Blog

A deep-dive into a variety of pension topics to help you understand and learn more about your pension and the Scheme.

Menu

A deep-dive into a variety of pension topics to help you understand and learn more about your pension and the Scheme.

Our blogs will give you information, tips, insights and guidance to help you get to know your pension and support you on your journey to retirement.

It might sound strange, but the costs associated with climate change can have a significant impact on companies and the financial markets.

This in turn means it can affect the assets of a pension scheme like ours. And ultimately affect the value of your savings, especially if you’re an IWDC member or pay Additional Voluntary Contributions (AVCs).

So what are we doing about it?

We understand that the large-scale financial industry has a responsibility, not only to protect members’ savings and investments. But also to play its part in tackling the impact of climate change on the world in general.

With this in mind, the scheme’s investment manager, RPMI Railpen, has long considered climate change in its investment decisions on behalf of our Trustees.

This includes:

As one of the UK’s largest pension schemes, we also work directly with policymakers and the wider industry to create a regulatory framework which supports the transition to a net zero world.

Our work on climate change to date

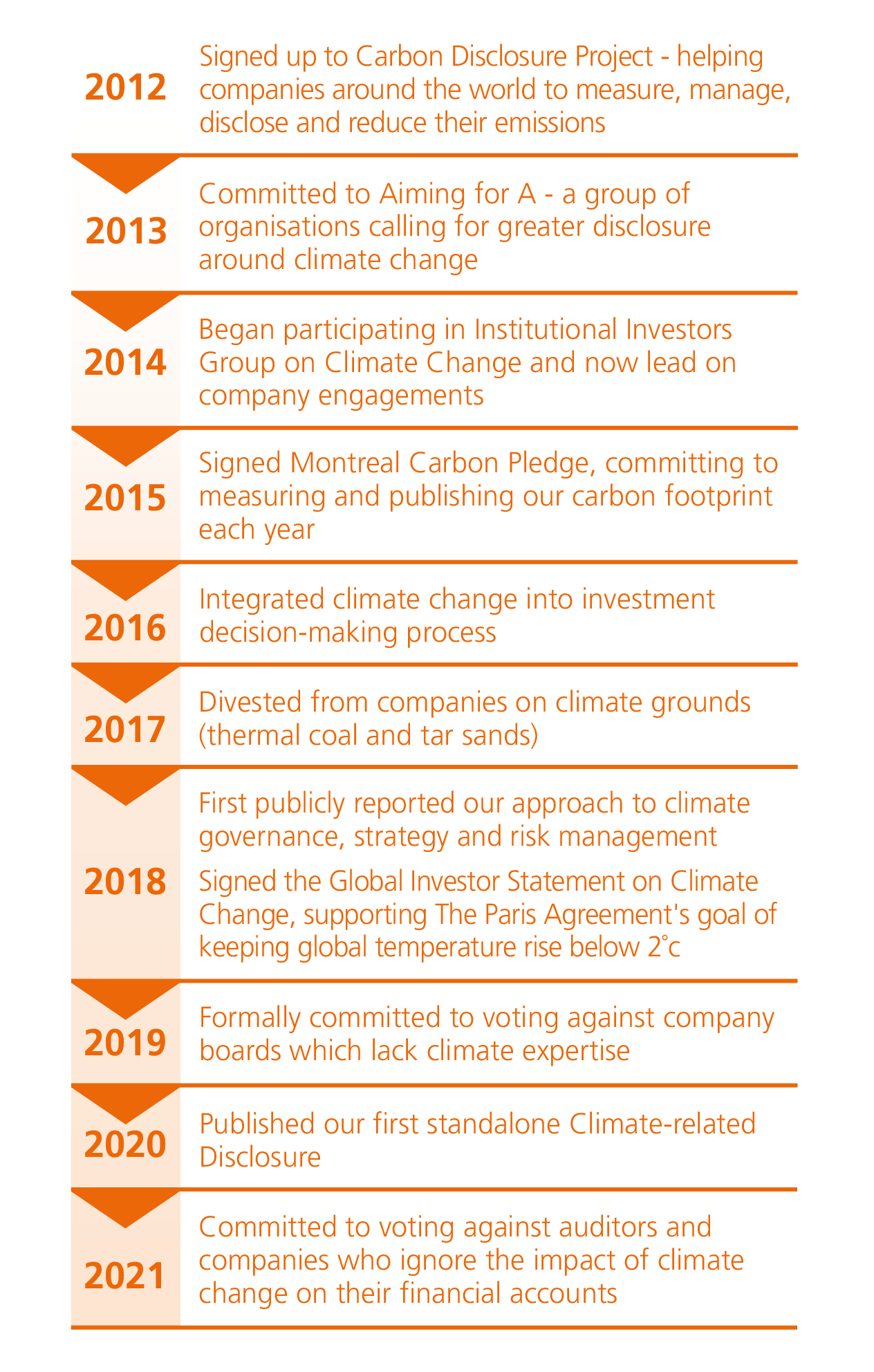

In 2019, RPMI Railpen formally committed to voting in Annual General Meetings (AGMs) against any companies that were believed to lack robust oversight of climate change at management level.

