Sustainable Ownership blogs

Our blogs on Sustainable Ownership and environmental, social and governance (ESG) issues will help you learn more about the Scheme's approach to its investments.

Read our blog posts to learn more about how we incorporate Sustainable Ownership and environmental, social and governance (ESG) issues through the Scheme's investments.

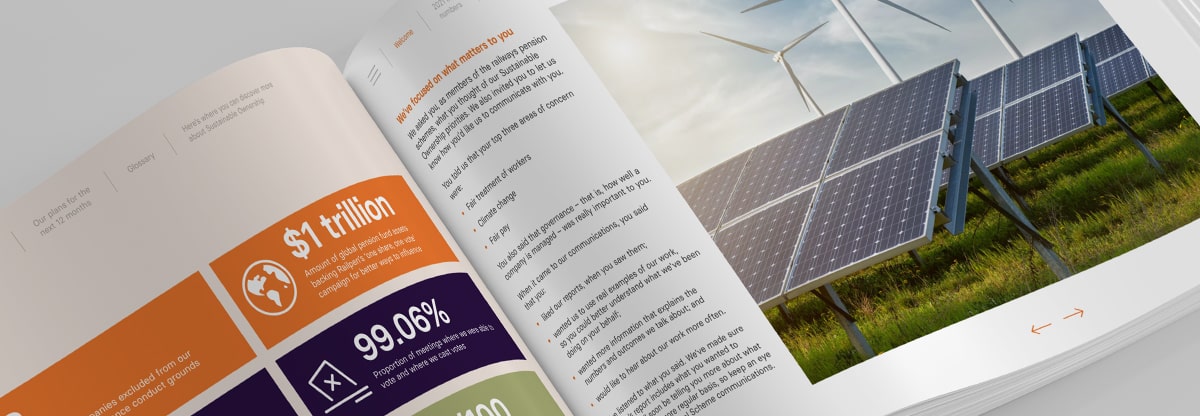

You can read more about our work on Sustainable Ownership on the Railpen website.

We know that Sustainable Ownership* is a topic that is of interest to many of our members. This is not only because it often happens to be at the forefront of pension talk with issues like climate, fair pay and how workers have been treated by their employers during the pandemic and others, but also because of the direct impact it may have on your pension money. And with it hitting the headlines lately, our 2021 Sustainable Ownership Member Review – “Staying on Track for a Sustainable Future” – seems to be coming at the perfect time to provide members with an insight into what we have been doing on Sustainable Ownership over the past year. We hope it also brings you reassurance that your pension money is in good hands and is being managed thoughtfully despite the challenging times we are all facing.

The document has been written for you based on feedback you gave us in last year’s member survey and roundtables. We heard you, and we hope the 2021 Sustainable Ownership Member Review gives you a better understanding of how and where we are investing your pension money to give you an income in retirement. We also hope it shines a light on how we address the impact of governance and sustainability issues on the world into which you will someday retire.

We asked Caroline Escott, Senior Investment Manager at Railpen - the investment manager of the railways pension schemes - to share some of the cornerstones of the report and to talk us through some of the main points raised in it.

Caroline, you’ve been heavily involved with the production of the 2021 Sustainable Ownership Member Review. Why should our members give it a read?

We know many members are interested in how we invest and manage contributions in a way that supports a sustainable future for them, and for all. Although we publish many formal, lengthy documents on our Sustainable Ownership work every year, the Member Review is short, snappy and designed specifically for members – it provides the perfect starting point for anyone wanting to find out more!

You’ve spoken to several of our members before writing the report. What are they mostly interested in when it comes to Sustainable Ownership and their pension?

As we produce the report purely for members, we were keen to really understand what would be of most use, so we worked with our Member Communications team to survey members and hold some focus groups.

Members told us in the survey that their top three priorities were fair treatment of workers, climate change and fair pay. When we asked the same question in member roundtables, participants said that good corporate governance – that the companies we invest in are well-managed, with expert leaders who are supported by strong teams and listen to investors – was important.

