high earner with an income of more than £200,000 a year, your annual allowance might gradually reduce to as low as £4,000 in the current tax year.</li></ul><h2>AVCs for defined benefit members</h2><p>The main AVC arrangement open to defined benefit (DB) members is called BRASS. When you join the Scheme, you’ll get a separate BRASS account, and your AVC contributions are then invested in a range of funds with the aim of building up extra pension savings over time.</p><p> You’ll be able to <a href="https://member.railwayspensions.co.uk/my-rps" data-sf-ec-immutable="">log in to your account</a> (or <a href="https://member.railwayspensions.co.uk/register" data-sf-ec-immutable="">register</a>) any time to:</p><ul><li>make changes to the BRASS amount you contribute</li><li>view your investment fund holdings</li><li>see how the funds are performing</li><li>change the funds you invest in.</li></ul><h2>How much more should I save?</h2><p>If you’ve used the planning tools, you’ll have a better idea of how much more to save, to have the retirement you imagined. </p><p>Some employers allow contributions to be paid via a ‘salary sacrifice’ arrangement, which reduces your National Insurance bill. And they may even increase the amount they pay into the scheme if you choose to save more. It’s worth checking! </p><p>Most members making additional voluntary contributions pay in more than £100 per month, but you can put in as little as £10 per month and top up your regular payments or make one-off payments at any time. No matter how big or small your contribution, it all helps.</p><p>There is a maximum amount that you can pay into BRASS. If you want to pay more AVCs, most members can apply to join AVC Extra. <a href="/knowledge-hub/help-and-support/RAYN">Check the Read as you Need guides</a> for the rules that apply to your section of the Scheme.</p><h2>AVCs for IWDC members</h2><p>If you’d like to make extra contributions, you’ll need to speak to your employer. The contributions will be deducted from your pay like your usual pension deductions. </p><p>Get more information on BRASS and AVC Extra <a href="/defined-benefit-members/saving-more-BRASS-AVC-Extra">here</a>.<span style="text-decoration: underline"></span></p><h2>What if the numbers don’t add up?</h2><p>The more you save now, the more time your money has to grow. Over the long-term, the investment returns on your AVCs could make a big difference to the amount you have to live on when you retire.</p><h2>Get advice before making any decisions. </h2><p>We can help you understand the Scheme rules that apply to you and tell you how it works, but we can’t give you advice relating to your personal circumstances. If you need help deciding what to do with your money, you’ll need to talk to a financial advisor. </p><p>Liverpool Victoria has been carefully chosen to give members access to independent financial advice. LV can be contacted on 0800 023 4187. </p><p>You are still free to choose your own Independent Financial Adviser. You can find an IFA in your area at <strong><a href="https://www.unbiased.co.uk/" target="_blank" data-sf-ec-immutable="">unbiased.co.uk</a></strong></p><p><strong><a href="https://www.moneyhelper.org.uk/en" target="_blank" data-sf-ec-immutable="">Moneyhelper.org.uk</a> </strong>offers free support on a wide range of financial matters, online and over the phone.</p><p>And there’s a wealth of information in the <strong>‘</strong><strong>Resources</strong><strong>’</strong> and <strong>‘In the Scheme’</strong> sections of the RPS website.</p><h3>Sources</h3><p><strong>*</strong> <a href="https://www.aberdeenplc.com/en-gb/news/all-news/uk-retirees-at-risk-of-running-pension-pots-dry" target="_blank" data-sf-ec-immutable="" data-sf-marked="">UK retirees at risk of running pension pots dry</a> </p><p>** <a href="https://www.barnett-waddingham.co.uk/comment-insight/research/gender-pension-gap/" target="_blank" data-sf-ec-immutable="">Bridging the gap: the gender pension gap and what can be done about it</a></p><p> </p>

How much will your retirement cost, and will you have enough to support the lifestyle you want?