Earlier this year the policy was expanded to include voting against companies in key climate-affected sectors that do not make the impact of climate change clear in their financial accounts.

It’s the latest in a series of steps RPMI Railpen have taken on behalf of the Trustees, which recognise the importance of climate change and its impact on your savings. Others can be found in the timeline below.

RPMI Railpen recently published its first Climate-Related Disclosure explaining its work on climate change and our plans for the future. This will be updated every year to reflect the fast moving nature of climate change. You can read it in full here.

We’ve also set up a cross-team Climate Working Group, chaired by Railpen’s Chief Investment Officer, Richard Williams, to look at how we can play our part in helping the UK achieve its ambition to bring greenhouse gas emissions to net zero by 2050.

We are actively involved in the Government’s Pensions Climate Risk Industry Group (PCRIG), which supports the pensions industry in responding to climate change and aims to raise standards of climate-aware investment.

And we will continue to use our voice, alongside those of other investors, to publicly call for positive corporate action on climate change and to apply positive influence on the companies we invest in.

We also hope that the UK hosting the 26th UN Climate Change Conference (UKCOP26) later this year will provide more opportunities to discuss the impact of climate change, not only on your pension but on the world you will retire into.

If this blog has piqued your interest, you can read more about the Trustees’ and Railpen’s approach to protecting members’ futures, including our work on climate change and other environmental, social and governance factors (ESG) in the Stewardship Report here.