As a result, we’ve provided case studies in this year’s Sustainable Ownership Member Review which explain what we’ve done on these topics over the last 12 months and how we’ve had an impact on members’ behalf.

You were also keen to find out what members thought of the way we are currently communicating with them. Was there anything that particularly struck you about the results? How would members like to be told of important updates on Sustainable Ownership?

Something we had suspected, and which the survey results confirmed, was the high proportion of members (76%) who had never seen any of our Sustainable Ownership reports. We’d like to change that and make sure that those people who want to find out more about our work, are able to do so.

There was huge support for our suggestion that we send information through via regular email updates. Members also said that they would prefer shorter content that is easily digestible, in plain English and spread throughout the year.

Could you please briefly explain what Railpen has done in 2021/2022 to address members’ top issues?

As investors, we have a few tools at our disposal to help us influence companies to improve what they do on governance and sustainability. This includes speaking to senior company management privately, making our concerns public – if progress is taking too long – or speaking to governmental policymakers, where we think a change in regulation may help more companies make sustainable decisions. We may also choose to remove companies from our portfolio if we think the risk they pose is too big to manage and no progress is being made.

This year, we publicly expressed our view on companies’ approaches to sustainable ownership at nearly 1,700 companies (by voting at their Annual General Meetings), flagging our concerns on one or more issues with nearly 60% of these companies. We are also intensively discussing approaches to climate change at 41 companies as part of our Net Zero Engagement Plan and have been working with the industry and policymakers to ensure more companies give us necessary information on how they treat their workers – so that Railpen and others can better hold these firms to account.

More information on our work and the impact we’ve had on members’ priority issues can be found in the Sustainable Ownership Member Review!

And Caroline, as a member of the Railways Pension Scheme - what is your favourite part of the Sustainable Ownership Member Review and why?

I’ve got a soft spot for the case studies, where we explain how the context of the issue shapes the nature of the tools we use and – where we haven’t yet had the necessary impact – what we’re going to do instead.

I also think the glossary is really helpful. We know that some of the language we use will be unfamiliar to some members, so we’ve dedicated two pages to explaining all the key terms: if you’re reading the Member Review and need to double-check what something means, do flip to the end of the report for an explanation!

Looking ahead, what are your key priorities for communications with members on Sustainable Ownership?

We want to encourage a two-way dialogue with members: we don’t just want to be talking ‘at’ you, we want to hear from you and if you’ve got a pressing question, we want you to feel able to ask it.

There are a few different things we can do to help build this kind of relationship. The Sustainable Ownership Member Review, which tells the story of what we do and how we’ve achieved impact on members’ behalf, is one part. The member survey – which we will be running again in November this year – is also important as it helps us gain a sense of what, if anything, has changed amongst the membership in terms of priority issues and communication preferences. And we’re hoping that by giving members the kind of regular communications they want, with the option to contact us if they have any thoughts about what they’ve read, we’re stimulating a more regular conversation throughout the year.

Read the report here.

*Broadly speaking, Sustainable Ownership is the way Railpen – the investment manager of the railways pension schemes - calls their approach to incorporating sustainability issues, like climate change or executive pay, into the investments Railpen manages on your behalf.

The information provided on this website is intended for general information and illustrative purposes. Your benefits will be worked out in accordance with and subject to the governing trust deed and rules and relevant legislation.

Although every effort has been made to ensure the information given on this website is accurate, none of the information provided can give you, or your beneficiaries, legal rights to benefits that differ from those provided in the pension trust and rules.

We recommend that you get independent financial or specialist advice before making any important decisions about your pension arrangements.

Learn more about how the Scheme invests and the beliefs that underpin its approach.

We provide regular newsletters to help you navigate your pension whether you're paying into the Scheme, not paying in anymore, or receiving your pension.

Read the latest updates from the world of pensions and see how they affect you as a member of the Scheme.