25/8/2021

Author: Editorial

<p><span style="background-color: rgba(0, 0, 0, 0); font-size: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; font-family: inherit; color: inherit">There’s a lot to consider when it comes to stopping work. And many of our members find themselves facing some tricky questions…</span></p><ul><li>Have I saved enough?</li><li>Should I put off retirement? </li><li>How will I get my money? </li><li>Will I have to pay tax on my pension? </li><li>What will happen to my AVCs?</li></ul><p>You’ll find a whole host of resources designed to help you understand all of this and more in the I'm Planning to Take My pension areas of the website. </p><h3><strong>Your retirement options </strong></h3><p>This section of the site includes information covering all of your retirement options, including:</p><ul><li>When you can retire</li><li>How you can take your pension </li><li>Working out what’s best for you </li><li>How to apply for your pension </li></ul><p>All you have to do is choose the area that’s tailored for you.</p><ul style="list-style-type: disc"><li>For <strong>DB</strong> members it’s <a href="https://member.railwayspensions.co.uk/defined-benefit-members/Im-planning-to-take-my-pension" data-sf-ec-immutable="" data-sf-marked=""><strong>here</strong></a></li><li>For <strong>IWDC</strong> members it’s <a href="https://member.railwayspensions.co.uk/iwdc-members/im-planning-to-take-my-iwdc-pot" data-sf-ec-immutable="" data-sf-marked=""><strong>here</strong></a> </li></ul><h3><strong>Getting your savings on track</strong></h3><p>Within the ‘Planning to take my Pension’ sections of the site, you’ll also find ideas for making sure your pension savings are on track before you stop work. </p><p>This includes using our <a href="https://member.railwayspensions.co.uk/knowledge-hub/help-and-support/retirement-budgeting-calculator" data-sf-ec-immutable="" data-sf-marked="">retirement budgeting calendar</a>, to help you estimate how much you’ll need in retirement and give you a personal target to aim for with your income. </p><p>And tools that will help you to see if your pension might give you enough to meet this target. </p><ul><li>For DB members it’s the <strong>pension planner</strong> – designed to show what your annual income could be when you stop work. And how this might be affected by different options, such as taking a lump sum or opting for a level pension. <p><span style="background-color: rgba(0, 0, 0, 0); text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; font-size: inherit; font-family: inherit; color: inherit"> </span></p></li><li><p><span style="background-color: rgba(0, 0, 0, 0); text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; font-size: inherit; font-family: inherit; color: inherit">And for IWDC members it’s the </span><strong style="background-color: rgba(0, 0, 0, 0); color: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; font-size: inherit">retirement modeller</strong><span style="background-color: rgba(0, 0, 0, 0); text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; font-size: inherit; font-family: inherit; color: inherit"> - designed to show you what your pension pot might be worth when you retire. And the different ways you can choose to use that money, such as an annuity or drawdown.</span></p></li></ul><p>All the tools are quick and easy to use. And you can access the one that’s relevant for you by logging in to your <a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable="">myRPS</a> account. </p><h3><strong>Getting help and advice </strong></h3><p>If all of this sounds a little daunting, you can find out how to get help and advice to guide you through the retirement process <a href="/defined-benefit-members/Im-planning-to-take-my-pension/guidance-and-advice"> here</a></p><p>You’ll also find short videos talking you through your retirement options in the <a href="https://member.railwayspensions.co.uk/knowledge-hub/help-and-support/video-library" data-sf-ec-immutable="" data-sf-marked="">video library </a> </p><h3><strong>Watching out for scams </strong></h3><p>When you’re approaching retirement and looking at what to do with your pension, you may be at risk from scammers trying to get their hands on your savings. </p><p>You can find some top tips for spotting a scam and protecting yourself, <a href="https://member.railwayspensions.co.uk/pension-essentials/pension-scams" data-sf-ec-immutable="" data-sf-marked="">here</a> </p>

Are you approaching retirement? Or looking ahead to the day that you do? If so it’s important you understand all of your options.

Read the latest updates from the world of pensions and see how they affect you as a member of the Scheme.

We provide regular newsletters to help you navigate your pension whether you're paying into the Scheme, not paying in anymore, or receiving your pension.

Register with Platform today to have your say in how we communicate with you and other members about your pension.

Railways Pensions is powered by Railpen Limited

© Railpen Limited 2010-2025. Registered Office: 100 Liverpool Street, London EC2M 2AT

Each of Railpen Limited (registered in England and Wales No. 2315380) and Railway Pension Investments Limited (RPIL) (Registered in England and Wales No. 1491097) is a wholly owned subsidiary of Railways Pension Trustee Company Limited (Registered in England and Wales No. 2934539). Registered office for each company: 100 Liverpool Street, London EC2M 2AT. RPIL is authorised and regulated by the Financial Conduct Authority for some of its activities. The administration of occupational pension schemes is not a regulated activity. Full details about the extent of RPIL's authorisation and regulation by the Financial Conduct Authority are available from us on request.

Please manage your cookie choices by switching the consent toggles on or off under the purposes listed below. You can also choose to click:

Accept All Reject All