10/5/2021

Author: Editorial

<p>The planner is designed to show you what your annual income could be when you stop work and how much you may be able to take as a tax-free lump sum. <br><br>It also lets you see <span style="background-color: initial; font-size: inherit; font-family: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">what it might look like if you decide to start taking your benefits before claiming your State Pension and then level your income out afterwards. This is known as the ‘level pension’ option. <br></span></p><div><p>The planner is a quick and easy way to take control and make your pension work better for you. And we’ll be making even more improvements to it in the future.<br></p></div><div><strong>This planner is for anyone with a Defined Benefit pension. If you are a member of the Industry-Wide Defined Contribution (IWDC) Section, you should use the DC retirement planner instead. If you’re unsure which type of pension you have, please check your member guide. You can find a copy in the My Library section of your <a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable="">myRPS account. <br></a><br></strong></div><h2>How can I try the pension planner?</h2><p><a href="https://member.railwayspensions.co.uk/login" data-sf-ec-immutable="">Log into your myRPS account</a> and go to the ‘Your pension planner’ section on the dashboard. Click ‘Try the planner’. Alternatively log into your online account and hover over the ‘myRPS account’ menu. Go to the ‘Planning for the future’ section and click on ‘Pension Planner’. <br><br><br><img alt="Your pension planner" src="https://cdn3.railpen.com/mp-sitefinity-prod/images/default-source/default-album/pension-planner/your-pension-planner.png?sfvrsn=17119713_5"><br><br><br>There is also a list of FAQs at the bottom of the page.<br><br><br><img alt="Pension planner FAQs" src="https://cdn3.railpen.com/mp-sitefinity-prod/images/default-source/default-album/pension-planner/pension-planner-faqs.png?sfvrsn=76e5590a_5"><br><br><br>You will already see the improvements we've made in comparison to the previous planner. This includes the use of real-time data to calculate your benefits.<br><br>While this will give you a more accurate result, it might also take a little longer to perform the calculation. Please be patient and if it looks to be taking a little longer than expected, this is probably because your real-time calculation is a little more complex. <br><br></p><h2>What does the pension planner do?</h2><p>Like the old one, the planner:<br></p><ul><li>works out what your annual pension is likely to be </li><li>shows your BRASS (if you have it) fund's current value and the projected future value</li><li>shows how much of a lump sum you may be able to take when you retire and how it would then affect your annual pension. If you have BRASS, it shows you how your BRASS fund works as part, or all of, your lump sum depending on the amount of BRASS you have and the size of lump sum you want</li></ul><p>The improved planner also:</p><ul><li>lets you see what it may look like if you go for a 'level pension' option</li><li>uses the latest salary data your employer has sent us, rather than the data from your last Annual Pension Estimate, to give you the most accurate results</li></ul><p>The planner's estimates are based on:</p><ul><li>your salary</li><li>retirement age</li><li>BRASS contributions made to date</li><li>weekly BRASS contributions going forward</li></ul><h2>How can I experiment with the pension planner?</h2><p>By simply using the plus and minus buttons in the planner, you can experiment with increasing or decreasing your: </p><ul><li>retirement age</li><li>weekly BRASS contributions</li><li>lump sum<br></li></ul><p><img alt="Using the pension planner" src="https://cdn3.railpen.com/mp-sitefinity-prod/images/default-source/default-album/pension-planner/using-the-pension-planner.png?sfvrsn=d6a2577_7"></p><p><br>This lets you see what may happen to your annual pension and lump sum if you're considering making any changes. It also lets you model different scenarios to see what your annual pension could be as a result. <br><br>Don't worry, the planner won't make any changes to your record. But it will show you what could happen if you did make the changes. <br><br>It's all about giving you the information you need to make the right decision for you. It's also a great way to see your pension benefits come to life and get a better view of what the future may hold. <br></p><h2>Will the pension planner tell me if I'm saving enough?</h2><p>The planner will show you how much your annual income is likely to be when you retire. <br><br>You can then compare this to the Retirement Living Standards (RLS) and decide for yourself whether it's likely to be enough for you.<br><br>As a guideline, the RLS shows that an individual will need between £10,200 and £33,000 per year when they finish work. You can find out more by visiting the <a href="https://www.retirementlivingstandards.org.uk/" target="_blank" data-sf-ec-immutable="">Retirement Living Standards website. </a> <br><br>We're busy building another new calculator using this RLS data to make it easier for you to judge how you may need and compare that to the results in the pension planner. <br><br></p><h2>What can I do with my pension planner results? </h2><p>Once you have your pension planner results, you can decide whether to take any further action. <br><br>For example, you may choose to:<br><br></p><ul><li>change your Target Retirement Age (TRA)</li><li>change your weekly BRASS contributions</li><li>make a one-off BRASS contribution</li></ul><p>Before making any changes, you may want to get advice from an Independent Financial Adviser. You can find one in your area by using the <a href="https://www.unbiased.co.uk/" target="_blank" data-sf-ec-immutable="">Unbiased website.</a> Remember to show them your pension planner results. <br><br>Please remember this planner has been designed to show you what your retirement benefits could be based on the information we currently hold for you and the options you have selected. <br><br><strong>The results shown by the planner are for illustration and comparison purposes only and do not guarantee any future outcome or entitlement. The results should not be replied upon for retirement planning. Your actual benefits in retirement could differ from the estimated figures shown. </strong><br><br></p><h2>Why wasn't the planner live before now?</h2><p>We know that many members really valued the planner on the old website and we wanted to reinstate it as soon as possible after the new site launched in September/October last year. <br><br>The main delay came from making sure we improved the planner and give members what they wanted most. <br><br>Based on survey results, thousands of members told us there were clear priorities for us to deliver on the new site:<br></p><ul><li>Online estimates</li><li>See more periods of membership under one log-in</li><li>Use more up-to-date salary data in the planner</li><li>Improve the planner to be able to model a level pension</li></ul><p>We put the new site live as soon as we had the online estimates ready and we're really pleased that more than 30,000 of you have already used the estimate tool.<br><br>You can now also see other periods of membership without having to log in with a separate ID. <br><br>Improving the planner did take a little longer than points 1 and 2 listed above, but we're pleased to say:<br></p><ul><li>it's now based on the latest salary data your employer has sent us, rather than on your last Annual Pensions Estimate as previously</li><li>it also lets you model what a level pension may look like. You can learn more about level pensions [here]<br></li></ul><p>For more information on what you can do with your online account, why not visit our <a href="https://member.railwayspensions.co.uk/resources/video-library" data-sf-ec-immutable="">Video Library?</a> We also have videos on there about planning and saving, your retirement options, and tax and other pension topics.<br></p>

If you're a DB member, there's a new way to see what your pension may be worth when you retire.

28/5/2021

Author: Editorial

<p>You will see how and why it all works, where your contributions are invested and how your money grows.</p><h2>The Trustee</h2>The funds from your Railways Pension Scheme contributions are carefully managed by a group of employer and elected member representatives, known as “The Trustee”. The Trustee’s job – along with the help of our team of pensions and investment specialists - is to regularly check that the Scheme administration and financial investments are doing well and to keep you informed. <br><br><h2>Our financial experts </h2>The Trustee works closely with our team of pensions and investment experts. Together, their responsibility is to pay your pension securely, affordably and sustainably. With their combined professional knowledge and financial market insight, this team makes careful and informed decisions on where to invest your money, so that your pension pot grows and you receive the benefits you were promised. These investment and financial specialists are known as the Scheme’s “investment manager” or <a href="https://www.railpen.com" target="_blank" data-sf-ec-immutable="" data-sf-marked="">RPMI Railpen</a>. <p><br>The Trustee and Investment Manager invest members’ pension contributions into a range of assets including shares, bonds and property. Investing widely like this helps to limit risk and this diverse approach also gives your retirement savings the best possible chance of increasing in value over the years.<br></p><h2>How your pension contributions are invested </h2><span style="background-color: initial; font-size: inherit; font-family: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">Your pension contributions are combined into “pooled” or collective investment funds. This means your money immediately benefits from economies of scale and the team can choose from a wider, more valuable range of investments.</span><br><p><br><span style="background-color: initial; font-size: inherit; font-family: inherit; text-align: inherit; text-transform: inherit; white-space: inherit; word-spacing: normal; caret-color: auto">Our investment team uses these funds to meet the specific needs of over 100 individual Sections within the Railways Pensions Scheme. </span></p><div>If your money was only held in cash savings, inflation could reduce its value, whereas investing gives your pension a much better chance to grow, whilst also helping the organisations your funds are supporting. The idea is that as these organisations grow, so too does the value of your pension.<br><br></div><div>Every Section has its own specific requirements, so we work with each Section and its representatives, to create the most suitable investment strategy for them. <br><br></div><div>To guide all their decisions, the team follows firm investment beliefs and principles on valuation, risk, diversification, costs and ESG (environmental, social and governance) factors.<br><br></div><div>While we are researching investments, we look at how companies behave. Do they operate honestly and fairly? Do they care for the environment and the communities they serve and operate in? We examine our potential investments carefully as we believe that sustainable, ethical organisations have sustainable futures. These are the organisations that will grow and last and we want to be part of them. <br><br></div><div>How these organisations use the money they receive from pension investors like you, via the Railway Pensions Scheme and RPMI Railpen, can make a big difference on behalf of us all, to the future of the world. </div><br><h2>Some examples of our recent investments <br><br></h2><ul><li>In 2017, we invested in Gigaclear, a company dedicated to building and operating ultrafast, pure fibre-to-the-premises broadband networks in rural Britain<br><br></li><li>In 2020, we purchased the majority interest in an onshore wind farm in Scotland, Carraig Gheal Wind Farm. This investment is expected to generate renewable energy over the next 30 years and help the decarbonisation of the UK energy supply<br><br></li><li>In 2021, we invested in MIPS, a company that makes a patented Brain Protection System for helmets that mimics the brain’s own protection system, offering a scientifically-proven element and much better protection than current products<br><br></li><li>In 2020, we co-invested in Sleaford Renewable Energy Plant, a biomass facility in Lincolnshire. The plant has been operational since 2014 and converts local straw into heat and energy, as a renewable source of power<br><br></li><li>In 2021, we invested in Lonza Group, a leading manufacturer of products and services to the biopharma and consumer health industries. Lonza offers direct exposure to the growth of tomorrow’s drugs<br><br></li></ul><p>We have been paying members’ pensions securely, affordably and sustainably for over 50 years. To achieve this, we continue to invest the Scheme’s assets to generate strong investment returns over the long term. <br><br>You are in very good hands.</p><p> </p><p> </p>

Let's go on a whistle-stop tour behind the scenes of your pension.

Read the latest updates from the world of pensions and see how they affect you as a member of the Scheme.

We provide regular newsletters to help you navigate your pension whether you're paying into the Scheme, not paying in anymore, or receiving your pension.

Register with Platform today to have your say in how we communicate with you and other members about your pension.

Railways Pensions is powered by Railpen Limited

© Railpen Limited 2010-2025. Registered Office: 100 Liverpool Street, London EC2M 2AT

Each of Railpen Limited (registered in England and Wales No. 2315380) and Railway Pension Investments Limited (RPIL) (Registered in England and Wales No. 1491097) is a wholly owned subsidiary of Railways Pension Trustee Company Limited (Registered in England and Wales No. 2934539). Registered office for each company: 100 Liverpool Street, London EC2M 2AT. RPIL is authorised and regulated by the Financial Conduct Authority for some of its activities. The administration of occupational pension schemes is not a regulated activity. Full details about the extent of RPIL's authorisation and regulation by the Financial Conduct Authority are available from us on request.

Please manage your cookie choices by switching the consent toggles on or off under the purposes listed below. You can also choose to click:

Accept All Reject All